-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Risk Assets Feeling The Strain

EXECUTIVE SUMMARY:

- CONGRESS SET TO VOTE ON RELIEF AND GOV'T FUNDING PACKAGE TODAY

- MORE THAN 30 COUNTRIES BAN TRAVEL FROM U.K. WITH NEW COVID STRAIN EYED

- TESLA SHARES DIVE ON FIRST DAY OF TRADING ON S&P 500

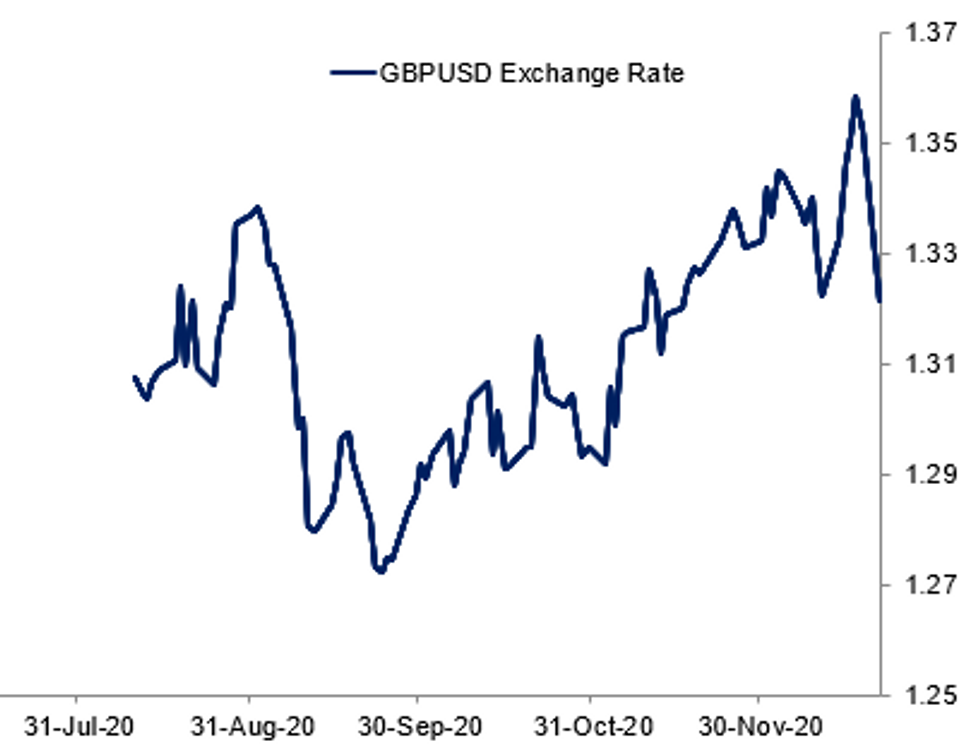

Fig. 1: Isolated

U.S.: Fox's Chad Pergram tweets this morning on the order of proceedings for today's COVID relief/gov't funding legiatlion:

- "Hse/Senate slated to vote on $900 billion coronavirus relief package today/$1.4 trillion omnibus gov't funding plan. The latter will fund the gov't through September 30, 2021. Government currently operating on one-day spending package. Funds gov't through 11:59:59 pm et tonight

- Hse Rules Cmte could meet this morning as early as 8 am et to prep the coronavirus bill for the flr. Timing for House debate is unclear. But the House will go first, followed by the Senate. Senate doesn't meet until noon et

- Senate will need cooperation from all 100 senators to accelerate process on the coronavirus bill and not go through all of the parliamentary hurdles to finish the bill today."

U.K.: The newsflow surrounding the UK over the weekend has been largely negative. There is still no trade deal agreed with the EU (although according to some sources all that holds this up is an agreement on how long the fishing transition will be). It is widely considered that negotiations will continue at least until Christmas but things really are getting down to thewire if the sides want to avoid an accidental no deal scenario.* The other big news of the weekend has been the introduction of Tier 4Covid-19 restrictions across Greater London and much of South East England. These restrictions are effectively in line with those seen during the English national lockdown of November.

U.K.: However, it is the new strain of Covid-19 that is particularly concerning -it has become the dominant strain throughout London and South East England. The new strain is through to be around 70% more contagious than the originalstrain and is expected to raise R by 0.4-0.9 points. A number of European countries have temporarily closed their borders with the UK, including France, which will disrupt already stretched trade channels ahead of the Brexit deadline.

U.K.: Travel consultant Paul Charles Tweets: "32 countries have now banned #UK flights - including Norway, Hong Kong, Canada, France, Germany, Croatia and Switzerland. The #EU is meeting now and may enforce an EU-bloc ban."

U.S. EQUITIES (BBG): Tesla Inc. shares fell 4.5% in premarket trading on Monday as the electric vehicle maker marks its trading debut on the S&P 500 Index. Its shares have catapulted 731% this year in anticipation of the historicinclusion, making it the biggest company ever to be added to the benchmark. The EV pioneer will also be joining the S&P 100, replacing oil and gas firm Occidental Petroleum Corp., which fell 7.5% premarket.

CHINA (MNI EXCLUSIVE): China may extend its anti-trust campaign to the financial sector following recent moves to penalise its internet giants as Beijing wants to strengthen competition and limit the systemic risk posed by mega holding companies that straddle and dominate industries, policy advisors told MNI. For full article contact sales@marketnews.com

RBA (MNI INSIGHT): The Reserve Bank of Australia is considering an upward revision of its 2021 forecasts for key indicators such as employment, which is already ahead of earlier forecasts, given the possibility of an earlier-than-expected global rollout of coronavirus vaccines and Australia's relative success in containing the pandemic, MNI understands. For full article contact sales@marketnews.com

RATINGS: Sovereign rating reviews of note from Friday included:

* Fitch affirmed Slovenia at A; Outlook Stable

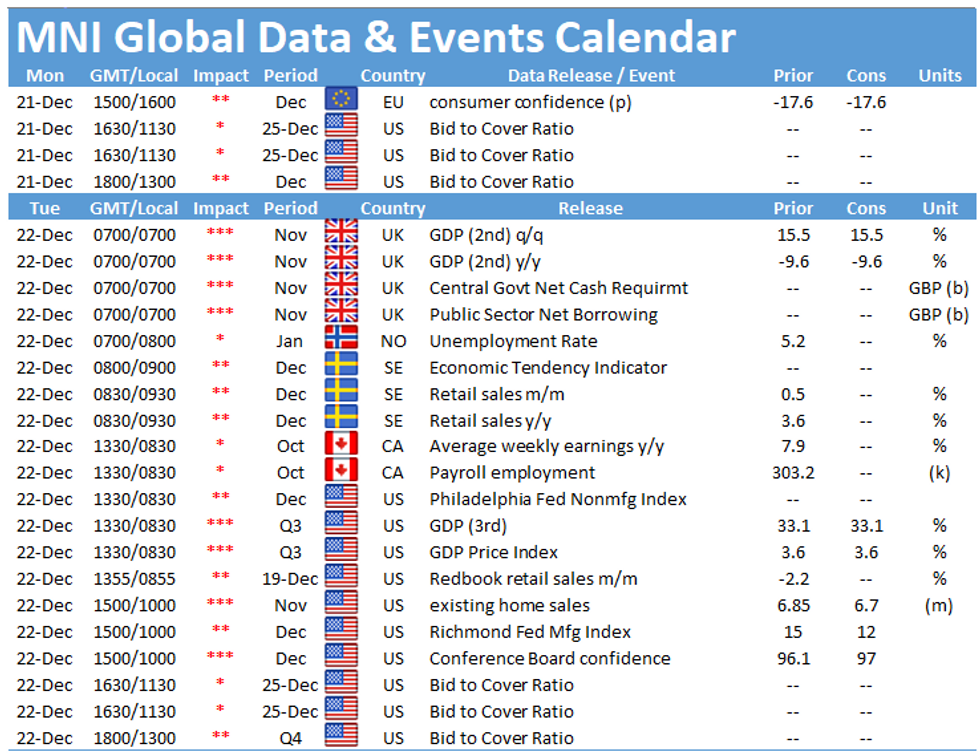

DATA:

No data of note released in the European morning.

FIXED INCOME: Lack of Brexit progress and new Covid-19 strain hit risk appetite

- Risk-off has been the theme of the morning with concerns about the new more virulent Covid-19 strain in the UK and another missed Brexit deadline. Unsurprisingly, gilts have been the outperformers this morning with much of the bad news originating in the UK.

- Brexit headlines still have the potential to be market moving, but there has not been much significant movement since the moves higher in core fixed income at the open.

- In line with the risk-off sentiment, peripheral spreads are wider.

- It's a pretty light day on the data calendar today with no Fed/ECB/BoE speakers scheduled.

- TY1 futures are up 0-11+ today at 138-03+ with 10y UST yields down -5.0bp at 0.899% and 2y yields down -1.0bp at 0.112%.

- Bund futures are up 0.63 today at 178.29 with 10y Bund yields down -3.9bp at -0.613% and Schatz yields down -1.5bp at -0.749%.

- Gilt futures are up 0.78 today at 135.74 with 10y yields down -7.5bp at 0.172% and 2y yields down -5.7bp at -0.150%.

FOREX: JPY, USD Sharply Higher as Risk-Off Gathers Pace

After a somewhat quiet start, risk-off is gathering pace ahead of the NY crossover, with JPY, USD sharply higher against all others in G10. Renewed fears over a fresh, more infectious mutation of COVID-19 in the south-east of England has been a primary driver, but stocks are also trading poorly ahead of the inclusion of Tesla in the S&P500 for the first time - their shares are lower by over 5% ahead of the open.

At the bottom of the pile, NOK has reversed recent outperformance, falling against all others as crude prices fall sharply. WTI and Brent are lower by over 5% apiece, knocking commodity-tied currencies across the board.

GBP is also suffering, with the lack of progress in Brexit negotiations knocking sentiment as well as severe controls on cross-border trade due to the new COVID strain. GBP/USD fell through 50-dma support at 1.3207, extending losses to over 300 pips.

Data releases are few and far between Monday, with just Chicago National Activity Index and Eurozone consumer confidence on the docket. There are no speakers of note.

EQUITIES: Weaker On Brexit, COVID Strain

- Asian markets closed mixed, with Japan's NIKKEI down 48.97 pts or -0.18% at 26714.42 and the TOPIX down 4.19 pts or -0.23% at 1789.05. China's SHANGHAI closed up 25.673 pts or +0.76% at 3420.569 and the HANG SENG ended 191.92 pts lower or -0.72% at 26306.68

- European futures are sharply lower, with the German Dax down 390.11 pts or -2.86% at 13382.97, FTSE 100 down 112.91 pts or -1.73% at 6444.45, CAC 40 down 154.32 pts or -2.79% at 5406.71 and Euro Stoxx 50 down 101.68 pts or -2.87% at 3481.38.

- U.S. futures are weaker, with the Dow Jones mini down 324 pts or -1.08% at 29789, S&P 500 mini down 45.5 pts or -1.23% at 3660.75, NASDAQ mini down 74.5 pts or -0.59% at 12637.25.

COMMODITIES: Lockdown Concerns See Oil Down Sharply, Precious Metals Bid

- WTI Crude down $2.06 or -4.2% at $47.44

- Natural Gas up $0.01 or +0.26% at $2.705

- Gold spot up $2.11 or +0.11% at $1897.73

- Copper down $5.65 or -1.56% at $360.4

- Silver up $0.53 or +2.06% at $26.8069

- Platinum down $25.98 or -2.49% at $1035.77

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.