-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Whatever It Takes To Avoid Early Italian Elections

EXECUTIVE SUMMARY:

- EX-E.C.B. PRES DRAGHI POISED TO BECOME NEW ITALIAN PRIME MINISTER

- IRELAND, SPAIN SERVICES PMIS DISAPPOINT; ITALY BEATS

- EUROZONE INFLATION TURNS POSITIVE FOR FIRST TIME IN 6 MONTHS

- CHINA EYES CAPITAL GAINS TAXES TO LIFT REVENUE (MNI EXCLUSIVE)

- COVID ANTIBODIES REMAIN SIX MONTHS AFTER INFECTION, STUDY SHOWS

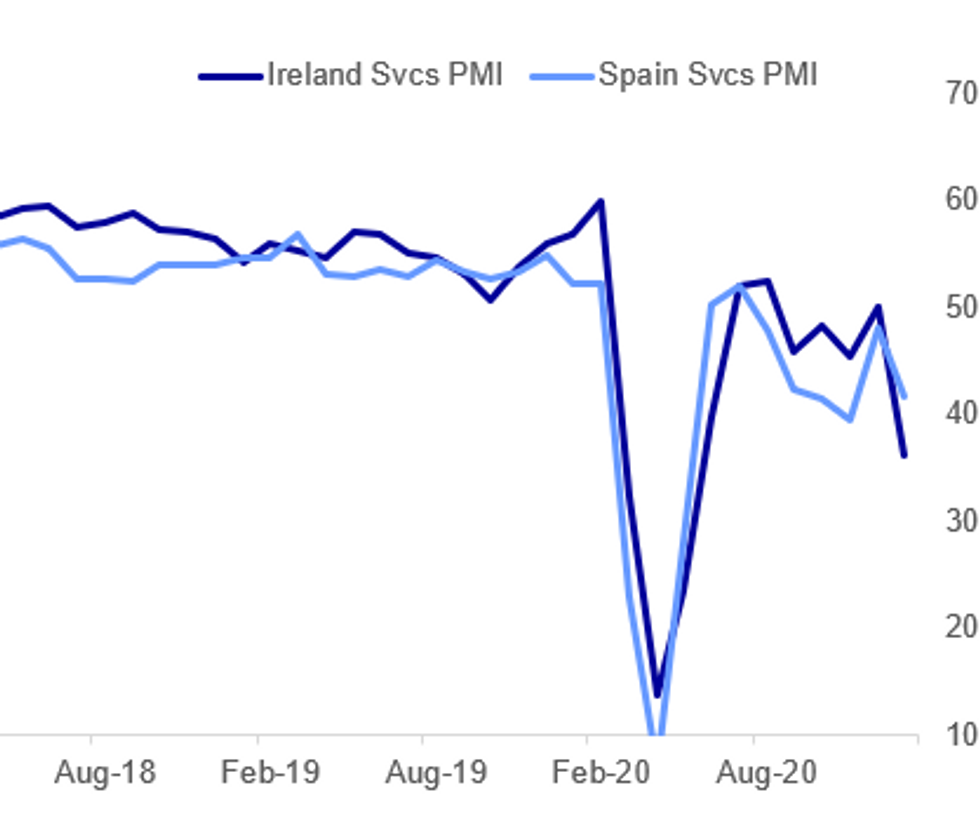

Fig. 1: Ireland and Spain Services Sectors Contract More Than Expected In January

IHS Markit, MNI

IHS Markit, MNI

NEWS:

ITALY: Former ECB chief Mario Draghi is set to meet with President Sergio Mattarella at 1200CET (0600ET, 1100GMT) to discuss the potential of the central banker forming a new technocratic gov't after it became clear last night Prime Minister Giuseppe Conte would not be able to put together a majority coalition.

- Thetalks taking place to cobble together a parliamentary majority under Conte broke down last night after it became clear that former PM Matteo Renzi would not accept the 5-Star Movement (M5S) offer of more influence in Cabinet for his minor Italia Viva party, and would demand that Conte does not lead the next gov't.

- The main risk at present is that M5S does not uniformly support the installation of a technocratic Conte gov't. Last night a senior Cabinet minister, Secretary of the Council of Ministers Riccardo Fraccaro from M5S, stated that his party had been clear that it would only support a gov't led by Conte.

- However, many M5S lawmakers are likely to support a technocratic Draghi gov't. While they may lose their influence in gov't, many will want to avoid snap elections given the slump in support for their party recorded in recent months.

- As such, Draghi gov't may rely on a patchwork quilt of support from parties of the left, centre, and right.

- In the event a Draghi gov't comes to power, as in previous technocratic gov'ts, it would likely be made up of independents and non-partisan officials. The gov'ts work would be to deal with the pandemic and associated economic crisis by utilising EUR200m+ of EU COVID-19 recovery funds - a major source of contention within the Conte gov't.

SPAIN DATA: Spanish Jan Services PMI came in much weaker than expectations, at 41.7 (45.0 expected, 48.0 prior). COVID lockdowns obviously a factor, but so too was weather. From the IHS Markit release:

- "the effects of local restrictions related to dealing with COVID-19 continued to have a noticeable and negative impact on the performance of the services economy. Moreover, the situation was exacerbated by recent snowstorms, which reportedly further weighed on market activity. Subsequently, volumes of new business were also down for a seventh month in succession, with the rate of contraction accelerating since the end of last year. Both domestic and foreign sales were lower: new export business declined for a twenty-first month in a row, and at the sharpest rate since October."

ITALY DATA: Italy Services PMI remained contractionary in January but accelerated from Dec and beat expectations (44.7 vs 39.5 expected, 39.7 prior). While business activity and new orders continued to fall, the rates of decline moderated, while future sentiment improved, per the IHS Markit report.

- Of some note was continued input price inflation... "At the same time, firms registered another round of cost inflation during January, with the rate of increase the quickest for three months, albeit still well below the long-run average. Respondents cited greater utility and fuel costs, as well as additional coronavirus related expenditure as the main drivers of inflation..."

- But: "In spite of rising costs, service providers continued to provide discounts to customers during January in an effort to stimulate sales. Average charges levied by services firms decreased at a slightly quicker pace than in December, and one that was solid overall."

- On jobs: "The rate of job shedding was little-changed from December and remained sharp. Lower employment was mostly attributed to the non-replacement of leavers and use of the government furlough scheme, however."

DATA:

MNI: EZ FINAL JAN SERVICES PMI 45.4; FLASH 45.0; DEC 46.4

MNI: EZ FINAL JAN COMPOSITE PMI 47.8; FLASH 47.5; DEC 49.1

MNI: GERMANY FINAL JAN SERVICES PMI 46.7; FLASH 46.8; DEC 47.0

MNI: GERMANY FINAL JAN COMPOSITE PMI 50.8; FLASH 50.8; DEC 52.0

MNI: FRANCE FINAL JAN SERVICES PMI 47.3; FLASH 46.5; DEC 49.1

MNI: FRANCE FINAL JAN COMPOSITE PMI 47.7; FLASH 47.0; DEC 49.5

MNI: ITALY JAN SERVICES PMI 44.7; DEC 39.7

MNI: ITALY FINAL JAN COMPOSITE PMI 47.2; DEC 43.0

MNI: SPAIN JAN SERVICES PMI 41.7; DEC 48.0

MNI: SPAIN FINAL JAN COMPOSITE PMI 43.2; DEC 48.7

MNI: UK FINAL JAN SERVICES PMI 39.5; FLASH 38.8; DEC 49.4

MNI: UK FINAL JAN COMPOSITE PMI 41.2; FLASH 40.6; DEC 50.4

EZ JAN FLASH HICP +0.2% M/M; +0.9% Y/Y; DEC -0.3% Y/Y

Italy Jan Flash Inflation Beats Expectations

- Prel Jan HICP -1.1% m/m, +0.5% y/y (Dec -0.3% y/y), coming in stronger than markets expected (BBG: 0.1% y/y)

- Main domestic index (NIC) Jan +0.5% m/m, +0.2% y/y (Dec -0.2% y/y)

- Italy prel y/y NIC CPI first uptick since March 2020 (+0.1%)- ISTAT

- Jan core HICP inflation +1.1% y/y vs Dec +0.4% y/y.

- Net-of-energy Jan HICP index +1.2 % y/y vs Dec +0.5% y/y

- Flash Jan HICP data provides -0.6 % "acquired" inflation

FIXED INCOME: A busy session for Italy

A busy session for EGBs and particularly the BTP, following Draghi being touted to form a Government.

- BTP saw a 110 ticks opening gap.

- The move in Italy saw BTP/Bund spread to 10.5bps tighter and through the January low, and at lowest levels since March 2016.

- Gilt is seeing a more subdued session, trading in a 23 ticks range (133.46-133.69).

- US treasuries have taken their cue from EGBs and trade in the red, albeit lagging behind Bund.

- Looking ahead, US ADP and service PMI, although will be the final reading for the PMI, so unlikely to move the needle.

- Italian Sergio Mattarella, Italy's head of state, will meet Draghi around lunchtime.

- Speakers sees Norge Bank Bech-Moen, and Fed Kashkari, Bullard, Harker, Mester and Evans

- Bund futures are down -0.20 today at 176.55

- BTP futures are up 1.06 today at 152.03

- OAT futures are down -0.01 today at 166.64

- Gilt futures are down -0.14 today at 133.61

- TY1 futures are down -0-3 today at 136-27

FOREX: EUR Circling Key 1.20 Support

The single currency remains weaker, with EUR/USD inching below the Monday low to narrow the gap with key psychological support at the 1.20 handle. The moves come despite Eurozone CPI estimates for January beating to the upside, with Core CPI rising at the fastest rate in five years.

It's clear there remains caution over further EUR losses, with options markets hedging more materially against further EUR downside. Today, 1m risk reversals for EUR/USD hit their lowest level since June of last year.

EUR's losses are working in favour of the greenback, with the USD index again challenging the best levels of 2021. Scandi currencies are softening along with the EUR, with SEK, NOK among the poorest performers. AUD, NZD trade well, rising against most others so far Wednesday.

US ADP Employment Change and ISM Services are the data highlights later Wednesday, with markets watching for any further clues on this Friday's payrolls release. There are numerous Fed speakers due today, with Kashkari, Bullard, Harker, Mester and Evans all on the docket.

EQUITIES: Tech Leading

Tech is leading overnight US futures gains, with Alphabet up sharply after earnings (and in contrast, recent 'frenzy' stocks such as Gamestop are dropping fast).

- Asian markets closed mixed, with Japan's NIKKEI up 284.33 pts or +1% at 28646.5 and the TOPIX up 24.07 pts or +1.3% at 1871.09. China's SHANGHAI closed down 16.377 pts or -0.46% at 3517.308 and the HANG SENG ended 58.76 pts higher or +0.2% at 29307.46.

- European stocks are higher, with the German Dax up 82.37 pts or +0.6% at 13916.1, FTSE 100 up 15.75 pts or +0.24% at 6556.66, CAC 40 up 14.16 pts or +0.25% at 5601.9 and Euro Stoxx 50 up 24.77 pts or +0.69% at 3615.9.

- U.S. futures gains are led by tech, with the Dow Jones mini up 38 pts or +0.12% at 30624, S&P 500 mini up 12.5 pts or +0.33% at 3830.75, NASDAQ mini up 76.5 pts or +0.57% at 13525.5.

COMMODITIES: Oil Gains, Precious Metals Slip

- WTI Crude up $0.41 or +0.75% at $55.1

- Natural Gas up $0.01 or +0.42% at $2.859

- Gold spot down $3.53 or -0.19% at $1835.69

- Copper up $1.35 or +0.38% at $352.7

- Silver down $0.06 or -0.21% at $26.7716

- Platinum down $3.28 or -0.3% at $1095.45

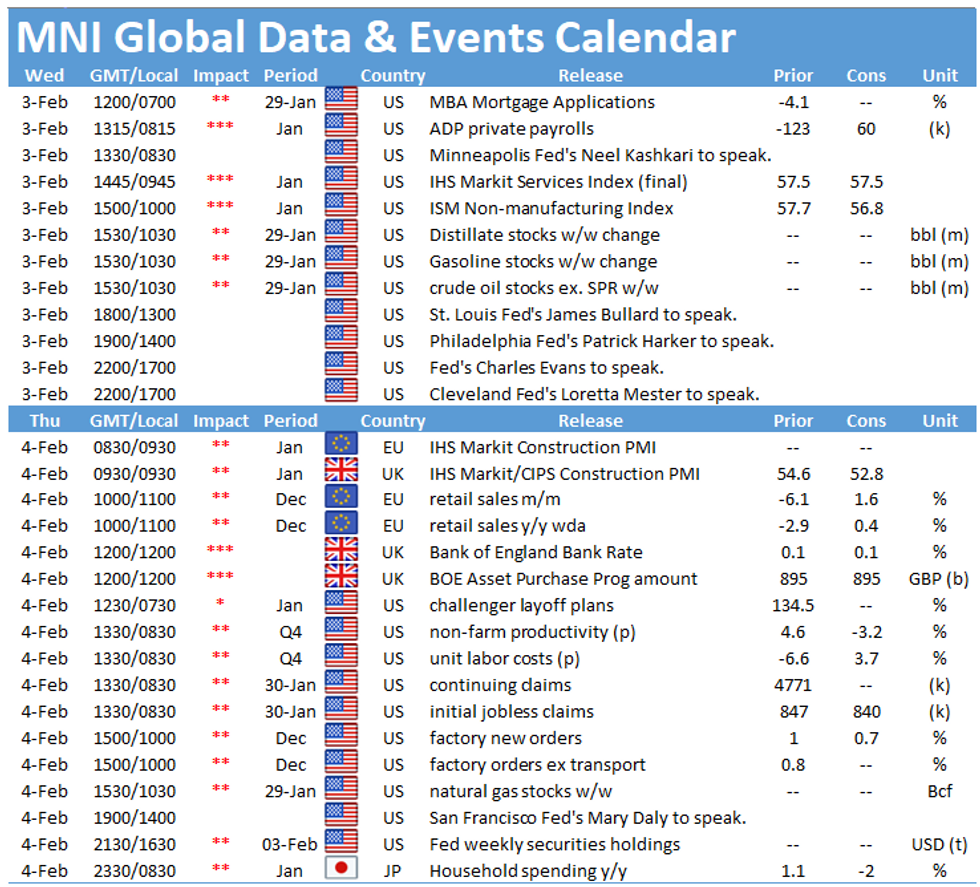

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.