-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: Scandi flash crash sets tone for European equities

EXECUTIVE SUMMARY:

- FLASH CRASH-TYPE PRICE MOVEMENTS IN NORDIC EQUITIES LEAD TO BRIEF BUT SIGNIFICANT MOVES ACROSS EQUITY SPACE

- EUROZONE MANUFACTURING PMI PRINTS MIXED

- BTP FUTURES RECOVER FROM CYCLE LOW TO BE HIGHER AT WRITING

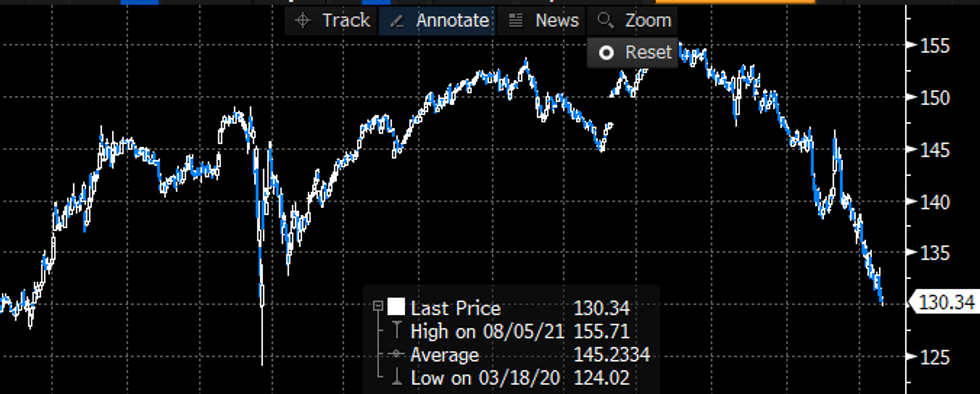

Source: Bloomberg, MNI

NEWS:

US TSYS (BBG): The latest data from BMO Capital Markets show the largest overseas holder of Treasuries has offloaded almost $60 billion over the past three months. While that may be small change relative to the Japan’s $1.3 trillion stockpile, the divestment threatens to grow.

US-JAPAN (NKY): Japan and the U.S. will deepen cooperation in building supply chains for cutting-edge semiconductors, amid growing rivalry between Washington and Beijing.

CHINA (BBG): China’s stringent lockdowns to curb Covid-19 infections are taking a significant toll on the economy and roiling global supply chains, with President Xi Jinping under pressure to deliver on pledges to support growth.

FINLAND-RUSSIA (BBG): Finland’s Fennovoima Oy dropped a contract with a Russian energy company for the delivery of a nuclear power plant under construction in the Nordic country.

MNI RBA PREVIEW: The much firmer than expected Q122 CPI print has tilted the scales towards a cash rate hike at the RBA’s May meeting, The MNI markets team has slight bias towards a 15bp cash rate target hike at this meeting, although we concede that this is a close call. For the full preview click here.

DATA:

- SPAIN APR MFG PMI 53.3; MAR 54.2

- ITALY APR MFG PMI 54.5; MAR 55.8

- FRANCE FINAL APR MFG PMI 55.7; FLASH 55.4; MAR 54.7

- GERMANY FINAL APR MFG PMI 54.6; FLASH 54.1, MAR 56.9

- EUROZONE FINAL APR MFG PMI 55.5; FLASH 55.3; MAR 56.5

- EZ APR ECONOMIC SENTIMENT INDICATOR 105.0; MAR 106.7r

- EZ APR INDUSTRIAL CONFIDENCE 7.9; MAR 9.0r

- EZ APR CONSUMER CONFIDENCE -22.0; MAR -21.6r

- EZ APR EMPLOYMENT EXPECTATIONS 112.4; MAR 113.5r

- EUROPEAN COMMISSION SAYS TWEAKS TO PREVIOUS S/ADJ METHODOLOGY

BONDS: Little headline drivers ahead of ISM

- There has been little in the way of headline drivers this morning for core FI with the China PMI disappointing overnight and more stories of lockdowns, but core FI moved lower through the Asian session.

- This morning's European PMI manufacturing prints were mixed while Eurozone confidence data was disappointing.

- European FI ground lower after the open, with BTP futures hitting a new cycle low and breaching the 130 psychological level. However, we have now recovered these losses and Bunds futures are now higher, BTP futures flat on the day but TY1 futures remain a little lower (despite being off their lows).

- The German curve has bull flattened, while UST and BTP curves have bear flattened.

- In the US session we will receive the final print of the S&P PMI andconstruction data for March but the main highlight will be the release of ISMmanufacturing data. The prices paid (and to a lesser extent employment)component will be closely watched in particular.

- - TY1 futures are down -0-8 today at 118-29 with 10y UST yields up 0.4bp at 2.941% and 2y yields up 1.2bp at 2.730%.

- Bund futures are up 0.31 today at 153.90 with 10y Bund yields down -1.5bp at 0.922% and Schatz yields down -2.8bp at 0.225%.

- BTP futures are unch today at 130.34 with 10y yields up 1.3bp at 2.786% and 2y yields up 0.1bp at 0.725%.

FOREX: Scandi FX Underperforms on Local Equity Volatility

- The greenback trades well early Monday, with the USD Index recouping a small part of the Friday pullback, although the bounce has stopped short of taking out either 103.665 or 103.928.

- Liquidity and price action has generally been subpar, with a UK market holiday keeping many traders on the sidelines ahead of key risk events later this week - most notably the Fed rate decision Wednesday as well as Friday's Nonfarm Payrolls release.

- Equity markets have been more volatile, with flash crash-type price action triggered in Scandinavian stock markets - supposedly triggered by an incorrectly sized basket order at the open - which saw Sweden's OMX Index drop 7% in seconds, before swiftly paring the losses in the subsequent few minutes.

- Euronext Oslo stated that there was no news in the market that could explain the rapid decline, adding that they are investigating the sharp fall "as a matter of routine". In response, SEK and NOK are underperforming in G10 - the weakest currencies so far this week.

- ISM manufacturing for April is the data highlight Monday, with markets expecting an improvement in the headline to 57.6 from March's 57.1.

EQUITIES: LEVELS UPDATE: European equities hit by earlier Scandi sharp moves

- Japan's NIKKEI down 29.37 pts or -0.11% at 26818.53 and the TOPIX down 1.27 pts or -0.07% at 1898.35

- German Dax down 177 pts or -1.26% at 13923.11, CAC 40 down 126.14 pts or -1.93% at 6403.7 and Euro Stoxx 50 down 78.35 pts or -2.06% at 3726.8.

- Dow Jones mini up 91 pts or +0.28% at 32977, S&P 500 mini up 7 pts or +0.17% at 4135.75, NASDAQ mini up 38.25 pts or +0.3% at 12894.5.

COMMODITIES: LEVELS UPDATE: Oil down $3/bbl

- WTI Crude down $3.23 or -3.09% at $101.06

- Natural Gas (NYM) up $0.14 or +1.91% at $7.363

- Natural Gas (ICE Dutch TTF) down $1.7 or -1.7% at $97.25

- Gold spot down $15.08 or -0.8% at $1881.23

- Copper down $11.9 or -2.7% at $428.7

- Silver down $0.13 or -0.59% at $22.6162

- Platinum down $0.31 or -0.03% at $937.85

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/05/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 02/05/2022 | 1400/1000 | * |  | US | Construction Spending |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/05/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 03/05/2022 | 0755/0955 | ** |  | DE | unemployment |

| 03/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/05/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/05/2022 | 0900/1100 | ** |  | EU | unemployment |

| 03/05/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/05/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 03/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/05/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 03/05/2022 | 1515/1615 |  | UK | BOE Mutton Panellist at Bankers Association | |

| 03/05/2022 | 1630/1230 |  | CA | BOC Sr Deputy Rogers speaks on operational independence |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.