-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI US Open: Stocks Defy Global Tax Talk

EXECUTIVE SUMMARY:

- E.U. FAILS TO FIND UNITED RESPONSE TO ASTRAZENECA VACCINE RISK

- E.C.B. WILL DECIDE ON 3Q PEPP PURCHASES AT END 2Q: HOLZMANN

- U.S. OFFER ON GLOBAL TAX DEAL WOULD TIE LEVIES TO REVENUE

- EUROPEAN COMMISSION SEES MOMENTUM FOR SUMMER DEAL ON FAIR GLOBAL TAX

- GERMAN MACHINERY ORDERS SURGE IN FEB, BUT FACTORY ORDERS SLIGHTLY MISS EXPECTATIONS

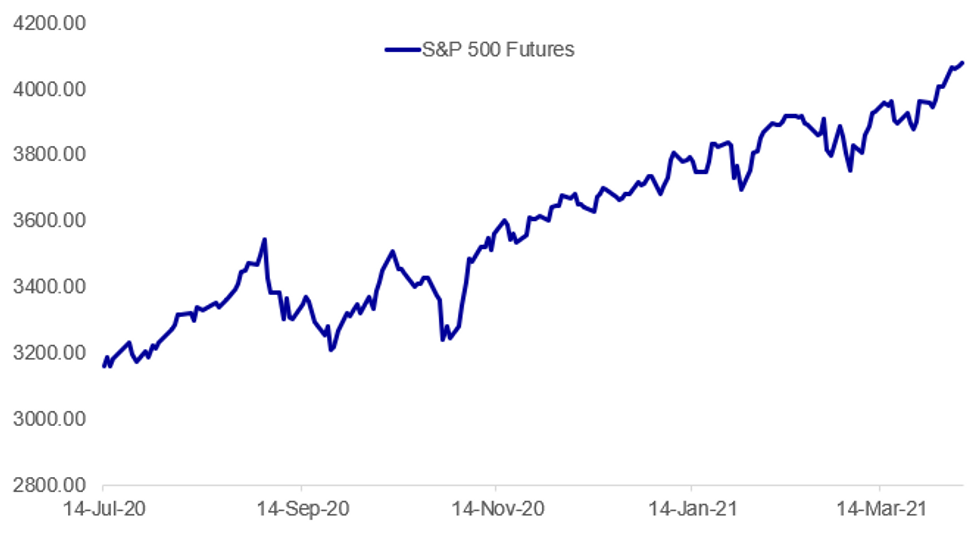

Fig. 1: Fresh Highs For S&P Futures

BBG, MNI

BBG, MNI

E.U./COVID VACCINES (BBG): The European Union failed to form a united response to links between AstraZeneca Plc's Covid-19 vaccine and a rare type of blood clotting, missing an opportunity to inject momentum into the bloc's sluggish inoculation program. At a meeting that ran until late Wednesday, EU health ministers promised to continue discussions on vaccination planning and process. In a statement afterward, the EU said ministers had shared "different interpretations" of a safety report on the AstraZeneca shot by the bloc's drugs regulator, indicating what may be deep divisions on the way forward.

E.U./COVID VACCINES (MT): Spain, Italy and Estonia joined the list of countries imposing age restrictions on AstraZeneca's COVID-19 jab amid reports of blood clotting after getting vaccinated. The three European nations will limit the COVID-19 shot to people over 60 years old, while some countries have stopped administering the vaccine pending further investigation by health authorities.

U.K./COVID VACCINES (BBC): The UK has more than enough supply of the Pfizer and Moderna jabs to vaccinate all adults under 30, the health secretary has said. The UK drugs regulator says people aged 18 to 29 should be offered a different vaccine due to evidence linking AstraZeneca jabs to blood clots. Matt Hancock said the UK is on track to vaccinate all adults by 31 July. He said the AstraZeneca jab remained safe and urged those who had received one dose to take up their second.

E.C.B. (BBG): European Central Bank Governing Council member Robert Holzmann tells CNBC in an interview that the decision on PEPP bond purchases in the third quarter will be decided upon at the end of the second. No need to deviate from capital key in PEPP is good news. ECB intervention on bond yields was successful, favorable financing conditions could be maintained.

E.C.B. (BBG): "If indeed there would be a delay in the disbursement of the Next Generation EU recovery fund that would be absolutely a piece of bad news because I do believe that fiscal policy is really at the forefront of the crisis fighting policy response" the ECB's Governing Council member from the Netherlands Klaas Knot tells CNBC in an interview." At the same time, the bulk of the fiscal response is of course national in nature and however important I do believe the recovery fund is, it's not a cyclical instrument, it's a structural instrument"

E.C.B. (BBG): European Central Bank Governing Council member Olli Rehn says the effect of U.S. fiscal stimulus on euro-area is about 0.3-0.5 percentage points of GDP, according to CNBC interview. Will maintain favorable financing conditions, that means ready to recalibrate purchases as neededWould be rather be cautious in regard to ending crisis support, must ensure there's genuine recovery

U.S./GLOBAL TAX (BBG): The U.S. is proposing that countries should be able to tax more corporate profits based on revenues within their borders in a bid to reach a global taxation deal, according to two people familiar with the offer.The U.S. sent a proposal to the nearly 140 countries participating the Organization for Economic Cooperation and Development's talks on digital taxation and global minimum levies, an offer that could help move previously stalled negotiations to consensus.

E.U./GLOBAL TAX (BBG): "The fair taxation of the digital economy is a top priority for the EU, and we remain committed to ensuring that all businesses, including digital ones, pay their fair share of tax where it is rightfully due," EU Commission spokesperson says in emailed remarks. "In that context, we welcome the strong support from all G20 Finance Ministers on 26/02/2021 for an agreement on both OECD pillars by July 2021."

GLOBAL TAX (MNI EXCLUSIVE): Wide divergences between countries on the issue of a minimum corporate tax as proposed by U.S. Treasury Secretary Janet Yellen as well as on a Digital Services Tax make an agreement by the G20's summer deadline unlikely, despite the initial welcome the initiative has received, European officials told MNI. For full article contact sales@marketnews.com

GERMANY: German machinery and plant producers saw a double-digit increase in new orders in February for the first time since October 2018, up 12% over the same period a year ago, the VDMA noted Thursday, with the organisation's chief economist, Ralph Wiechers, pointing to strong demand not just in Asian countries, but other regions outside of Europe as well.

GLOBAL AUTOS (BBG): A year after German luxury-car makers' bleakest period in decades, business has never been better.BMW AG on Thursday joined rival Mercedes-Benz in reporting record first-quarter vehicle deliveries, driven largely by explosive demand in China. Both are also getting big boosts from newly introduced plug-in hybrid and fully electric vehicles.Sales of BMW, Mini and Rolls-Royce vehicles surged more than a third to 636,606 in the quarter, the Munich-based manufacturer said in a statement. Deliveries in China almost doubled, and with the iX SUV and i4 coupe rolling out over the course of the year, the company is on track to hand over more than 100,000 fully electric vehicles to customers in 2021.Mercedes brand sales jumped 22% to 581,270, with Daimler AG's main division posting a 60% jump in China deliveries.

UBS (BBG): "If inflation continues to rise, central banks could be forced to raise interest rates sooner than expected," UBS Chairman Axel Weber says in speech at annual shareholder meeting.

CHINA: China will continue to stand with other developing country members at the WTO no matter how the external environment changes, said Gao Feng, spokesman of the Ministry of Commerce at a briefing on Thursday, when asked to respond to recent comments from Liz Truss, the UK trade secretary, who said China no longer warranted its status as a developing nation at the WTO.

DATA:

German Feb Factory Orders Up, But Below Expected

GERMANY FEB IND ORD +1.2% M/M, +5.6% Y/Y; JAN +0.8% M/M

- German factory orders rose by 1.2% in Feb, marking a 3-month high but coming in weaker than markets expectations (median 1.3%).

- Jan's reading was revised down to 0.8% from 1.4% reported previously.

- Industrial orders are now 5.6% higher than in Feb 2020 before the crisis.

- Feb's uptick was mainly driven by domestic orders which rose by 4.0% in Feb.

- Foreign orders eased by 0.5%, with orders from the EZ rising by 2.7%, while orders from other foreign countries ticked down 2.3%.

- Orders for intermediate goods edged up 0.5% and capital goods order rose by 2.1%, while consumer goods orders declined by 1.9% in Feb.

MNI: EZ MAR CONSTRUCTION PMI 50.1; FEB 45.0

MNI: UK MAR CONSTRUCTION PMI 61.7; FEB 53.3

MNI: FRANCE FEB SA TRADE BALANCE -EUR5.2 BN; JAN -EUR4.2 BN

FIXED INCOME: Reversing early losses

Core fixed income has been grinding higher in the European session but has merely been erasing some of the weakness seen overnight and on the open. European peripheral spreads are generally tighter this morning, led by Italy.

- Focus in the European morning session has focused on supply with France, Spain and the UK all coming to the market to sell via auction.

- The only noteable economic data in the European session was German factory orders which came in in line with expectations.

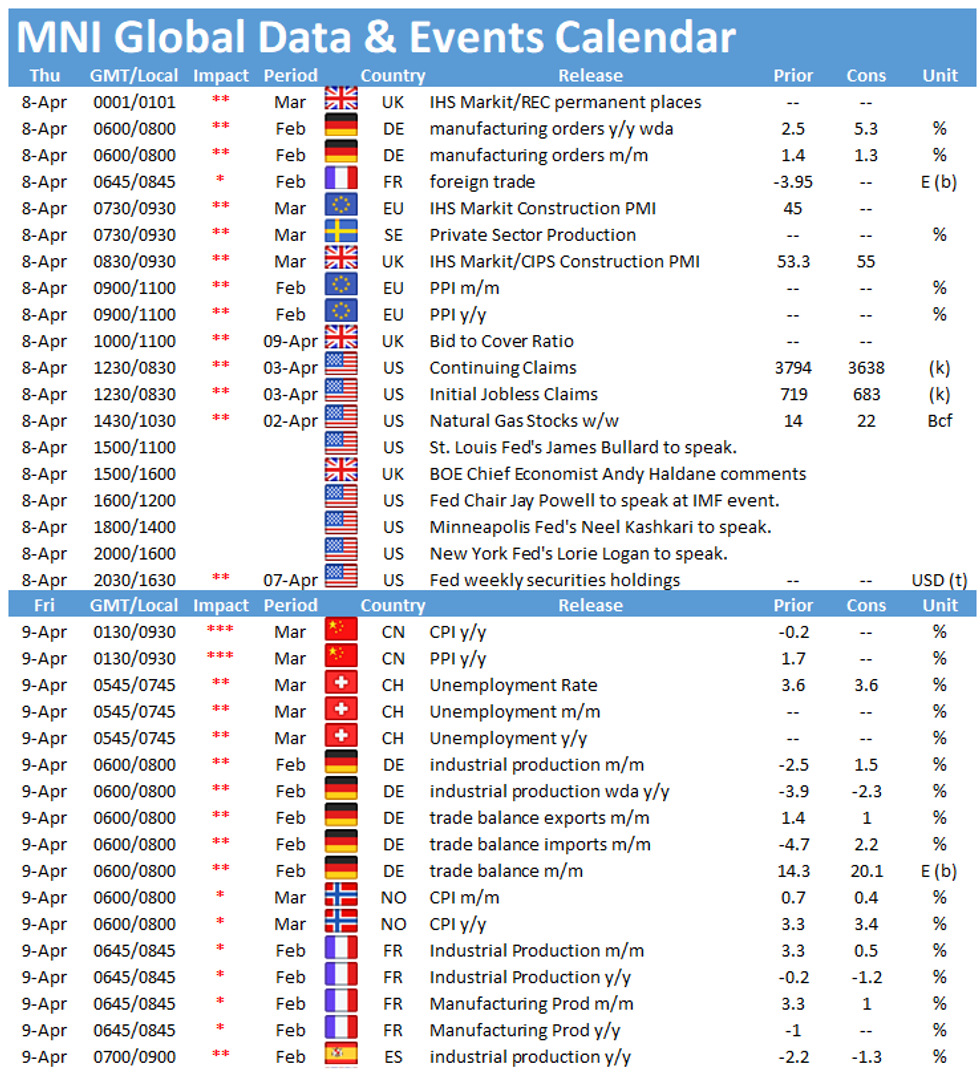

- Looking ahead focus will turn to the Accounts of the March ECB meeting and speeches from Fed members. Chair Powell is due to take part in an IMF panel on the global economy at 17:00BST/12:00ET, Bullard will speak at 16:00BST/11:00ET and Kashkari at 19:00BST/14:00ET.

- TY1 futures are up 0-00+ today at 131-27 with 10y UST yields down -2.5bp at 1.650% and 2y yields down -0.4bp at 0.150%.

- Bund futures are up 0.20 today at 171.87 with 10y Bund yields down -0.6bp at -0.331% and Schatz yields down -0.7bp at -0.716%.

- Gilt futures are up 0.03 today at 128.23 with 10y yields up 0.9bp at 0.781% and 2y yields up 0.3bp at 0.061%.

FOREX: Mixed Session For USD

A mixed session for the USD during our morning European session.

- On the margin the Dollar is better offered in G10, a continuation of the light overnight session, following S&P hitting an all time record high.

- USD is up 0.18% against the NOK, and down 0.38% versus the SEK.

- USDJPY hovers near session low, lower US yields and Equities off their best levels is contributing somewhat.

- USD is still trading mixed with better buying against GBP, CNH, CAD.

- USDJPY support comes at 109.36 20-day EMA.

- EURUSD is up 0.03% against the Greenback, and some focus on large options expiry for today, with 6.03bn between 1.1840-1.1910.

- Turnovers have been on the low side, with G10 crosses trading at ~30% of 5 days average.

- Cable is flat, after attempting to fade some of yesterday's weakness, on Astra vaccine concerns and after MHRA's decision to stop AstraZeneca vaccinations of people under 30s

- Question for Europe, is whether they will follow EMA's guidance on vaccinations, or will most EU countries match UK MHRA's decision to pause Astra vaccination for under 30s.

- Looking ahead, US IJC is the only notable data. ECB will publish their minutes. Fed Bullard and Kashkari on Economy..

- Fed Powell is in an IMF panel, as well as Riksbank Ingves and Breman.

- RBNZ's Ha to Speak at Citi Conference

EQUITIES: S&P Futs Touch Record Highs (Again)

- Asian stocks closed mixed, with Japan's NIKKEI down 21.81 pts or -0.07% at 29708.98 and the TOPIX down 15.57 pts or -0.79% at 1951.86. China's SHANGHAI closed up 2.93 pts or +0.08% at 3482.555 and the HANG SENG ended 333.27 pts higher or +1.16% at 29008.07.

- European equities are higher, with the German Dax up 16.16 pts or +0.11% at 15228.6, FTSE 100 up 10.43 pts or +0.15% at 6885.32, CAC 40 up 28.34 pts or +0.46% at 6130.66 and Euro Stoxx 50 up 14.56 pts or +0.37% at 3970.45.

- U.S. futures continue to gain, led by the NASDAQ, with the Dow Jones mini up 21 pts or +0.06% at 33349, S&P 500 mini up 13.5 pts or +0.33% at 4083.5, NASDAQ mini up 102.5 pts or +0.75% at 13707.25.

COMMODITIES: Oil Lags Broader Gains

- WTI Crude down $0.34 or -0.57% at $59.41

- Natural Gas down $0.03 or -1.11% at $2.489

- Gold spot up $5.84 or +0.34% at $1743.79

- Copper up $2.65 or +0.65% at $407.85

- Silver up $0.09 or +0.36% at $25.3397

- Platinum down $0.99 or -0.08% at $1234.03

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.