September 23, 2024 14:50 GMT

Nepi Rockcastle (NEPSJ: BBB/BBB+): Roadshow

REAL ESTATE

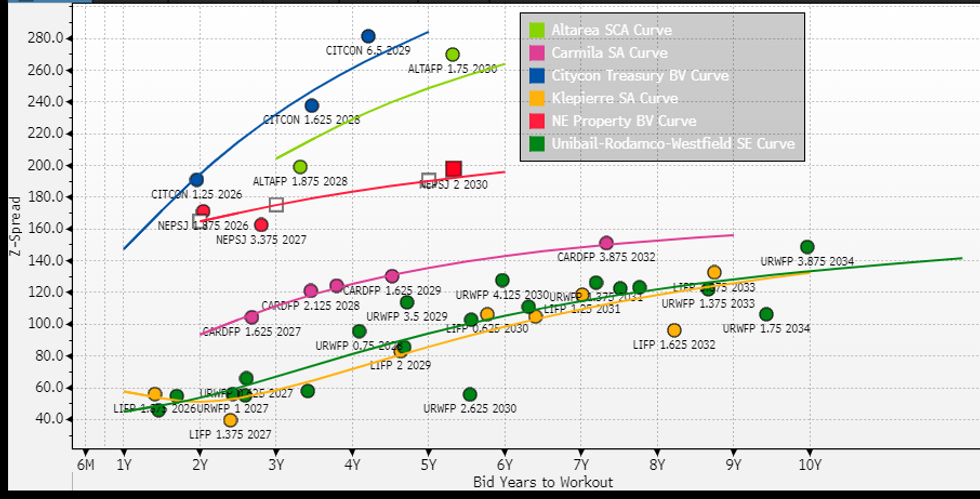

- Roadshow drew comparisons to Unibail, Klepierre, CityCon, Altarea and - inparticular - Carmila

- vs Carmila:

- Gross Assets are larger at 7bn vs 5.9bn (6.6bn post Galimmo)

- LTV is lower at 33.6% (post bond deal) vs c.40%

- Initial Yield on Portfolio is higher at 6.95% vs 6.58%

- Occupancy is higher at 97.3% vs 96%

- Interest coverage higher at 5.7x vs 4.5x

- The difference of course is that NEPSJ is based mainly in Poland and Romania vs France & Spain. Moreover, it was started by South African investors and still owned 77% by South Africans - so has always had an EM discount

Source: MNI, Bloomberg

Source: MNI, Bloomberg

111 words