-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Still Reeling From CPI

EXECUTIVE SUMMARY:

- ECB'S LAGARDE PUSHES BACK AGAINST ACTING "HASTILY" OVER RATE HIKES

- UK Q4 GDP EDGES HIGHER, DECEMBER BEATS WORST FEARS

- GERMANY PLANS ~EU10B TAX RELIEF STARTING 2022: SPIEGEL

- BLINKEN: RUSSIA FACES "MASSIVE CONSEQUENCES" IF INVADES UKRAINE

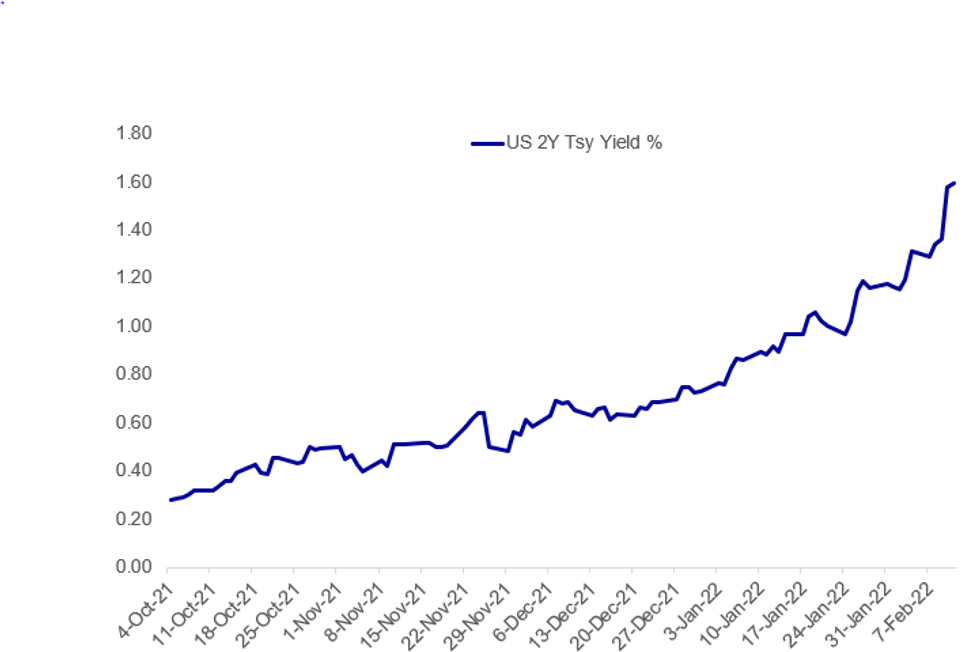

Fig. 1: 2Y Tsy Yield Pulls Back Slightly From Post-2019 High

NEWS:

ECB (DJ/REDAKTIONSNETZWERK): Financial markets that have been pricing in faster-than-expected European interest rate hikes should, as they say, cool their jets. That's according to European Central Bank President Christine Lagarde, who pushed back at speculation in an interview with Redaktionsnetzwerk Deutschland that published Friday. The comments came in response to a question as to why the central bank doesn't just fight higher prices with interest rate increases. "This would not solve any of the current problems. On the contrary, if we act hastily now, our economies could recover significantly worse and jobs would be at risk. That wouldn't help anyone," she said.

GERMANY (BBG): German Finance Minister Christian Lindner is planning ~EU10 billion in tax relief, Spiegel reports, without saying where it got the information from. Tax relief as measure to return gains due to higher inflation to taxpayers. State expects to get 2022 ~EU3 billion more tax payments than expected, and about twice as much in 2023.

US FOREIGN POLICY: Following a meeting of foreign ministers of the Quadrilateral Security Dialogue (or 'Quad'), formed by Australia, India, Japan, and the United States - press pack questions them on the group's stance on Ukraine, the Burmese junta, and the group's role in Indo-Pacific security. On Ukraine, US Secretary of State Anthony Blinken states that Russia will face "massive consqeuences" if it invades Ukraine. Australian FM Marise Payne states that "I have reiterated our very deep concerns about Russia's military build-up on Ukraine's border. We will continue to support our allies." Indian FM S. Jaishankar does not issue comments as foreceful as his US, Australian, or Japanese counterparts.During the meeting, Blinken stated that confrontation between the Quad nations and China "is not inevitable". Payne says that the joint Russia-China statement following the meeting between Presidents Xi Jinping and Vladimir Putin was "concerning".

FED: Goldman has raised their Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs 5 previously). They continue to expect three more hikes at a once-per-quarter pace in 2023Q1-Q3, reaching the same terminal rate of 2.5-2.75% but earlier.

UK-EU: EU Commission VP Maros Sefcovic and UK Foreign Secretary Liz Truss will hold further talks today intended to reach a deal on alterations to the Northern Ireland protocol that will be acceptable for both sides. The talks come with an unofficial deadline of 21 February looming. That is the day on which the EU-UK Joint Committee under the Withdrawal Agreement meets for the first time since mid-2021, with Northern Ireland's hardline unionst Democratic Unionist Party (DUP) in particular demanding changes be made removing customs checks between Great Britain and Northern Ireland.

CHINA - UK: Last night Politico reported that the UK gov't could be seeking to restart trade talks with China, which have been on hold since 2018. The Department for International Trade (DIT) and the Treasury are seen to be keen to improve trade links with China, which sits as the UK's third-largest trading partner, although the DIT stated it was not seeking an FTA with Beijing. While an improved relationship with China could provide an economic boost to the UK, seeking high-level ministerial talks risks upsetting an increasingly vocal wing of the governing Conservative party formed of China hawks at a time when Johnson's leadership is under significant threat.

ECB: Climate and evironmental risks must become part of the DNA of every euro area financial institution, ECB Executive Board member Frank Elderson said during a panel discussion Friday, with supervisory authorities expecting to receive action plans this year and preparing on-site visit to fully assess bank's risk management practices.

DATA:

MNI BRIEF: UK Q4 GDP Edges Higher, December Beats Worst Fears

UK GDP expanded by 1.0% in Q4 2021, slightly worse than that predicted 1.1% gain, with the December contraction of 0.2% more shallow than feared, data released by the Office for National Statistics showed Friday. That left GDP 0.4% below pre-pandemic levels.

Consumer spending rose by 1.2% in the closing months of the year, adding 0.69 percentage points to GDP. Government spending rose by 1.9%, while business investment rose by 0.9% in the quarter, but rose 0.8% on the year. Business investment remains 10.4% below pre-pandemic levels.

On the output side, services rose by 1.2%, despite a 0.5% decline in December (mostly dampened by weakness in retail trade). Services accounted for just under a percentage point of total growth, lifted by a resumption of GP visits and an extension of test and trace and vaccination programmes.

For the 2021 calendar year, GDP rose by 7.5%, countering at 9.4% plunged in 2020. It was the strongest growth since ONS records began in 1948 and the strongest data since 1941 using Bank of England data.

Source: ONS

MNI BRIEF: UK Dec Trade Deficit Narrows, Lifts Q4 GDP

The UK trade deficit narrowed to GBP6.536 billion in the final quarter of the year, from GBP15.789 billion in the third quarter, adding 1.62 percentage points to the 1.0% growth in total output, the Office for National Statistics said Friday. The trade gap narrowed slightly to GBP2.337 billion in December, from a revised 2.586 billion in November. The November reading was revised from a surplus of GBP626 million, largely due to amendments in the trade of non-monetary gold.

Exports rose by 1.5% in December, while imports increased by 0.9%.

Non-EU imports outpaced inward shipments from the EU for the 12th straight month, with the gap rising to a 2021 high of GBP4.1 billion. Much of the gap was powered by increasing non-EU imports of fuel, particularly gas from Norway.

FIXED INCOME: A busy, and large morning volume session

- Longer end Germany 10yr and 30yr (Bund, Buxl) rallies on short cover, squaring, yield hunting, and a Dove Christine Lagarde overnight.

- " Raising interest rates would not solve any of the current problems,” “On the contrary: if we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardized", she told Redaktionsnetzwerk

- BTP/Bund spread widens by another 6bps today, and test next target area at 166.2655

- A more subdued range bound session for Gilts, the contract is flat at the time of typing, while the Gilt/Bund spread is 1.6bp wider, but mostly led by the price action in the German contracts.

- The 2yr printed a 1.6358% yesterday (highest since 24/12/19),

- Yield this morning are lower, as Treasuries stay underpinned by Germany and the Bund.

- Looking ahead, there is nothing left in terms of tier 1 data for Europe. Main focus will be on the US Michigan on its inflation component.

FOREX: Greenback Extends Post-Bullard Move Higher

- Equities are weaker, with the USD stronger and yields retracing as the dust settles after a volatile Thursday session. Prevailing USD weakness that followed CPI has wholly reversed following Bullard's acutely hawkish comments after the London close, which continues to exert influence over markets this morning.

- The USD Index has shown above the 50-dma, but is yet to make a convincing break above, and the considerable distance to the 2022 highs printed in late January leaves the greenback with a solid runway on any protracted rally.

- AUD is the poorest performer so far, weaker against all others in G10 and putting EUR/AUD higher for a second session. The cross eyes near-term resistance at 1.6033 - the 50% retracement for the February downleg - and a consolidation above here opens 1.6226 over the more medium-term.

- Lastly, JPY trades well amid equity market weakness, with a negative close across Asia-Pac markets feeding into lower futures across the US and Europe today.

- The data slate is lighter for the rest of the session, with just the prelim Uni. of Michigan Confidence Survey due. Central bank speakers are similarly few and far between, but markets will be on watched for any further unscheduled commentary from FOMC members, after Bullard and Daly's impactful speeches yesterday.

EQUITIES: Weaker But Off Overnight Lows

- Chinese markets closed weaker (Japan's closed for holiday): China's SHANGHAI closed down 22.959 pts or -0.66% at 3462.948 and the HANG SENG ended 17.69 pts lower or -0.07% at 24906.66.

- European equities are lower, with the German Dax down 128.97 pts or -0.83% at 15490.44, FTSE 100 down 68.36 pts or -0.89% at 7672.4, CAC 40 down 98.44 pts or -1.39% at 7101.55 and Euro Stoxx 50 down 52.01 pts or -1.24% at 4197.07.

- U.S. futures are weaker as well, with the Dow Jones mini down 150 pts or -0.43% at 34989, S&P 500 mini down 24.75 pts or -0.55% at 4472.75, NASDAQ mini down 113.25 pts or -0.77% at 14587.75.

COMMODITIES: Metals Head Lower

- WTI Crude up $0.58 or +0.65% at $89.73

- Natural Gas up $0.04 or +1.06% at $3.966

- Gold spot down $1.08 or -0.06% at $1825.96

- Copper down $11.3 or -2.43% at $453.7

- Silver down $0.25 or -1.06% at $22.9544

- Platinum down $0.56 or -0.05% at $1024.49

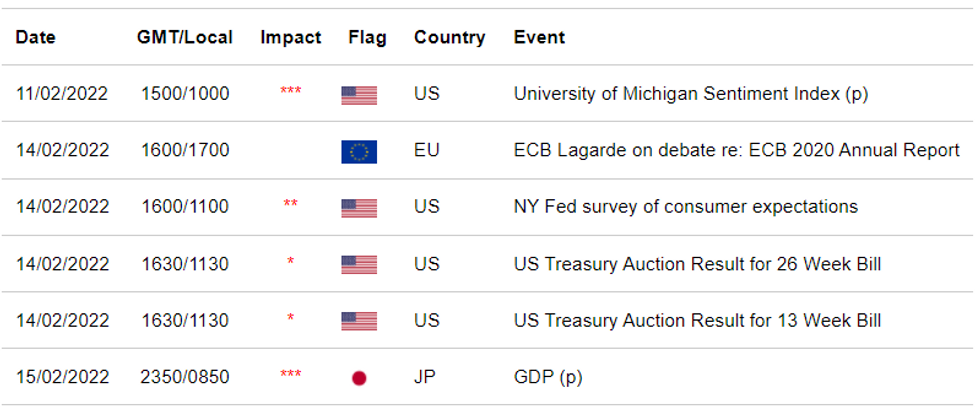

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.