-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US Open: Yield Curves Keep Flattening

EXECUTIVE SUMMARY:

- E.C.B. SAID TO AGREE NEW INFLATION GOAL OF 2% AND ALLOW OVERSHOOT (BBG SOURCES)

- B.O.J. SEEN CUTTING GROWTH FORECAST AS COVID-19 CURBS HURT OUTLOOK (RTRS SOURCES)

- CHINA COULD OFFER FEWER SPECIAL BONDS THAN EXPECTED (MNI)

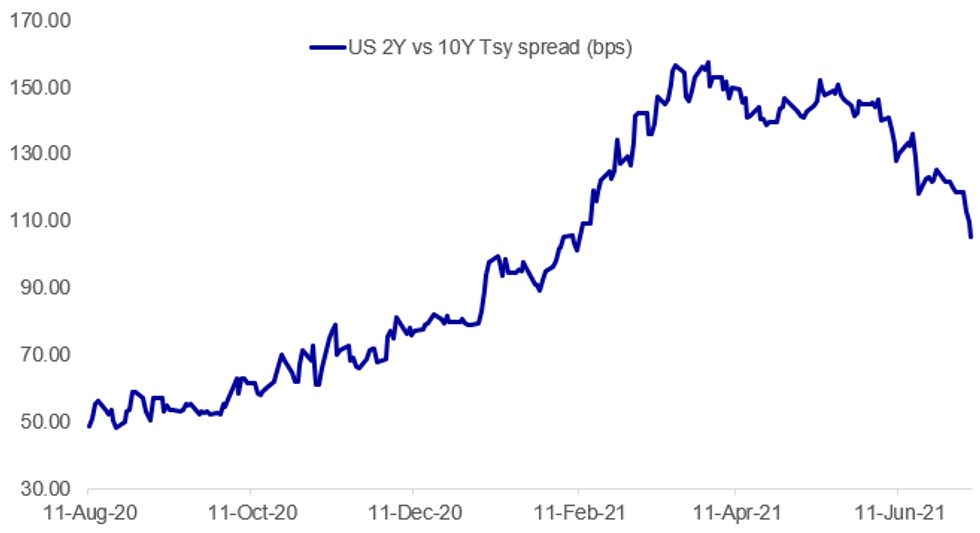

Fig. 1: US Yield Curve Keeps Flattening

Source: BBG, MNI

Source: BBG, MNI

NEWS:

E.C.B. (BBG): European Central Bank policy makers have agreed to raise their inflation goal to 2% and allow room to overshoot it when needed, according to officials familiar with the matter. The decision marks a significant change from the previous target of "below, but close to, 2%," which some policy makers felt was too vague. The consensus emerged at a special meeting on Tuesday and Wednesday to conclude the ECB's first strategy review in almost 20 years. The revamped strategy could give officials the justification for sustaining ultra-loose monetary policy for longer as they strive to reverse years of below-target inflation, which have weighed on the euro area's economic potential.

JAPAN (RTRS):The Bank of Japan is expected to slash this fiscal year's economic growth forecast in fresh quarterly projections due out next week, sources say, as prospects of another state of emergency for Tokyo threaten to dent consumption. But the central bank is likely to maintain its view the world's third-largest economy is headed for a moderate recovery as robust exports and output offset some of the weakness in consumer demand, said four sources familiar with its thinking. The expected downgrade highlights Japan's struggle to contain the COVID-19 pandemic, as slow vaccine rollouts and a resurgence in infections force authorities to declare a state of emergency for Tokyo just 16 days before the Olympic Games begin.

JAPAN: Japanese Prime Minister Yoshihide Suga has confirmed the widely-anticipated state of emergency measures will be imposed on the capital, Tokyo, from this Sunday until 22 August, encompassing the whole of the Tokyo Olympic Games, which run from 23 July to 8 August. Suga said the measures were required to "prevent the resurgence of the future spread on cases across the country." The Japanese new caseload has risen marginally in recent weeks, with the weekly increase in cases around the 11k mark presently, compared to 10k per week in late-June. The number of weekly fatalities due to COVID-19 has fallen to its lowest level since April.

CHINA (MNI): Local special bond issuance in China may not jump as sharply as expected in the second half of this year as it becomes harder to select suitable infrastructure projects even amid differing views on the chances of an economic slowdown ahead, policy advisors told MNI. For full article contact sales@marketnews.com

U.K. (BBG): British travelers who have received both doses of a coronavirus vaccine will no longer need to isolate when they return home from moderate risk countries, under a plan officials expect to come into force this month.Ministers have been working on an overhaul of pandemic rules for foreign trips to give more freedom to fully vaccinated passengers returning to England from destinations on the government's "amber list."

U.K.: Speaking to the BBC, Chancellor of the Exchequer Rishi Sunak hints that the pensions 'triple lock' -which sees the state pension increase by whichever is highest out of the rate of increase in average earnings, inflation measured by CPI, or 2.5% - could be amended due to the formula requiring an 8% increase in the state pension at present. The anomaly comes as a large number of workers who took a pay cut during the pandemic now receiving their full wages, resulting in a spike in average earnings.

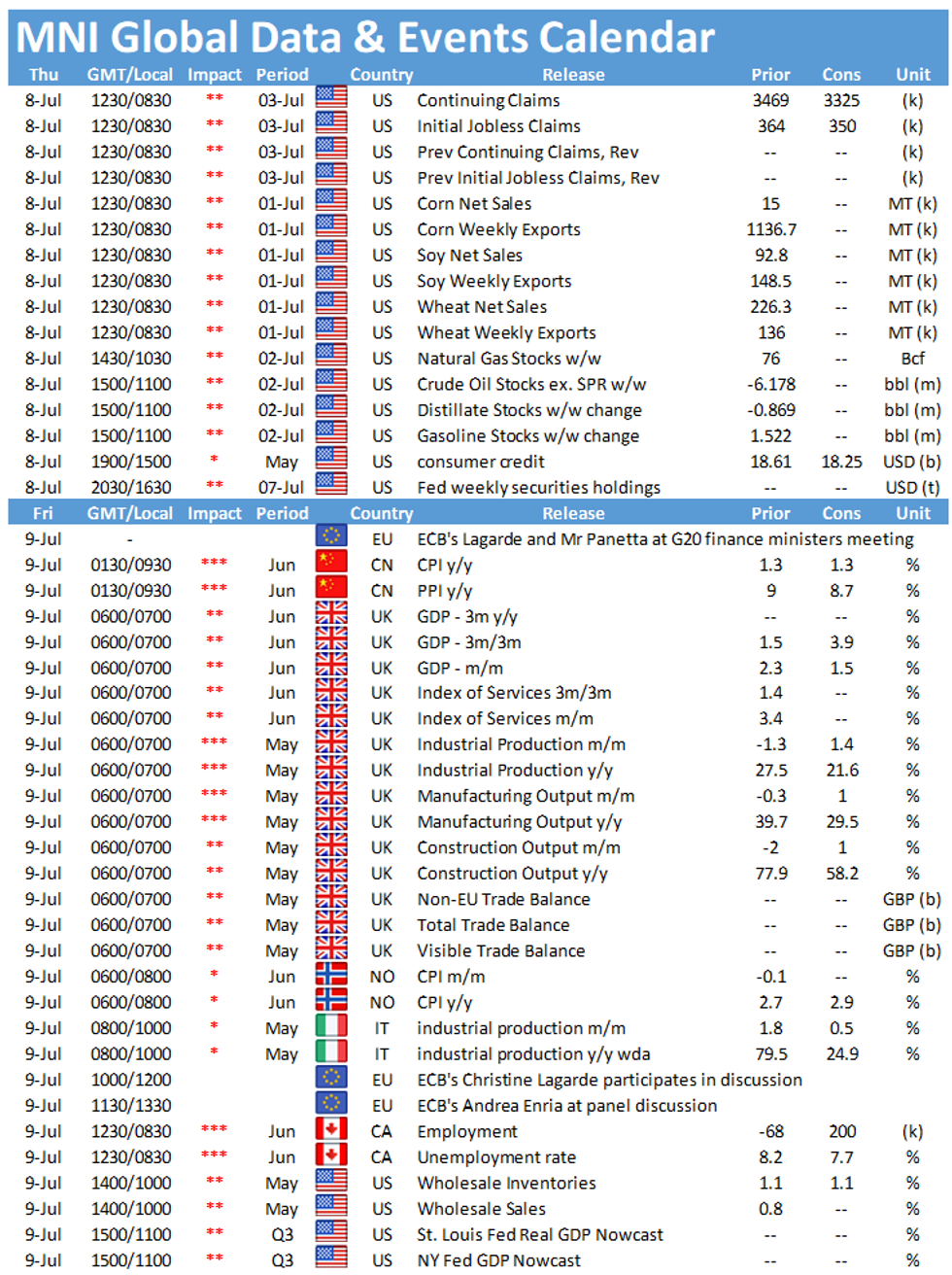

DATA:

FIXED INCOME: A busy morning session for Global Bonds

A busy morning session for Global Bonds, coupled with decent volumes.

- EGBs resumed their rallies, testing new multi months low in yields, as Equities fell,

- Estoxx futures fell 1.78% to trade below the June low, and now at lowest levels since the 21st May.

- Risk off triggered further short covering, pushing curves Bull Flatter.

- Bund 10yr yield is now eyeing a test the 08/04 low at -0.346%, printing a -0.343% low.

- Peripherals are all trading wider against the German 10yr, Italy is the wider spread by 3.4bps, as BTP futures lags behind Bund.

- Similar story for Gilts, with 2s/10s trading at the flattest levels since 15th February.

- US treasuries followed suit from the EU Govie open, and 10yr notes tested initial psychological resistance at 134.00.

- In turn 10yr yield trades at lowest level since the 18th February, printing a 1.2562% low.

- Looking ahead ECB strategy review results at 12.00BST, followed by ECB President Lagarde, V-P De Guindos presser at 13.30BST

- We also get ECB minutes, and in terms of Data, US Jobless

FOREX: Risk-Off Pervades Further, ECB Strat Review in Focus

- Volumes across JPY, AUD and NZD have been healthy so far Thursday, with the pervasive risk-off helping fuel trade in currency markets, sending havens higher and growth proxies lower from the off.

- JPY is comfortably the best performer in G10, pressing USD/JPY through the 50-day EMA at 109.89 to expose losses toward the mid-June lows of 109.72.

- The themes and catalysts behind today's return of risk-off are unchanged, with concerns over the more transmissible Delta COVID variant, waning global GDP growth rates and the prospect of tighter monetary conditions still a weight on market sentiment.

- Haven CHF, JPY currencies are strongest so far, with NOK, CAD weaker alongside oil prices. AUD and NZD follow equity markets, with the e-mini S&P showing through the week's lows well ahead of the NY open.

- There's little data on the slate to digest beyond the weekly jobless claims numbers from the US. This will keep focus on the release of the ECB's strategy review, due at 1200BST/0700ET, at which the bank are expected to agree upon an upgraded inflation goal of 2%, allowing for price level overshoots in the near-term.

EQUITIES: Weak Start, With Financials And Materials Stocks Leading Losses

- Asian markets closed weaker, with Japan's NIKKEI down 248.92 pts or -0.88% at 28118.03 and the TOPIX down 17.36 pts or -0.9% at 1920.32. China's SHANGHAI closed down 28.212 pts or -0.79% at 3525.504 and the HANG SENG ended 807.49 pts lower or -2.89% at 27153.13.

- European equities are sharply lower, with the German Dax down 199.93 pts or -1.27% at 15473.32, FTSE 100 down 93.04 pts or -1.3% at 7068.44, CAC 40 down 110.67 pts or -1.7% at 6437.97 and Euro Stoxx 50 down 72.16 pts or -1.77% at 4009.56.

- U.S. futures are lower too, with the Dow Jones mini down 390 pts or -1.13% at 34178, S&P 500 mini down 45.25 pts or -1.04% at 4304.5, NASDAQ mini down 165.75 pts or -1.12% at 14636.25.

COMMODITIES: Industrials Lead Losses

- WTI Crude down $1.15 or -1.59% at $71.39

- Natural Gas down $0.04 or -1.08% at $3.583

- Gold spot up $10.39 or +0.58% at $1807.39

- Copper down $6.35 or -1.47% at $425.3

- Silver up $0.02 or +0.08% at $26.0302

- Platinum down $6.95 or -0.64% at $1081.04

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.