-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessOFZs Haemorrhage as CPI Develops Above Consensus, 3x6 FRAs See +85bp in Hikes

- OFZs remain under pressure this week, as protracted CPI pressures continue to impact demand for OFZs, despite more attractive fundamentals brewing in the background. Moreover, rising UST yields in line with more hawkish FOMC developments, expedited taper timelines and threats of US debt sanctions have added fuel to the fire in this regard.

- Yields hit a trough in August as the CBR began to call a peak in proinflationary drivers around the 5.9% mark, but have incrementally given back gains as prices continued to develop above CBR forecasts – denting market confidence in its assessments.

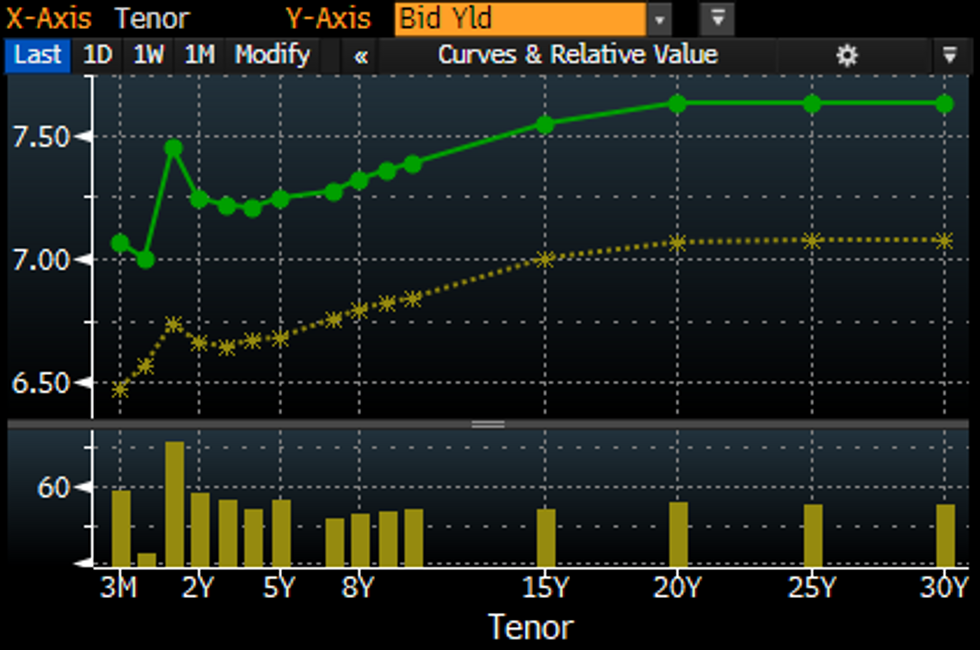

- The curve stands +51-71bp higher across the breadth, with a

slight bear flattening bias in 1-5Y yields in line with higher tightening

expectations. 10Y yields are now hovering above the 7.50 mark, en route towards

the 61.8% fib of the 07/09/18 – 18/05/20 range if the inflation picture does

not change for the better.

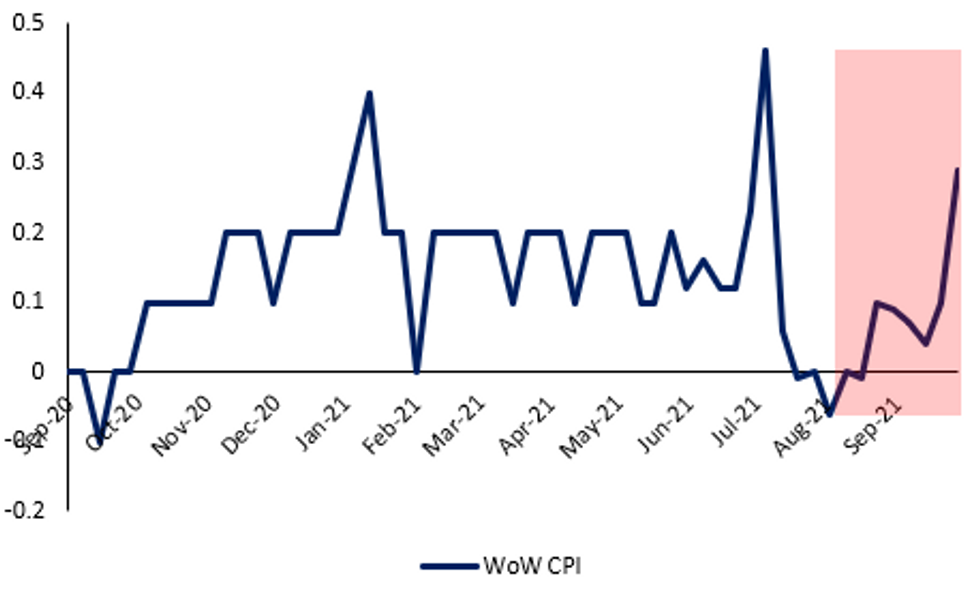

- Weekly CPI has continued to rise sharply in September following the CBR's decision to reduce the size of hikes from +100bp to +25bp in a smaller step that wrong-footed the markets at a time when CPI expectations were still extremely elevated (12.5% in Aug) and a more heavy-handed approach may have served to better anchor expectations lower.

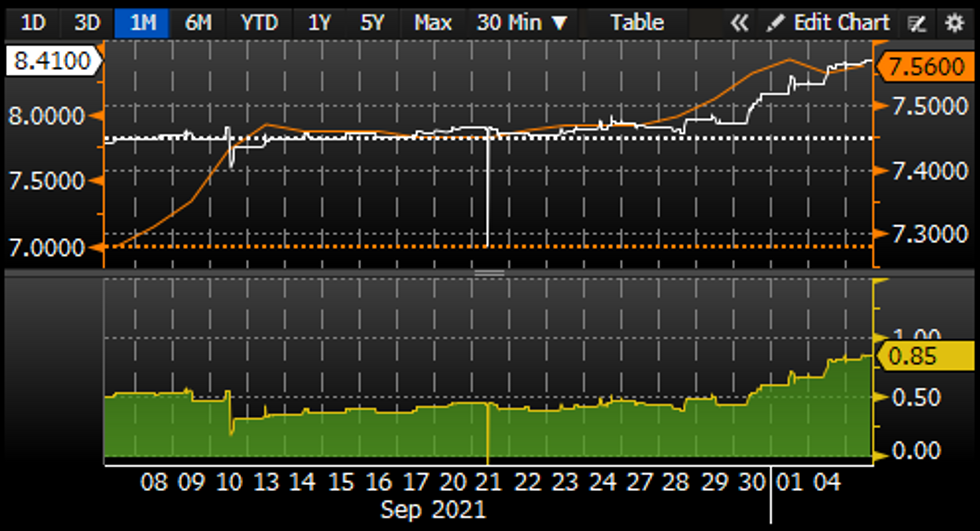

- Going into tomorrow's CPI print, markets anticipate a rise to 7.3% y/y in headline CPI – notably above the CBR's 4% upper threshold. Since the prior meeting, 3x6 FRA-Mosprime spreads have widened from a low of +32bp to +85bp at current levels with a notable acceleration at the end of September.

- The sell-side has also continually revised estimates for a peak in inflation, but still see a sizeable moderation coming in November following this print to bring y/y headline CPI closer to the 4% target by mid-2022. Nevertheless, institutions remain divided over at this point over whether the CBR will stick with its promises for more orderly +25bp steps or opt for +50bp as the rollercoaster of varied hike sizes continues.

- Here, the CBR can either stick with its +25bp steps and try to regain market confidence in its assessments of inflation by committing to more hikes and a prolonged cycle or be a bit more decisive and opt for a +50bp step with the possibility of another +25bp should the need arise. Either way, the decision remains difficult to telegraph

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.