-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Jun Nonfarm Payrolls: More Focus On Upside Surprise (Repeat)

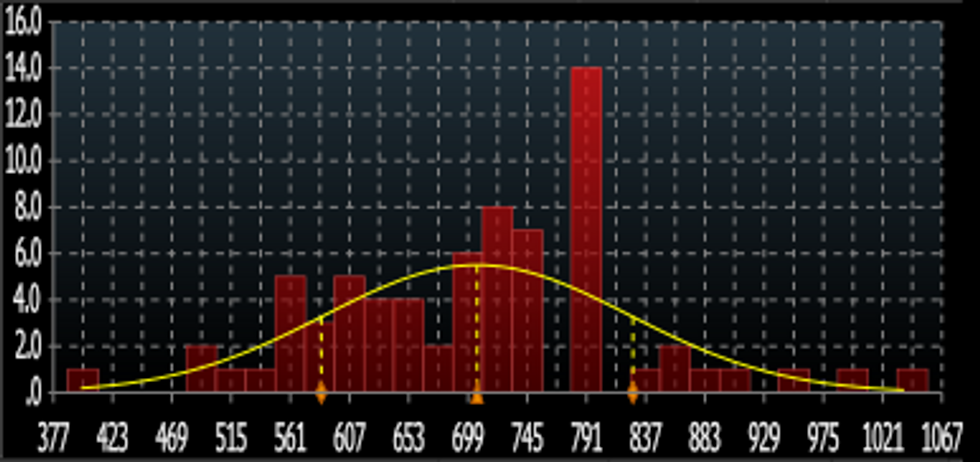

June nonfarm payrolls (out 0830ET/1330BST) are seen rising by 720k (BBG median) vs +559k in May, with the range of estimates running from 400k-1050k with standard distribution of 123k.

- The unemployment rate is seen falling to 5.6% vs 5.8% in May, with average hourly earnings slowing to +0.3% M/M from +0.5% prior.

- As our data team reports, while new graduates and students off for the summer likely expanded the labor pool, the supply of available workers last month remained muted, keeping upward pressure on wages.

- The sell-side forecasts we've seen mostly expect a strong contribution from government payrolls due largely to fewer-than-usual June layoffs in the education sector.

- Market reaction is likely to be more pronounced on an upside beat rather than a downside miss.

- This is because a weaker-than-expected headline figure will probably be seen as a supply-side rather than demand-side issue, and one that's already taken into account by the Fed; on the other hand a figure of say 1mn+ could reignite concerns about an earlier rate hike liftoff.

- The timing ahead of the holiday weekend is also a consideration: JPM points out that Tsy yields "are sensitive to payroll surprises, and that these moves can be amplified when employment data are released on holiday-shortened trading sessions."

Distribution of Estimates For Jun Nonfarm Payroll Growth ('000s on x-axis)Source: BBG Survey, MNI

Distribution of Estimates For Jun Nonfarm Payroll Growth ('000s on x-axis)Source: BBG Survey, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.