-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Risk-Off Into Month-End

EXECUTIVE SUMMARY:

- FRENCH, GERMAN AND SPANISH Q4 GDP GROWTH BEATS ESTIMATES

- ECB'S MAKHLOUF SAYS RATE CUT NOT NEEDED AT THIS POINT

- BOJ LOWERS SHORT-, MID-TERM JGB BUY RANGE IN FEB

- CHINA MAY RECAPITALIZE BANKS, SPEED NPL DISPOSAL (MNI EXCLUSIVE)

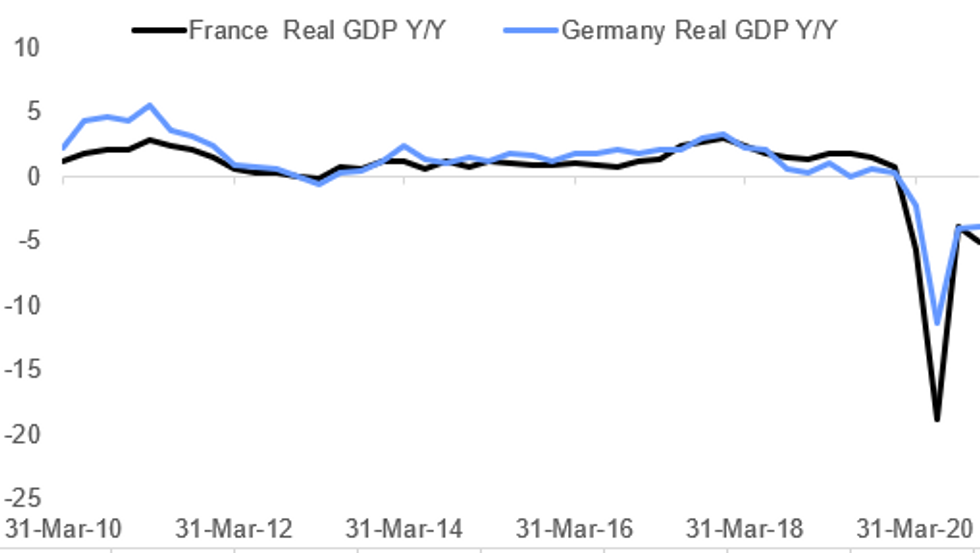

Fig. 1: German And French GDP Better Than Expected In Q4 But Still Negative Y/Y

BBG, MNI

BBG, MNI

NEWS:

ECB (BBG):The European Central Bank doesn't need to cut interest rate at the moment, Governing Council member Gabriel Makhlouf said, adding that the option remains a possibility if the economic outlook darkens. "Right now, today, I don't think that's warranted," Makhlouf, who heads Ireland's central bank, said in an interview on Bloomberg TV about the possibility of a rate cut. "Our toolkit is available to use and we haven't ruled out using any of our options, including a rate cut. And when we get together in March we'll make a call. It'll depend ultimately on what is happening to the outlook."

BOJ: The Bank of Japan said Friday it has lowered the total range of its government bond buying in the 1 to 3 years and 3 to 5 year buckets in February. The BOJ kept the frequency of all JGB buying operations in February unchanged from January. Flexibility across the bond buying scheme gives the BOJ's operations team room for manoeuvre as they target the yield on the benchmark 10-year JGB close to 0%, albeit with a range of 20bps either side. In an interview with MNI published Friday, ex-BOJ chief economist Kazuo Momma said the central bank could consider widening the permitted trading band, if needed.

CHINA (MNI EXCLUSIVE): China's anti-epidemic measures to limit travel during the upcoming Chinese New Year holidays are a boon for manufacturing companies that are inundated with orders and could lift production data, offsetting any weakness in consumption and sectors such as transportation, advisors said. For full article contact sales@marketnews.com

CHINA (MNI EXCLUSIVE): China could inject capital into its banking system and accelerate the disposal of bad loans made under emergency Covid aid programs even as the economy returns to trend growth rates, a former member of the People's Bank of China's monetary policy committee told MNI. For full article contact sales@marketnews.com

CHINA-HONG KONG-UK (BBG): Chinese Foreign Ministry spokesman Zhao Lijian says China won't recognize British National (Overseas) passports as travel documents or identification as of Sunday. Zhao reiterates China's opposition to U.K.'s plan to start accepting visa applications from Hong Kong BN(O) holders this weekend. Action is "grave infringement" of Chinese sovereignty, Zhao says.

DATA:

German GDP Up Slightly in Q4

GERMANY FLASH Q4 GDP +0.1% Q/Q SA, -3.9% Y/Y WDA

GERMANY Q3 GDP +8.5% Q/Q, -4.0% Y/Y

- The German economy grew by 0.1% in Q4, coming in slightly stronger than markets expected (0.0%)

- The annual rate improved further to -3.9% in Q4 after recording -4.0% in Q3.

- The recovery which started in the third quarter slowed significantly in the last quarter due to the renewed lockdown.

- Destatis noted that the tightened restrictions weighed particularly on household consumption, while exports and gross fixed capital formation in construction supported the economy.

- Over the year of 2020, GDP was 5.3% (calendar adjusted) lower than in 2019.

Spanish GDP Stronger Than Expected in Q4

SPAIN Q4 FLASH GDP +0.4% Q/Q SA, -9.1% Y/Y WDA

SPAIN Q3 GDP UNREVISED +16.4% Q/Q; -9.0% Y/Y

- Spanish economic growth decelerated to 0.4% in Q4 as the second wave of Covid-19 hit the country, but outpaced expectations looking for a modest decline.

- The annual rate deteriorated slightly to -9.1% after recording -9.0% in the previous quarter.

- Over the year of 2020, GDP will be 11.0% lower than in 2019.

- Q3 growth rates have been unrevised, showing a strong rebound after Q2's severe fall.

- Household consumption slowed to 2.5% in Q4 after growing by 20.8% in Q3.

- Government consumption increased 4.0% in Q4 after rising by 1.2% in the previous quarter.

French GDP Declines in Q4

FLASH Q4 GDP -1.3% Q/Q SA, -5.0% Y/Y WDA

Q4 HH CONSUMPTION EXPENDITURE -5.4% Q/Q

Q4 GOVT CONSUMPTION EXPENDITURE -0.4% Q/Q

Q4 EXPORTS +4.8% Q/Q; IMPORTS +1.3% Q/Q

- The French economy contracted by 1.3% in Q4 after the record-breaking 18.5% gain in Q3. However Q4 beat market expectations of a bigger drop (median 4.0%).

- Annual GDP fell by 5.0% in Q4 following Q4's improvement to -3.9%.

- Over the year of 2020, GDP declined by 8.3% compared to a growth rate of 1.5% in 2019.

- Q4's decrease was driven by a significant decline of household consumption, down 5.4% q/q amid the renewed strict curfews and containment measures throughout the quarter.

- However, the decline is much smaller than the one seen in Q2 during the first lockdown.

- Government consumption eased 0.4% in Q4 after rebounding by 14.6% in Q3

- Meanwhile, exports decelerated to 4.8% and imports slowed to 1.3% in Q4.

MNI: GERMANY JAN UE RATE (SA) 6.0%; DEC 6.0%

MNI: GERMANY DEC IMPORT PRICES +0.6% M/M, -3.4% Y/Y

FOREX: USD/JPY Streak Extends, Targets November Highs

Upside in USD/JPY extended throughout the Friday morning, with the pair printing up at 104.94, having topped several key resistance levels. The pair's rally appeared to stall ahead of the 104.95 mark, the 76.4% retracement of the Nov 11 - Jan 6 downleg. A break above here would open 105.16 initially, the Nov 13 high. JPY is comfortably the poorest performer in G10.

The greenback is generally firm, extending the week's uptrend, although the week's highs for the USD index remain in tact at 90.880. A break north of here opens 2021 highs of 90.951.

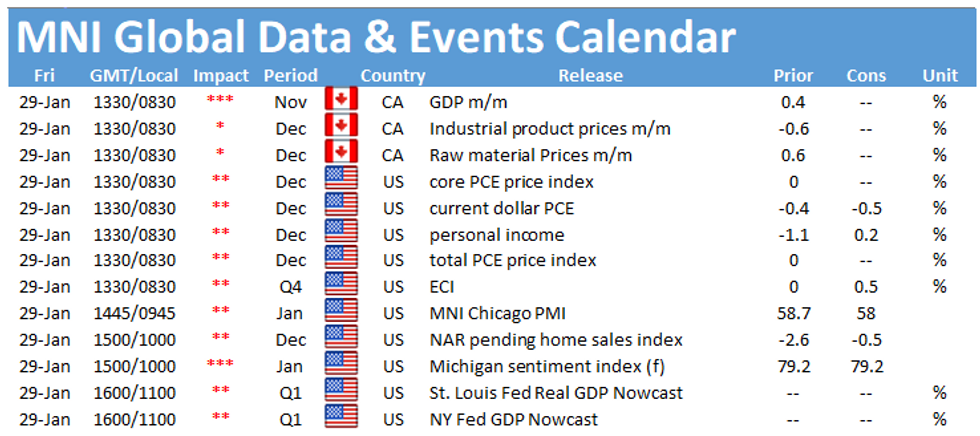

Focus today turns to US personal income/spending figures for December, as well as the latest Canadian GDP. We see the first Fed speakers cross after Wednesday's FOMC rate decision, with Fed's Kaplan and Daly both scheduled.

FIXED INCOME: Lower in spite of lower equities

Fixed income markets are on the backfoot today despite equities also having taken a leg lower. There are no real obvious reasons for the moves but we do note that today is the last trading day of the month so the moves could be month-end related. Peripheral spreads are also bucking the trend of equity markets and are tighter on the day.

- We have received German, French and Spanish Q4 GDP data and all have been been a little better than expected.

- The focus later today will be on US personal income/spending for December as well as the MNI Chicago PMI.

- TY1 futures are down -0-3 today at 137-05 with 10y UST yields up 2.3bp at 1.070% and 2y yields down -0.3bp at 0.116%.

- Bund futures are down -0.59 today at 177.18 with 10y Bund yields up 2.8bp at -0.512% and Schatz yields up 1.2bp at -0.737%.

- Gilt futures are down -0.42 today at 134.14 with 10y yields up 2.7bp at 0.313% and 2y yields up 0.7bp at -0.112%.

EQUITIES: Risk-Off Into Month-End

- Asian stocks closed lower, with Japan's NIKKEI down 534.03 pts or -1.89% at 27663.39 and the TOPIX down 30.07 pts or -1.64% at 1808.78. China's SHANGHAI closed down 22.107 pts or -0.63% at 3483.069 and the HANG SENG ended 267.06 pts lower or -0.94% at 28283.71

- European equities are weaker, with the German Dax down 142.86 pts or -1.05% at 13542.01, FTSE 100 down 56.06 pts or -0.86% at 6468.27, CAC 40 down 56.75 pts or -1.03% at 5450.57 and Euro Stoxx 50 down 41.92 pts or -1.18% at 3520.14.

- U.S. futures are lower, led by tech, with the Dow Jones mini down 281 pts or -0.92% at 30227, S&P 500 mini down 41.75 pts or -1.1% at 3737.5, NASDAQ mini down 210.75 pts or -1.6% at 12975.25.

COMMODITIES: Broadly Higher Despite Otherwise Risk-Off Tone

- WTI Crude up $0.16 or +0.31% at $52.32

- Natural Gas up $0.02 or +0.64% at $2.681

- Gold spot up $7.66 or +0.42% at $1845.27

- Copper down $1.85 or -0.52% at $355.65

- Silver up $0.47 or +1.78% at $26.8239

- Platinum up $11.07 or +1.03% at $1087.32

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.