-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

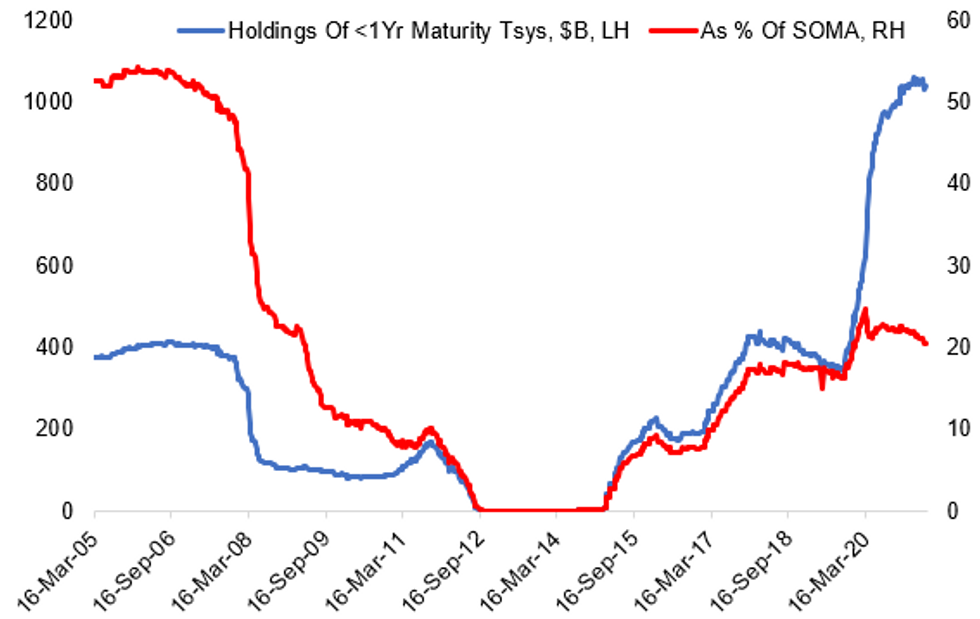

"No Fundamental Reason" For Fed To Hold $1trn Of Short-End Tsys: ICAP

Wrightson ICAP writes that "it seems likely" the Fed will "modestly boost" both the ON RRP and IOER rates in June to help address downward pressure on overnight rates, but "less likely" the Fed will make balance sheet adjustments to address the issue.

- On the latter, "There is no fundamental reason why the Fed should be sitting on more than $1 trillion of Treasuries maturing within one year at a time when nonbank investors are so starved for short-end assets that money funds are forced to recycle half a trillion dollars of surplus cash back into the RRP facility. The Fed is not providing any additional 'policy accommodation' by holding onto those short-term assets; at this point, it is just adding to market strains at the front end."

- This echoes a BofA note last month which cited similar reasons in arguing it was possible the Fed would decide to stop reinvesting in Bills.

- But shifting short-end buys would present a communications challenge in a way that an administered rate tweak likely wouldn't, and the Fed may fear "muddying its core message" on tapering - so Wrightson ICAP see action as unlikely, though "the odds of a technical adjustment to the Fed's balance sheet might improve if the employment report this Friday and the CPI next Friday are at the low end of expectations."

- They see one risk being that if the status quo remains, cash will flow into more leveraged structures, citing as one example, the volume of triparty repo backed by equity collateral rising rapidly in the early part of the year.

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.