-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks Find A Footing

EXECUTIVE SUMMARY:

- EQUITIES STABILIZE FOLLOWING MONDAY'S ROUT

- B.O.J. WORRIES U.S. ELECTION RESULT JITTERS TO LIFT YEN (MNI POLICY)

- E.C.B. SAYS BANKS TIGHTENED LENDING STANDARDS IN Q3

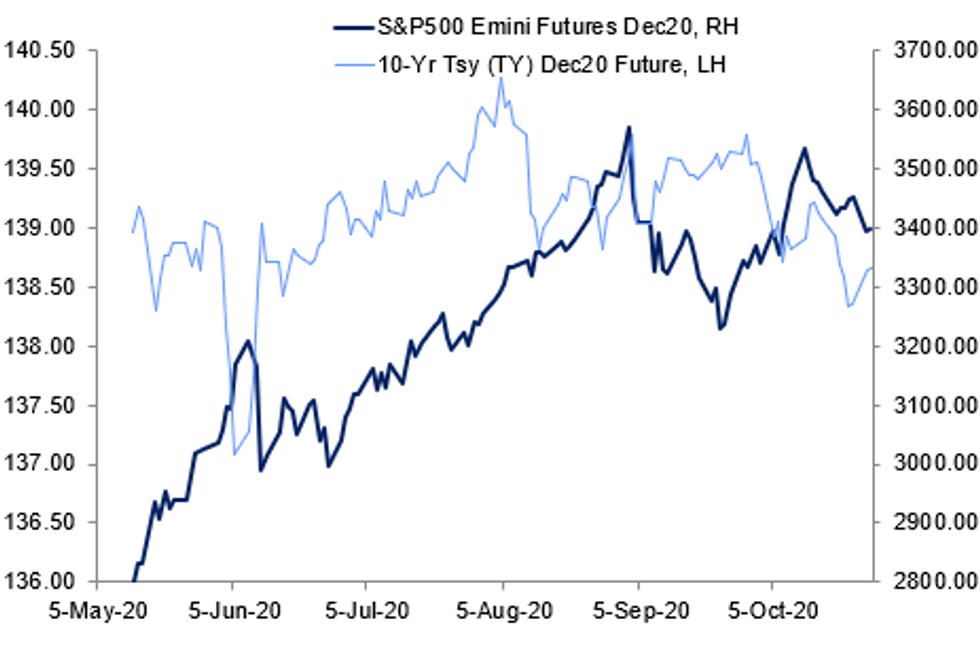

Fig. 1: Taking A Breather

NEWS:

GLOBAL MARKET/OPINION: Equities Bouncing, Helped by Better Bank Earnings

* EQUITIES: US futures bounced well after yesterday's rout - E-mini S&P back above 3400, but VIX still elevated.* BANKS: European banks surge on better earnings. Santander, HSBC in focus.

* FISCAL: With the Senate now on a pre-election break, stimulus package in the near-term now close to impossible. Focus turns to prospect for fiscal aid inNovember.

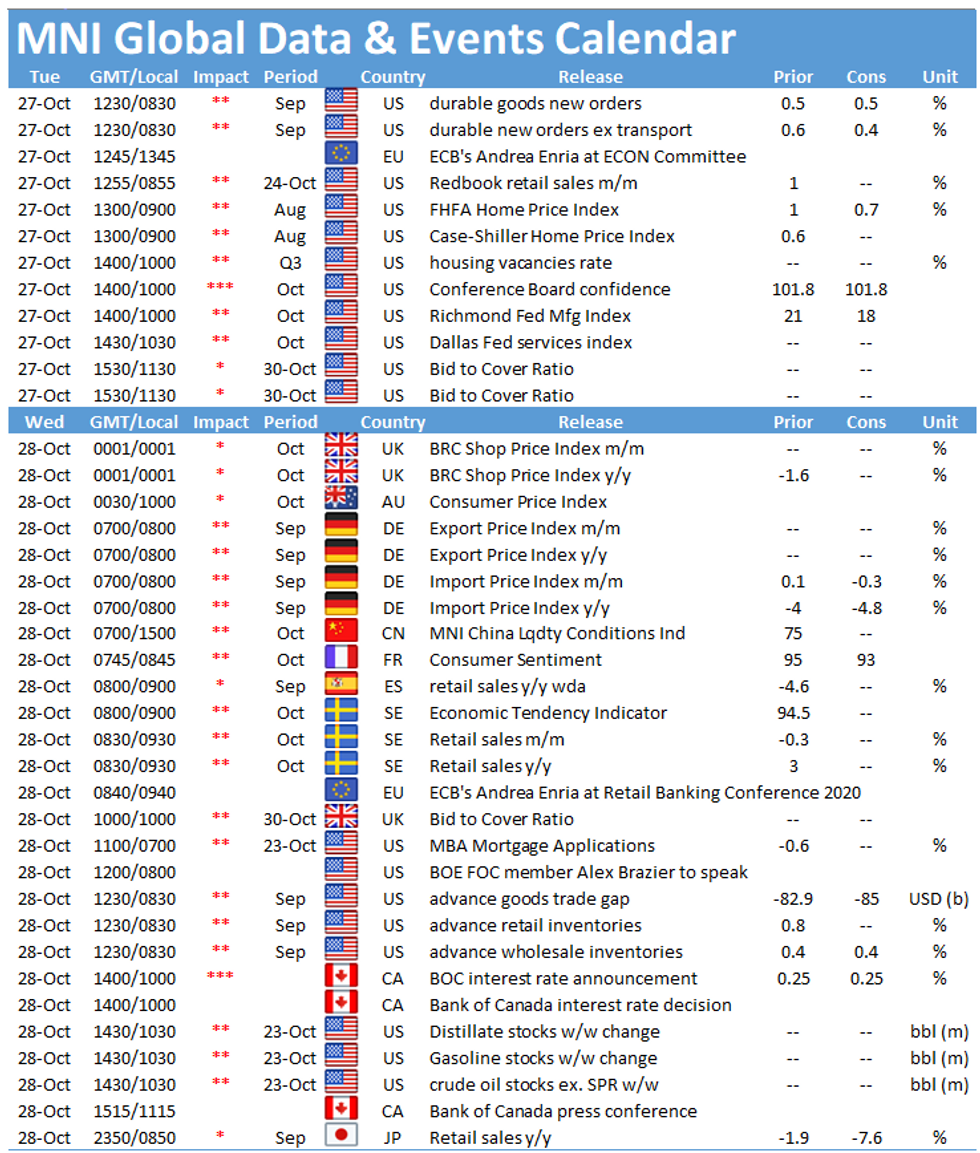

* DATA: Quiet data day, with just US durable goods, consumer confidence due. FOMC still in pre-decision blackout period.

* EARNINGS: Caterpillar, Merck & Pfizer are due ahead of the bell, with Microsoft reporting after the close.

* TURKEY: TRY continues to plumb new all time lows, with the escalation of the spat with France yesterday continuing to undermine market confidence. Reports of further clashes between Russian and Turkish backed forces in Syria also weighing.

BOJ (MNI POLICY): Bank of Japan officials are worried that a delay in the U.S. presidential election result will increase volatility and destabilize financial markets by strengthening the yen, thereby hurting Japan's economy, MNI understands. The election is due on Nov. 3, but the result is expected to be delayed due to postal voting. A contested result could extend the waiting period.

ECB (BBG): Credit standards tightened across the board in the euro area in the third quarter, the European Central Bank said on Tuesday, a sign that banks started to rein in lending even before the recent surge in infections.Banks' internal guidelines became more stringent between July and September for loans to companies, mortgages, consumer credit and other lending to households, according to the ECB's Bank Lending Survey.Banks expect credit standards to tighten further for companies in the fourth quarter, which reflects "concerns around the economic recovery as some sectors remain vulnerable, as well as uncertainties around the prolongation of fiscal support measures," according to the report.

ITALY (BBG): Italian Prime Minister Giuseppe Conte is finalizing a new relief package to help sectors hardest hit by the latest coronavirus restrictions amid growing protests over the measures in cities including Milan and Turin. Conte's cabinet is meeting on Tuesday in Rome to sign off on measures worth about 5 billion euros ($6 billion) to partially compensate businesses that will suffer due to a partial lockdown approved at the weekend.

FRANCE (BBG): French Interior Minister Gerald Darmanin says on Tuesday that the government is mulling "difficult decisions" to fight the Covid resurgence in France. Darmanin says the current curfews in major cities designed to curb night life are "much respected".

RBA: Financial systems both in Australia and globally have stood up well to the devastating economic impact of the Covid-19 pandemic. Michele Bullock, RBA Assistant Governor (Financial System) said Tuesday, saying banks were well capitalised going into the crisis and have used their substantial buffers to support the economy.

DATA:

FIXED INCOME: Core Curves Stable, Supply Eyed

Markets taking a breather after an active risk-off Monday, with core FI curves slightly steeper though largely stable, and futures steady within ranges.

- With pre-election US fiscal stimulus now all-but-dead, attention turns to the ECB meeting, Brexit negotiations, COVID developments, and of course the US election itself next week.

- Another limited European data slate; today's data highlight is prelim US Sep Durable Goods, followed later by US Consumer Confidence. ECB's de Cos speaks.

- In supply we get Italy CTZ and Linkers sales, with UK selling Jan-24 and Oct-71 Gilts; also, EIB syndicating 7-Yr bond. US sells $54B of 2-Yr notes.

Latest levels:

- Dec 10-Yr US futures (TY) steady at at 138-20.5 (L: 138-18.5 / H: 138-22)

- Dec Bund futures (RX) up 9 ticks at 175.39 (L: 175.27 / H: 175.53)

- Dec Gilt futures (G) up 3 ticks at 135.46 (L: 135.34 / H: 135.51)

- Italy / German 10-Yr spread 0.6bps wider at 132.5bps

FOREX: Market Sentiment Remains Shaky, But Little Readthrough for FX So Far

EUR/USD inched through the Monday low in early Tuesday trade, with a poor open for European equity markets leaving stock market sentiment fragile. While US futures volumes sit well below average for this time of day, prices have stabilised slightly, with some support coming from better European bank earnings, with HSBC and Santander reports in focus. It appears this support is already beginning to fade however, which may keep markets concerned over a return to the week's lows.

The greenback is mixed/lower, with the likelihood of a pre-election stimulus package dwindling close to zero as the Senate take their pre-election break. NOK, CAD slightly outperform on better oil prices.

It's a relatively quiet data day, with just US durable goods, consumer confidence due. FOMC still in pre-decision blackout period. Caterpillar, Merck & Pfizer are due ahead of the bell, with Microsoft reporting after the close.

EQUITIES: US Earnings Eyed Later

Equities have stabilised since Monday's rout, though US futures are off session highs. European equities have been boosted by better earnings reports. Key US earnings today include Caterpillar, Merck, Pfizer, and Microsoft.

- Asian markets closed mixed, with Japan's NIKKEI down 8.54 pts or -0.04% at 23485.8 and the TOPIX down 1.45 pts or -0.09% at 1617.53. China's SHANGHAI closed up 3.197 pts or +0.1% at 3254.316 and the HANG SENG ended 131.59 pts lower or -0.53% at 24787.19.

- European futures are weaker, with the German Dax down 87.91 pts or -0.72% at 12096.03, FTSE 100 down 19.3 pts or -0.33% at 5790.83, CAC 40 down 53.74 pts or -1.12% at 4781.81 and Euro Stoxx 50 down 30.15 pts or -0.97% at 3075.36.

- U.S. futures are flat/mixed, with the Dow Jones mini down 16 pts or -0.06% at 27565, S&P 500 mini up 1.5 pts or +0.04% at 3395, NASDAQ mini up 27.25 pts or +0.24% at 11519.75.

COMMODITIES: Steady, With Oil Outperforming Slightly

Commodities are mixed Tuesday, as the USD is steady-to-slightly lower and equities stabilizing slightly vs Monday's rout.

- WTI Crude up $0.14 or +0.36% at $38.7

- Natural Gas up $0.03 or +0.93% at $3.052

- Gold spot down $3.25 or -0.17% at $1899.12

- Copper down $0.2 or -0.06% at $308.7

- Silver down $0.01 or -0.03% at $24.2687

- Platinum up $2.13 or +0.24% at $876.67

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.