-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessOur Thoughts on the Equity Bubble Narrative

We’ve seen a influx on analyst & news media pointing to a Mag 7/tech driven equities rally. As we've mentioned earlier this year, some of this structural (Mag7 are index heavyweights hence will "contribute" more even on a equal move) and some of this ignores impact of different methods of returning capital to equity holders - buybacks (more common in tech) are captured in price indices whereas dividends (common in financials) are not.

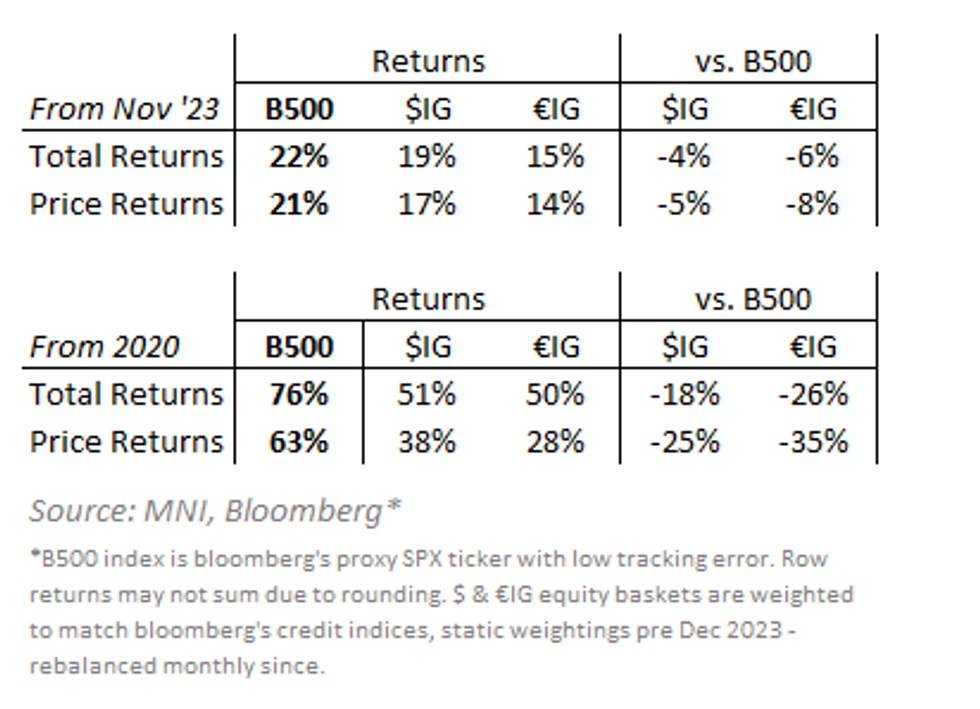

On the latter, when we refer to our credit eqv. equity baskets & broader equity indices we look at Total NOT Price returns over time – the tech outperformance is much more stark (as expected) on price. This has added relevance when comparing to our credit baskets that are financials heavy - since 2020. 25% of financials total return has been dividends. As below table shows, total returns have not lagged by much in the Nov-to-date equity rally - which spreads have tracked closely.

Some may point to P/E ratios (or when inverted earnings yields) as a solution for removing the impact of dividends - we'd note 1) these (on Forward PE's) don't point to the extent of a bubble that price indices do - SPX's 1yr forward P/E is still lower than 2021 levels 2) both look at the non-cash metric net income - non-tech/mature sectors can still provide significantly higher FCF than tech names despite only being a fraction of the market cap - FCF conversion generally the focus for us/credit.

To account for all this, we focus on the flow through to aggregate (weighted mean & median) credit ratios on credit indices & use forward EPS estimates as a guide only. As we mentioned last week, IG balance sheets at aggregate have remained levered at healthy levels helping contain ICR increases to still within normal ranges.

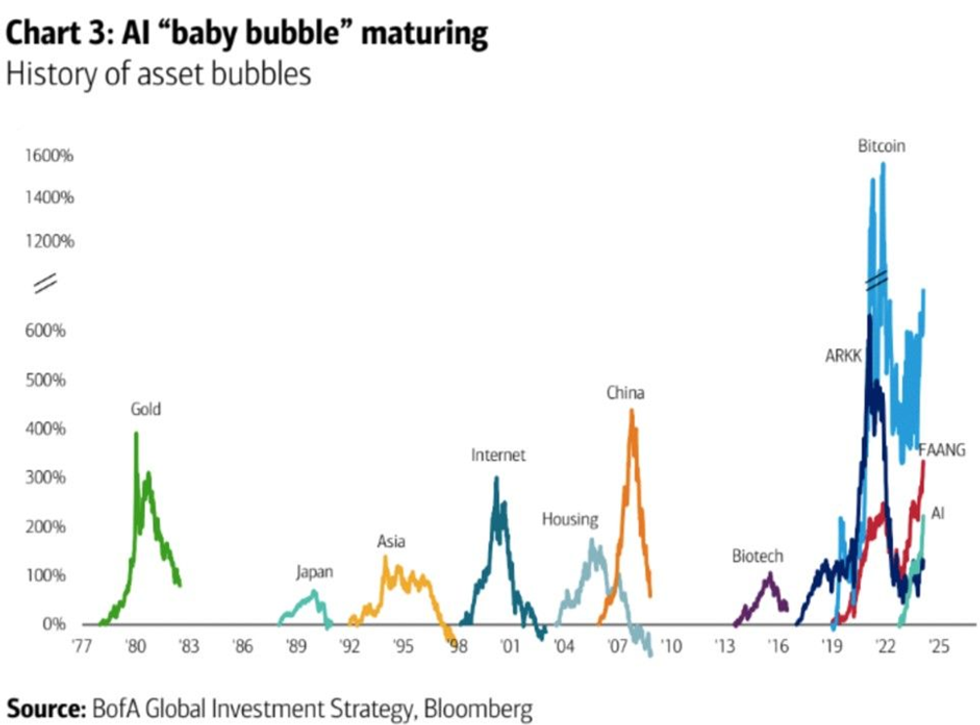

We'd caution all of the above by noting tech now makes up large portion of equity markets (35% in SPX) & a reversal in current forward expectations for it could still impact broader risk sentiment. As BoFA strategist highlighted the other week, history may not be on the side of the tech/AI hype (below).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.