-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

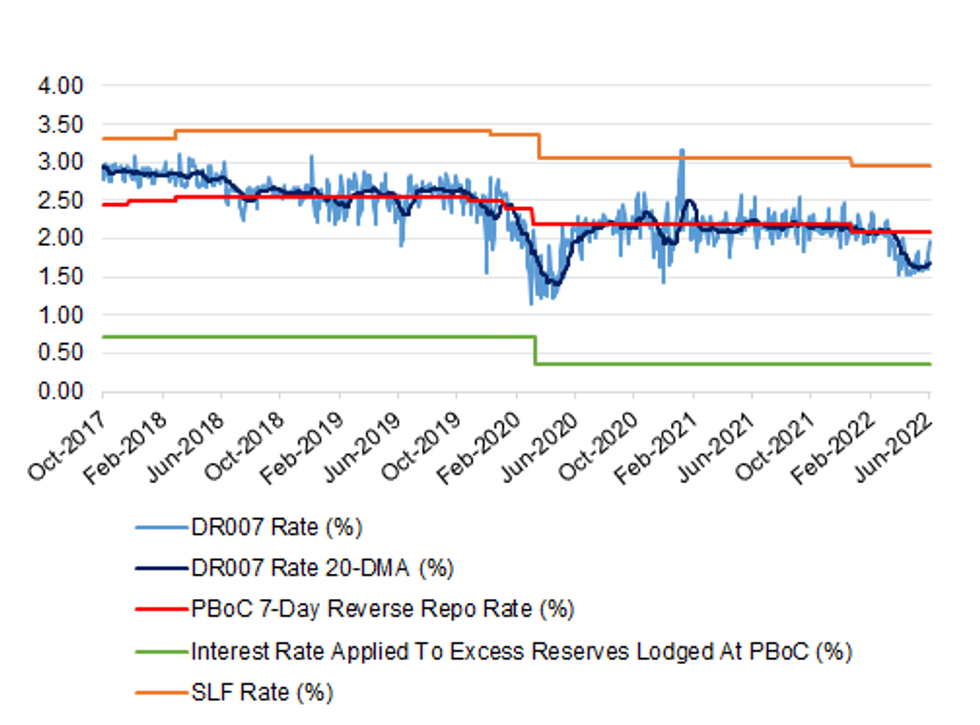

Free AccessMonth-End Matters See Repo Rates Pull Higher

China’s 7-day repo rate has jumped in recent days, with month-end matters cited as a driving force. The 7-day repo rate between deposit taking institutions (DR007) has also moved higher (although holds below 2.00%). Note that this particular month-end effect is mostly driven by tighter cash conditions stemming from record monthly local government bond issuance in June (as policymakers look to stimulate the faltering economy via infrastructure investment) and tax payments. This has pulled the headline 7-day repo rate above the short-term policy rate (the 7-day reverse repo rate, which currently sits at 2.10%), although the DR007 rate has not challenged that level as of yet.

- DR007 has been operating below 2.00% since April, on the back liquidity overflows into the wholesale market after the PBoC’s series of easing moves, which included a cut in the reserve requirement ratio, increases in relending tools and a turnover of its profits.

- The 7-day repo rate has historically been a reliable indicator when it comes to future PBoC moves, with the previously alluded to discount seen as being indicative of an easing bias at the central bank, as it looks to get the Chinese economy back on track as the likes of Beijing and Shanghai move away from the depths of their well-documented COVID restrictions. Note that the re-opening observed in those key cities may also be adding to the usual month-/quarter-end cash demand. The recently reported shortening of the quarantine period surrounding international travellers entering China may also result in cash demand in the coming weeks, applying further tightening pressure.

- The PBoC has already stepped in to bridge the liquidity gap, coming to market with the largest round of daily net OMO injections observed since March in recent days.

- A quick reminder that our policy team recently flagged communique with local market participants who suggested that “the PBoC may guide money market rates up, approaching their policy rates, if the economy continues to improve” (see here).

- It will be interesting to see where money markets settle after the month-end gyrations subside. The combination of looser COVID mobility restrictions, a possible closing of the PBoC’s easing window as the U.S. Federal Reserve accelerates its monetary tightening cycle and the potential for the PBoC to exert an upward bias on money market rates if the economy improves could mean that we do not see the DR007 trading at the discount that we had become accustomed to in recent weeks.

- A quick heads up that the latest MNI China Liquidity Index survey findings will be published later today (07:00 London time), with the release set to give deeper insight on the matter after surveying local market participants.

Fig. 1: PBoC Interest Rate Corridor

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.