-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Tentative Stability (But Not For GBP)

EXECUTIVE SUMMARY:

- U.K.'S LATEST BREXIT OFFER ON FISH REJECTED BY EU: OFFICIALS (BBG)

- EU'S BARNIER SET TO BRIEF AMBASSADORS ON BREXIT TALKS AT 1500GMT

- TRUMP SIGNS STOPGAP FUNDING AS CONGRESS PASSES VIRUS RELIEF BILL

- U.K. GDP SEES MODEST Q2, Q3 UPWARD REVISION

- BRITAIN HAS "PLENTY OF FOOD, NO NEED TO WORRY": U.K.'S PATEL

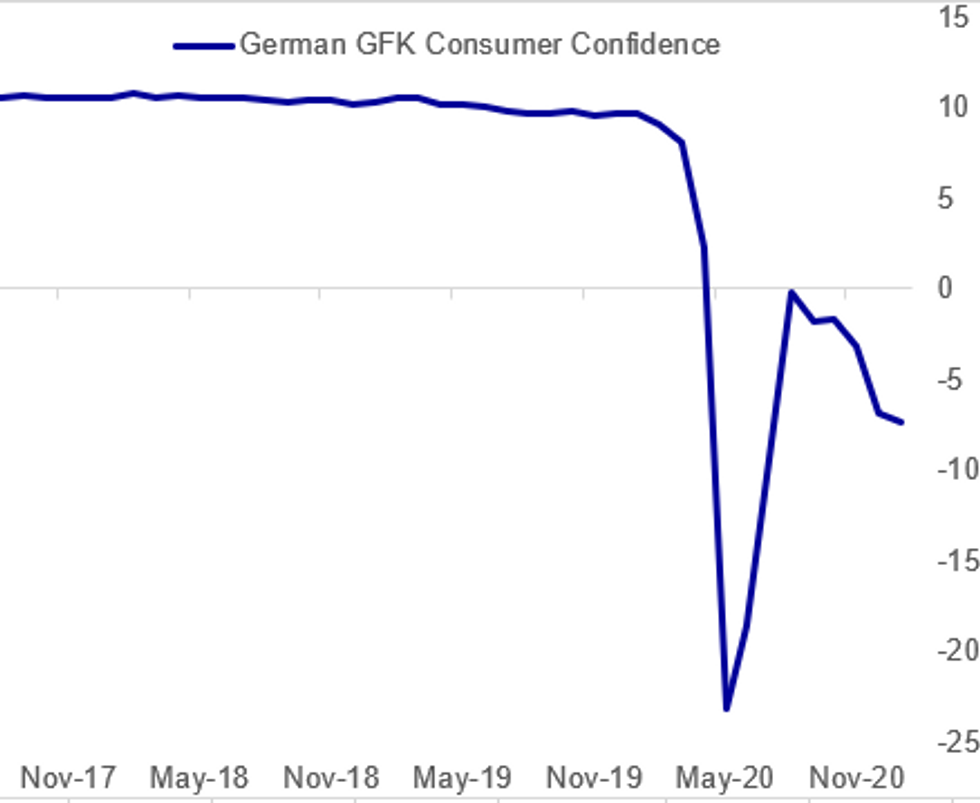

Fig. 1: German Consumer Confidence Waning Again

GFK, MNI

GFK, MNI

NEWS:

EU-UK (BBG): The European Union rejected the U.K.'s latest concessions on fishing, two officials said, in a setback to efforts to secure a post-Brexit trade deal. On Monday, the U.K. made a proposal that would see the EU reduce the value of the fish it catches in U.K. waters by 30%. Last week the U.K. was insisting the EU accept a 60% cut.

EU-UK: FT's @jimbrunsden: "#Brexit update: #EU's @MichelBarnier set to brief national ambassadors on the state of the talks around 16h00 CET"

U.S. (BBG): President Donald Trump signed a seven-day government spending bill, averting a federal shutdown as the White House awaits formal paperwork after Congress cleared long-term funding and a $900 billion pandemic relief measure designed to revive the U.S. economy. Both the House and Senate on Monday night approved a massive spending bill that combines the Covid-19 aid with $1.4 trillion in regular government funding. Trump is expected to sign that measure, but logistical complexities prevented the 5,593-page bill from quickly getting to him.

UK DATA: The second estimate of UK Q3 GDP was revised up to 16.0% q/q from the previously reported uptick of 15.5% an up from Q2's revised drop of 18.8%. The annual rate was revised up to -8.6% in Q3. However, the level of GDP is still 8.6% lower than where it was at the end of 2019. Both household and government spending came in stronger than markets expected and were revised up from flash estimates. Household spending was up 19.5% after dropping 22.2% in Q2 but remains 9.8% below the pre-crisis level. Government expenditure rose 10.4% in Q3, up from -10.4% seen in Q2 and 8.8% below Feb's level. The household savings rate decreased to 16.9% in Q3 compared to 27.4% recorded in Q2. Morevover, the UK's current account deficit excluding non-monetary gold and precious metals registered at GBP15.6bn in Q3, or 2.9% of GDP.

UK DATA: UK year-to-date borrowing rose to GBP 240.9bn in Nov, which is GBP 188.6bn higher than in the same period a year ago and the highest borrowing in any Apr to Nov since records began in 1993. YTD borrowing was revised down to GBP209.9bn in Oct. Debt-to-GDP was 99.5% in Nov, which is the highest debt to GDP ratio since the fin. year ending 1962. Borrowing (ex-banking groups) was estimated at GBP 31,571bn in Nov, which is GBP 26.0bn higher than in Nov 2019 and the highest Nov borrowing on record. Government tax receipts were less than a year ago in Nov, recording GBP38.9bn with marked declines of VAT and business rates. On day-to-day activities the gov. spent GBP 80.6bn in Nov, which is GBP 23.5bn more than in Nov 2019 and includes additional spending, GBP 5.9bn for the coronavirus job support schemes. CGNCR was around three times the highest cash requirement in any other Apr-Nov period since records began in 1984 and was estimated at GBP23,945bn in Nov.

U.K. (RTRS): Food in Britain is plentiful and shoppers should not be concerned about supermarkets running out of supplies, interior minister Priti Patel said on Tuesday. On Monday, Britain's two biggest supermarket groups Tesco and Sainsbury's warned that gaps will start to appear on British supermarket shelves within days if transport ties with mainland Europe were not quickly restored. But Patel played down those concerns. "I don't think anybody should be worried - there is plenty of food in our shops," Patel told LBC.

GERMAN DATA: German consumer sentiment is forecast to decline to -7.3 in January, down from -6.8 seen in December, according to the latest Gfk survey. Consumer confidence presents an uneven picture with economic expectations and the propensity to buy seeing a marginal uptick, while income expectations eased. Germany saw a sharp increase in infection rates which led to a hard lockdown and, as a result, further uncertainty.

EUROZONE DATA: Growth across the eurozone is set to contract by 2.7% in Q4 as the renewed lockdowns as Covid-19 infections surge again weigh on consumer confidence, Germany's ifo Institute said Tuesday. Their Eurozone Economic Outlook for the year sees the 2.7% decline replacing the 2.2% Q4 GDP growth forecast in the September Outlook.

GERMANY/COVID (RTRS): It is highly likely that the mutation of the coronavirus that has been found in Britain also exists in Germany, the head of the Robert Koch Institute (RKI) health institute said on Tuesday, adding, however, that it had not shown up in data yet.

GERMANY/UK/COVID (RTRS): Germany has imposed a travel ban for anyone coming from Britain, Northern Ireland and South Africa, which could remain in place until Jan. 6, according to a document seen by Reuters. Rail and bus operators, shipping companies and airlines are forbidden to transport people from those countries to Germany, it said.

CHINA (MNI EXCLUSIVE): China's consumer prices may remain in negative territory through the first quarter or even the first half of next year when the base effect of higher pork prices will start to fade and spending recovers further, policy advisors told MNI, adding that the short-lived decline is unlikely to draw any action from the central bank. For full article contact sales@marketnews.com

JAPAN: Japan's government has left its main economic assessment unchanged for the sixth straight month noting the economy "is still in a severe situation due to the Novel Coronavirus but it is showing movements of picking up." The government upgraded its assessment on exports for the first time since September, saying "exports are increasing", an improvement on the previous "improving."

DATA:

UK DATA: Final GDP Revised To +16.0% Q/Q

Q3 GDP +16.0% Q/Q; -8.6% Y/Y, PRELIM +15.5% Q/Q, -9.6% Y/Y; Q2 -18.8% Q/Q

Q3 BUSINESS INV +9.4% Q/Q, -11.3%Y/Y; Q2 -22.8% QQ, -23.8%YY

Q3 CONSUMER SPENDING +19.5%% Q/Q, -10.1% Y/Y; Q2 -22.2% QQ, +24.7%YY

Q3 GOVT SPENDING +10.4% Q/Q, -8.8% Y/Y; Q2 -14.5% QQ, -18.1%YY

UK DATA: Nov Borrowing Third-Highest on Record

NOV PSNB-X GBP 31,571BN VS GBP 5,570BN IN NOV 2019

NOV CGNCR GBP 23,945BN VS GBP 9,155BN NOV 2019

NOV PSNCR GBP 23,518BN VS GBP 9,385BN NOV 2019

NOV DEBT/GDP RATIO EX-BOE 88.4% VS 74.5%

NOV YTD BORROWING GBP 240.9BN VS GBP 52.3BN NOV 2019

FIXED INCOME: Brexit dominates thin markets (again)

- Markets are beginning to feel a lot like Christmas. Bunds moved higher following Treasuries this morning on the familiar concerns of Brexit, Covid-19 and US stimulus. However gilts opened marginally lower after yesterday's big rally (despite remaining some way off the high).

- Just around the time of writing, Bloomberg has reported that the EU has rejected the UK's offer to reduce the EU's value of fish caught in UK waters by 60% (up from 30% last week). This is in line with reports from the Telegraph overnight but still moved gilts a little higher (and sterling a bit lower) - although not enough to retrace the moves of the day so far.

- TY1 futures are up 0-4 today at 137-28+ with 10y UST yields down -0.9bp at 0.926% and 2y yields down -0.5bp at 0.118%.

- Bund futures are up 0.07 today at 177.93 with 10y Bund yields down -0.9bp at -0.591% and Schatz yields down -0.9bp at -0.750%.

- Gilt futures are down -0.11 today at 135.30 with 10y yields up 0.5bp at 0.209% and 2y yields up 0.2bp at -0.119%.

FOREX: Another Dose of Bad News for GBP

Equities are bouncing very modestly in Europe after yesterday's pullback, with core European indices higher by around 1% or so. This has failed to translate into currency markets, however, with AUD, NZD among the weakest in G10 so far. USD, JPY are slightly stronger.

Another dose of bad news for GBP, as the EU rejected the UK's latest approach on fish. There was a decent pick-up in GBP volumes on the back of the headline - around 5k contracts crossing in GBP futures in the minutes following release - around £320mln cash equivalent. This followed the UK reaching out with a revised offer on fish, with Johnson ready to let EU boats retain two thirds of their catch. Markets now await the UK's response.

Focus turns to the tertiary reading of US Q3 GDP, expected largely unrevised. This is followed by consumer confidence data for December and existing home sales for November.

EQUITIES: Mixed Start

- Asian stocks closed weaker, with Japan's NIKKEI down 278.03 pts or -1.04% at 26436.39 and the TOPIX down 27.93 pts or -1.56% at 1761.12. China's SHANGHAI closed down 63.787 pts or -1.86% at 3356.782 and the HANG SENG ended 187.43 pts lower or -0.71% at 26119.25.

- European stocks are higher, with the German Dax up 101.62 pts or +0.77% at 13425.07, FTSE 100 up 14.86 pts or +0.23% at 6409.67, CAC 40 up 56.46 pts or +1.05% at 5442.78 and Euro Stoxx 50 up 25.58 pts or +0.74% at 3495.84.

- U.S. futures are mixed, with the Dow Jones mini down 75 pts or -0.25% at 30038, S&P 500 mini down 2 pts or -0.05% at 3683.75, NASDAQ mini up 39.5 pts or +0.31% at 12723.

COMMODITIES: Oil, Copper Lower On COVID-Led Slowdown Concerns

- WTI Crude down $0.76 or -1.58% at $47.17

- Natural Gas up $0.03 or +1% at $2.732

- Gold spot down $2.55 or -0.14% at $1873.15

- Copper down $4.3 or -1.2% at $353.35

- Silver down $0.26 or -1.01% at $25.9124

- Platinum down $2.99 or -0.3% at $1009.79

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.