-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI EUROPEAN MARKETS ANALYSIS: JPY Outperforms In Asia

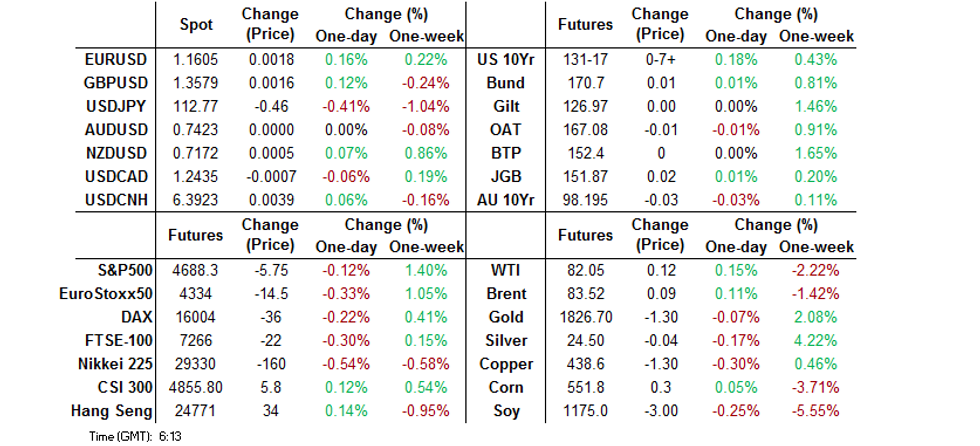

- BBG source reports suggested that Fed Governor Brainard is a "serious rival" for Fed Chair Powell when it comes to the race to sit atop the central bank, while POLITICO sources suggested that Powell was the clear favourite, with a decision due by Thanksgiving. a meeting between U.S. Biden & Brainard had already been fleshed out by the press last week, but suggestions that she was a "serious rival" to Powell drove the market reaction.

- U.S. Tsys richened a little, while JPY rose to the top of the G10 leaderboard, with Brainard seen as a dovish alternative when compared to Powell.

- A busy central bank speaker slate headlines the broader economic docket on Tuesday.

BOND SUMMARY: Brainard-Inspired Bid In Asia

A BBG source report pointed to current Fed Governor Lael Brainard being a "serious rival" to the incumbent when it comes to the race to become the next Fed Chair, after an interview with President Biden last week. A reminder that Brainard is seen as a more dovish alternative when compared to Jerome Powell, this meant that the Tsy market richened a little in the wake of the story crossing (note that the meeting was already reported by the wires last week). An earlier POLITICO sources piece pointed to Powell being the clear frontrunner in the race, while indicating that a decision will likely be made by Thanksgiving at the latest. TYZ1 +0-07 at 131-16+, 0-03 off highs, while cash Tsys run 1-3bp richer across the curve, with the belly leading. Asia-Pac flow was headlined by a 5K block buy of the FVZ1 122.50 calls, with a 2,410 lot block seller of TU futures seen as we moved towards London trade. PPI data, a raft of Fedspeak & 10-Year Tsy supply headline the local docket on Tuesday.

- The bid in U.S. Tsys and smooth passage of 30-Year JGB supply facilitated some light flattening of the JGB curve during early afternoon trade in Tokyo, while JGB futures ticked higher. In terms of auction specifics, the supply saw the low price meet broader dealer expectations (as proxied by the BBG dealer poll), while the cover ratio recovered from the multi-month low witnessed at last month's auction as the tail saw some marginal narrowing (demand from the domestic life insurance community likely helped takedown). More details surrounding the Y100K payments to children were fleshed out via local media outlets later in the day, which saw JGB futures back from Tokyo highs and applied some pressure to the longer end of the curve, leaving the former +1.

- Aussie bond futures recovered from their early Sydney lows, leaving YM -1.5 and XM -3.0 at the bell. For XM, TCV priced a $1.0bn tap of its Nov '34 line, with the passage of the pricing removing one source of pressure. Nov-27 index linked supply from the AOFM passed smoothly, with the cover ratio moving higher vs. prev. auction and pricing printed comfortably through prevailing mids, given the well-documented inflation dynamic in play at present.

FOREX: On The Defensive

Defensive flows dominated, lending support to the yen, which comfortably outperformed its peers from the G10 basket. Fresh safe haven demand resulted in USD/JPY sales, which took the rate past the Y113.00 mark and to its lowest point in a month.

- The Antipodeans went offered across the board, with a BBG trader source flagging the trimming of leveraged long positions in these currencies. AUD/NZD bottomed out at its worst level since Sep 24, before trimming some losses.

- USD/CNH posted a sudden spike higher, which did not seem timed with any notable headline catalyst. Earlier, the PBOC delivered another softer than expected yuan fixing.

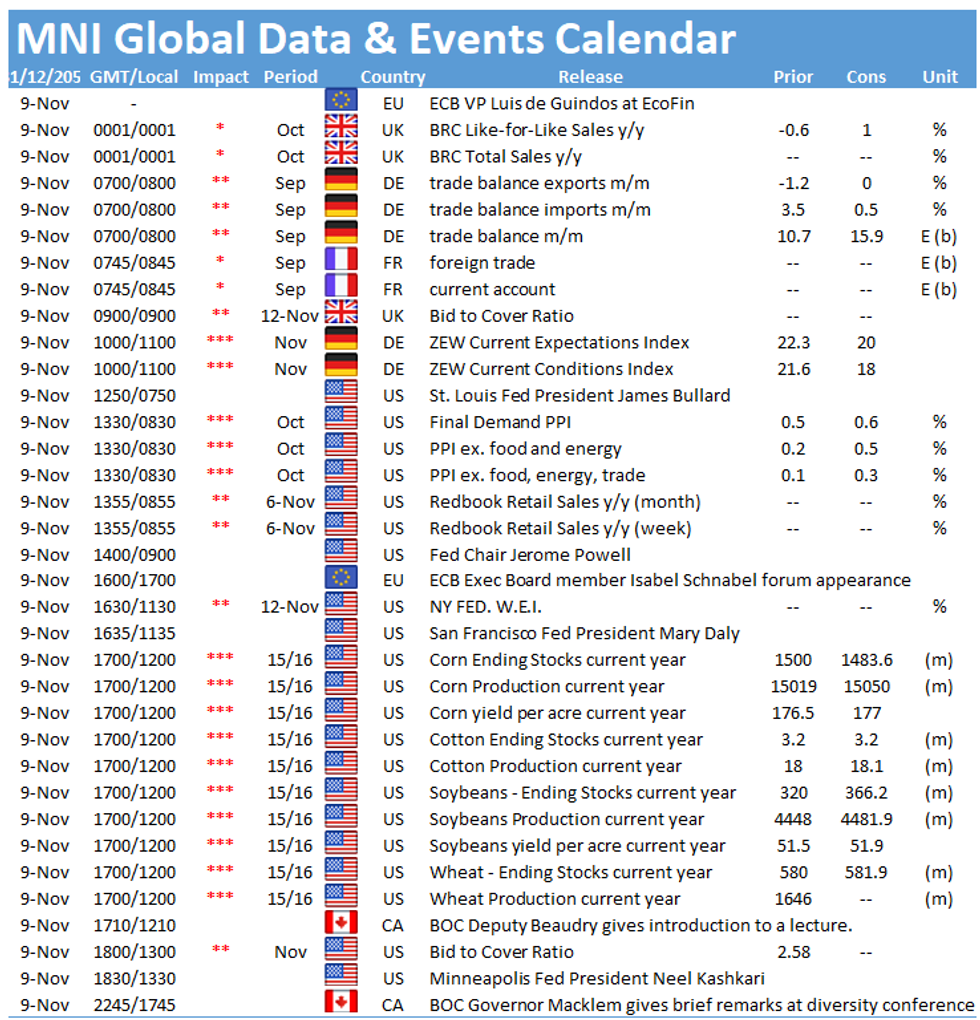

- German ZEW Survey & U.S. PPI provide the main points of note on the global data docket today. Central bank speaker slate features PBOC Gov Yi, Fed Chair Powell, ECB Pres Lagarde, BoE Gov Bailey and others.

FOREX OPTIONS: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550(E1.3bln)

- USD/JPY: Y113.70($2.0bln)

- EUR/GBP: Gbp0.8500(E593mln)

- USD/CAD: C$1.2400-05($700mln), C$1.2460($1.1bln)

ASIA FX: Optimism Surrounding Recovery Prospects Lends Support To Asia EM FX

Overnight greenback sales coupled with optimism surrounding improving Covid-19 situation and economic recovery prospects across the region applied pressure to most USD/Asia crosses.

- CNH: USD/CNH spiked higher despite the apparent absence of coinciding headline catalysts. The PBOC had earlier delivered another softer than expected yuan fixing, missing sell-side estimate by 10 pips.

- KRW: The won went bid from the off, with spot USD/KRW playing catch up with overnight greenback weakness. South Korea's ruling Democratic Party and FinMin Hong sparred over the former's cash handout proposal.

- IDR: The rupiah firmed as Bank Indonesia reported stronger retail sales performance in October, while the government struck an optimistic note on economic recovery prospects for Q4. Spot USD/IDR tested its 50-DMA but struggled to stage a clean break below that moving average.

- MYR: USD/MYR slipped on the back of broader market impetus coupled with the announcement that Malaysia and Singapore will reopen two-way quarantine-free travel on one of the world's busiest air routes.

- PHP: The peso garnered strength after the release of Philippine blowout GDP report for Q3, which showed that the economy expanded considerably faster than forecast, defying Covid-19 countermeasures implemented by the government. Spot USD/PHP pierced its 100-DMA and printed levels not seen since Sep 17.

- THB: The baht was the best performer in the region, as Thailand's daily Covid-19 cases fell to the lowest level since Jul 7, while the government discussed purchasing Covid-19 antiviral drugs. Spot USD/THB plunged through its 100-DMA to the lowest point since Sep 13.

EQUITIES: Equities Nudge Lower In Asia

The major Asia-Pac equity indices lodged marginal losses during Tuesday trade, while U.S. e-minis nudged lower. There wasn't much in the way of notable headline flow to observe, with continued focus on the Evergrande situation (and spill over/other risks within the sector) evident. Note that the troubled property developer needs to satisfy missed USD-denominated bond coupon payments on Wednesday, when the grace period on the missed payments will elapse.

GOLD: Still Not Able To Test Key Resistance

Rangebound Asia-Pac trade for bullion leaves spot little changed around the $1,825/oz mark. Monday's downtick in U.S. real yields (driven by a widening in breakevens) leaves our weighted U.S. real yield monitor within touching distance of the all-time lows witnessed earlier this year, with the downtick in the DXY adding further support for gold. Still, a test of key resistance in the form of the Sep 3 high ($1,834.0/oz) hasn't been forthcoming.

OIL: Crude Little Changed In Asia

WTI & Brent futures print at virtually unchanged levels into European hours. This comes after crude firmed on Monday, although the major benchmarks finished a little shy of best levels, adding ~$0.70 on the session, with the potential U.S. response to the recent rally in oil prices via the release of some of its SPR holdings limiting gains (an announcement on such a move could come as soon as this week, per media reports). Tuesday will see focus fall on the latest STEO from the EIA (outlined as a key input re: any SDR decision, per U.S. Energy Secretary Granholm) and the weekly API inventory release.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.