-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - SA Study Sees Pfizer Efficacy Wane vs. Omicron

EXECUTIVE SUMMARY:

- UK PAYROLL EMPLOYMENT SEES RECORD JUMP

- SOUTH AFRICA STUDY SEES PFIZER EFFICACY DROP TO 33% VS. OMICRON

- E-MINI S&P EBBS THROUGH MONDAY LOWS

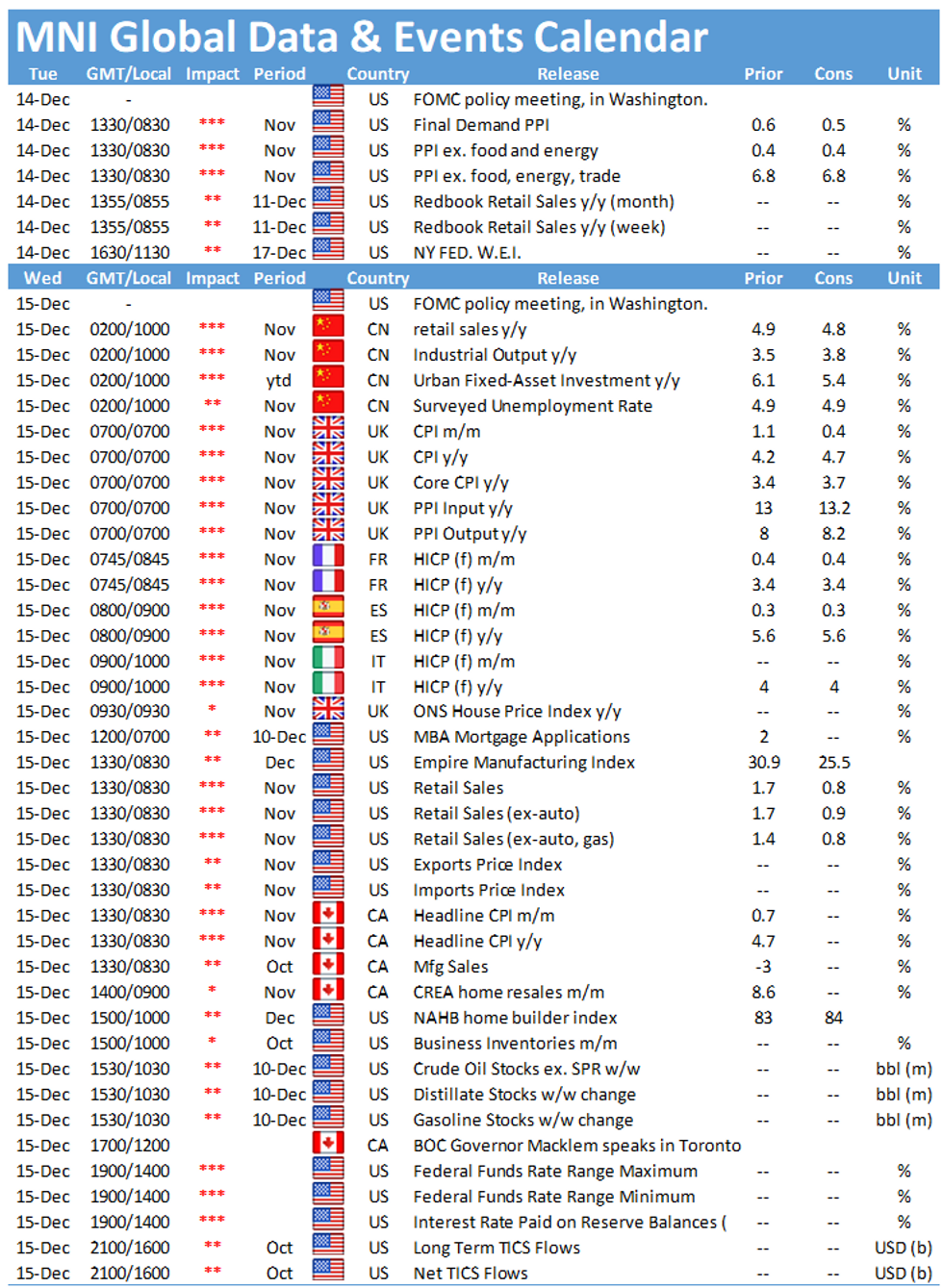

Figure 1: US PPI Y/Y seen climbing to fresh series high on a final demand basis

NEWS

CORONAVIRUS (Telegraph): Two shots of the Pfizer coronavirus vaccine provides 70 per cent protection against hospitalisation, according to a major real-world study from South Africa analysing the impact of the omicron variant. The research, which comes amid mounting concern about the spread of the highly contagious variant worldwide, was based on more than 211,000 positive coronavirus test results in the three weeks leading to December 7 – including 78,000 thought to be omicron. In total, 41 per cent of those testing positive had received two Pfizer-BioNTech shots. It found that the effectiveness of two Pfizer shots at preventing severe disease – defined as hospitalisation – has dropped to 70 per cent, substantially lower than the 93 per cent protection offered during South Africa’s delta wave.

EUROPE (MNI): Concerns Said Building Over Pace Of EU Fiscal Reform Talks

Concerns over the pace of talks to reform the EU's fiscal rules are mounting as France's turn in the rotating presidency looms for the new year, officials in Brussels told MNI. The talks have already narrowed in scope given member states' desire to avoid a treaty change, meaning that key Stability and Growth Pact rules such as the 60% limit on debt-to-GDP and 3% annual budget deficit ceiling are certain to remain.

CHINA (Bloomberg): China Property Plunge Worsens as Shimao Deal Raises ‘Red Flag’

Chinese property stocks sank to a nearly five-year low after a deal between two units of Shimao Group Holdings Ltd. heightened corporate governance concerns in an industry already grappling with a liquidity crisis. Shares of Shimao Group and its property-services unit both tumbled by the most ever on Tuesday, while a Bloomberg index of property stocks dropped 4.3% to the lowest level since February 2017. A connected-party acquisition announced by the developer late Monday “not only implies tight liquidity conditions for Shimao, but is also a corporate governance red flag,” JPMorgan Chase & Co. analysts wrote as they downgraded both stocks.

MNI STATE OF PLAY: ECB PEPP Seen Nearing End Of Live Phase

The European Central Bank will likely confirm the March end of the net purchase phase of its pandemic-era emergency bond-buying (PEPP) on Thursday, although with inflation running at multi-decade highs, it is less clear whether it will take other key pending decisions, including setting the scale of future bond buys through the legacy asset purchase program.

DATA

MNI: EZ OCT IND PROD +1.1% M/M, +3.3% Y/Y; SEP -0.2% M/M

MNI DATA BRIEF: UK Nov Payroll Employment Sees Record Jump - UK payroll employment rose by a record-high 257,000 in November, although an Office for National Statistics official cautioned that those data could include those working out notices after the end of the furlough programme on 30 Sept. The official also warned that the series has been subject to heavy revision; the October reading was downgraded to an increase of 74,000 from the initially-reported 160,000.

However, other measures of the labour market raise questions of a potential cooling of the jobs market in months to come. Vacancies declined by 80,000 between October and November, even as the level of openings rose by 185,000 to 1.219 million in the three months to November compared to the three months ending in August.

MNI BRIEF: Earnings Growth Slows in Hot UK Labour Market

UK earnings growth slowed markedly in the three months to October, despite a large increase in employment over the autumn, data released by the national statistics office. Total earnings rose by 4.9% over the same period a year earlier, down from 5.9% in the third quarter, although the outturn exceeded analysts' forecasts of a deceleration to 4.6%.

BONDS: Attention turning to CBs later this week

Core fixed income have been grinding lower off of yesterday's highs through most of the morning session with little in the way of headline drivers. Overall, however, moves have been rather limited.

- Attention is turning to the FOMC decision tomorrow and BOE/ECB meetings Thursday.

- Today the UK parliament's vote on Covid Plan B restrictions will be watched, as will the US Senate's vote on the debt ceiling extension.

- On the data front we have already seen some strong UK labour market data while the data highlight later will be US PPI.

- TY1 futures are down -0-2 today at 130-25 with 10y UST yields up 1.3bp at 1.430% and 2y yields up 1.4bp at 0.649%.

- Bund futures are down -0.19 today at 174.49 with 10y Bund yields up 1.1bp at -0.373% and Schatz yields up 1.1bp at -0.703%.

- Gilt futures are down -0.12 today at 127.42 with 10y yields up 1.5bp at 0.710% and 2y yields up 1.8bp at 0.406%.

FOREX: EUR/USD Back Above 1.13 as Risk Wanes

- Markets trade with a general risk-off tone, as equity indices slip through yesterday's lows and extend the pullback off the week's best levels at 4731 printed on Monday. This has translated into more solid haven currencies - with CHF and JPY among the session's best performers, although the single currency also trades well, with EUR/USD back above the 1.13 handle and eyeing the next resistance level at Monday's 1.1319.

- The broad risk-off follows the release of a further dataset from South Africa's Discovery study into omicron, which showed the effectiveness of the Pfizer jab against omicron waned to 33% from 80% against the prior delta variant.

- Risk and growth proxies including the NOK and AUD are the poorest performers as a result, with USD/NOK rising to touch new weekly highs of 9.0912.

- US PPI data takes focus going forward, with the Y/Y final demand figure seen climbing to a new series high of 9.2%. There are few speakers of note, keeping focus on the key policy decisions due later in the week.

EQUITIES: A little lower on SA Omicron data

- Japan's NIKKEI down 207.85 pts or -0.73% at 28432.64 and the TOPIX down 4.32 pts or -0.22% at 1973.81

- China's SHANGHAI closed down 19.557 pts or -0.53% at 3661.525 and the HANG SENG ended 318.63 pts lower or -1.33% at 23635.95

- German Dax down 17.7 pts or -0.11% at 15613.42, FTSE 100 up 18.77 pts or +0.26% at 7252.49, CAC 40 down 1.13 pts or -0.02% at 6944.71 and Euro Stoxx 50 down 1.99 pts or -0.05% at 4183.59.

- Dow Jones mini down 37 pts or -0.1% at 35586, S&P 500 mini down 15.5 pts or -0.33% at 4655.75, NASDAQ mini down 106.75 pts or -0.66% at 15988.75.

COMMODITIES: Natgas leading commodities lower

- WTI Crude down $0.19 or -0.27% at $71.06

- Natural Gas down $0.07 or -1.9% at $3.723

- Gold spot down $1.71 or -0.1% at $1784.66

- Copper down $1.05 or -0.25% at $427.4

- Silver down $0.12 or -0.54% at $22.2162

- Platinum down $0.76 or -0.08% at $932.06

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.