-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks Set Fresh Highs Again

EXECUTIVE SUMMARY:

- CHINA'S PORT SHUTDOWN RAISES FEARS OF CLOSURES WORLDWIDE

- "WE COULD BE BACK" IN AFGHANISTAN IF AL QAEDA RETURNS: UK DEFENCE MINISTER

- JAPAN PM SUGA: TOKYO'S HEALTHCARE SYSTEM IN CRITICAL CONDITION

- EUROZONE TRADE SURPLUS DOWN IN JUNE

Fig. 1: Italy/Germany 10Yr Spread Testing 100bp Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA / GLOBAL SHIPPING (BBG): A Covid outbreak that has partially shut one of the world's busiest container ports is heightening concerns that the rapid spread of the delta variant will lead to a repeat of last year's shipping nightmares. The Port of Los Angeles, which saw its volumes dip because of a June Covid outbreak at the Yantian port in China, is bracing for another potential decline because of the latest shutdown at the Ningbo-Zhoushan port in China, a spokesman said. Anton Posner, chief executive officer of supply-chain management company Mercury Resources, said that many companies chartering ships are already adding Covid contract clauses as insurance so they won't have to pay for stranded ships.

UK/AFGHANISTAN (RTRS): Britain could return to Afghanistan if the country starts hosting al Qaeda in a way that threatens the West, defense minister Ben Wallace said on Friday.Asked if the UK would ever send troops back to Afghanistan again, Wallace told LBC Radio: "I'm going to leave every option open. If the Taliban have a message from last time, you start hosting al Qaeda, you start attacking the West, or countries like that, we could be back."

JAPAN / COVID: In the clearest sign yet that PM Yoshihide Suga may be forced into implementing more stringent COVID-19 restrictions in the Japanese capital, he stated today that Tokyo's healthcare system is in 'critical condition'. Says that people should restrict their movement as much as possible, and that the government will 'strive to restrain the flow of people in commercial facilities'. Comes as the city reports 5,773 new cases, a record high and exceeding lastFriday's total of 4,515.

GERMAN POLITICS: The latest opinion polling from FGW will make happy reading for Germany's centre-left Social Democratic Party (SPD) as it shows them drawing level with the environmentalist Greens in joint-second place while the party's chancellor candidate - current Vice Chancellor and Finance Minister Olaf Scholz - now holds a commanding lead in polling assessing respondents' preferred chancellor. * Federal election poll :CDU-CSU : 26% (-2), SPD: 19% (+3), Grne: 19% (-2),FDP: 11% (+1), AFD: 11%, Die Linke: 7%, FGW, 12/08/21. Chgs w/ 27-29 July. Preferred Chancellor poll: Scholz (SPD): 44% (+10), Laschet (CDU): 21% (-8),Baerbock (Grne): 16% (-4) FGW, 12/08/21, chgs w/ 27-29 July

U.K. WAGES (BBG): U.K. wages are rising as companies scramble to recruit workers to help them recover after the last coronavirus restrictions eased in July, a survey showed. The Recruitment & Employment Confederation, whose jobs report was one of the first to flag labor shortages in the second quarter, counted a near-record numbers of online job adverts posted last week. It was the fourth-highest weekly figure since the start of the pandemic.

SWEDEN INFLATION: CPIF 1.7%Y/Y (1.6% prev, 1.6% consensus). CPIF ex energy 0.5% Y/Y (0.9% prev, 0.5% consensus). CPIF a tad higher than expected, but only just rounded up to 1.7% (it camein at 1.677%). No reaction in SEK.

DATA:

EUROZONE DATA: Trade Surplus Down In June

The eurozone trade deficit slid to EUR12.4 billion in June, from an upwardly-revised EUR13.8 billion in May, dampened by a decline in exports. Outward shipments declined by 0.7%, the first fall since January, suggesting that supply bottlenecks and slowing Chinese growth may be hitting EU exporters, a fear raised in the German ZEW report released earlier this week.

Exports to the UK rose by a seasonally adjusted 4.7%, while shipments to other non-EU nations declined by 0.6%. Over the year to June, total exports rose by 23.8%, while imports increased by 28.2%. Six months on from the end of the transition period with the UK, Eurostat noted overall imports from the UK were down 18.2% (NSA).

FRANCE DATA: July Y/Y HICP Slows In July

- French HICP up 0.1% m/m to 1.5% y/y, according to final numbers, down from flash estimate of 1.6%

- HICP down to its lowest level since March

- CPI up 0.1% m/m to 1.2% y/y, unchanged from flash estimate, also lowest since March

- Annual HICP stood at +0.9% in July 2020, before falling to a multi-year low of 0.0 in September.

Source: INSEE

MNI: SPAIN JUL FINAL HICP -1.2% M/M, +2.9% Y/Y; JUN +2.5% Y/Y

*SPAIN JUL FINAL CPI -0.8% M/M, +2.9% Y/Y; JUN +2.7% Y/Y

FIXED INCOME: Treasuries outperform this morning

It has been another day of low volumes while fixed income has moved off the highs it saw on the European open this morning as equities have moved higher. There is no real macro/headline explanation for today's moves.

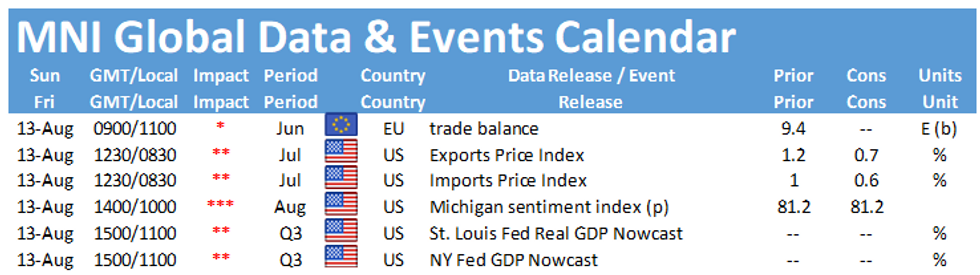

- Michigan confidence is the highlight of today's session and is expected to fall back a little from last month's print. US import/export prices are also due.

- TY1 futures are up 0-5 today at 133-19+ with 10y UST yields down -1.6bp at 1.345% and 2y yields unch at 0.224%.

- Bund futures are up 0.02 today at 176.60 with 10y Bund yields unch at -0.461% and Schatz yields up 0.5bp at -0.746%.

- Gilt futures are up 0.03 today at 129.50 with 10y yields down -0.3bp at 0.597% and 2y yields down -0.1bp at 0.149%.

FOREX: GBP/USD Narrowing the Gap with Key Support at the 200-DMA

- The greenback is inching lower early Friday, with the USD Index just below yesterday's highs although still comfortably clear of the week's lowest levels. The USD's modest weakness has relieved some of the bearish pressure off EUR/USD, which now sits nearer to 1.1750 than the bear trigger at 1.1704.

- GBP has moved from weak to weaker, with GBP/USD printing a new August low and narrowing the gap with the key support at the 1.3779 200-dma.

- NOK is the best performer in G10, with CAD not far behind. USD and GBP are the weakest.

- US Import/Export price indices are on the docket Friday, followed by the prelim reading for August Uni of Michigan sentiment data. Central bank speakers are few and far between, with no FOMC members on the schedule Friday.

EQUITIES: S&P Futs And EuroStoxx600 All Time Highs, Gains Today Led By Financials

- Asian stocks closed mixed, with Japan's NIKKEI down 37.87 pts or -0.14% at 27977.15 and the TOPIX up 2.84 pts or +0.15% at 1956.39. China's SHANGHAI closed down 8.438 pts or -0.24% at 3516.299 and the HANG SENG ended 126.2 pts lower or -0.48% at 26391.62.

- European equities are higher, with the German Dax up 66.57 pts or +0.42% at 15937.51, FTSE 100 up 25.86 pts or +0.36% at 7193.23, CAC 40 up 16.86 pts or +0.25% at 6882.47 and Euro Stoxx 50 up 8.19 pts or +0.19% at 4226.33.

- U.S. futures are slightly higher, with the Dow Jones mini up 44 pts or +0.12% at 35447, S&P 500 mini up 3.75 pts or +0.08% at 4458.25, NASDAQ mini up 12 pts or +0.08% at 15090.5.

COMMODITIES: Oil Sags, Precious Metals Edge Higher

- WTI Crude down $0.53 or -0.77% at $68.53

- Natural Gas down $0.05 or -1.17% at $3.893

- Gold spot up $3.15 or +0.18% at $1758.47

- Copper up $0.35 or +0.08% at $436.6

- Silver up $0.13 or +0.56% at $23.3702

- Platinum down $1.4 or -0.14% at $1022.81

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.