-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPeso Goes Bid Despite Fresh Covid Restrictions

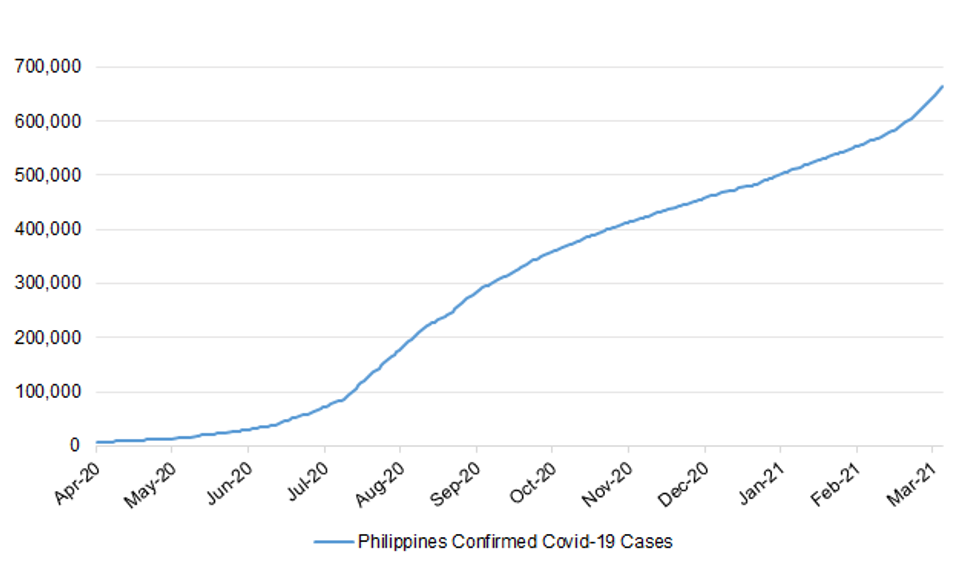

Spot USD/PHP re-opened lower, despite a broadly firmer USD & fresh Covid-19 curbs imposed by Philippine authorities over the weekend. There has been speculation that the new restrictions may weigh on imports, which might be supporting the peso today. The pair last trades at PHP48.586, slightly below neutral levels.

- The gov't imposed restrictions on travel into/out of the Manila region for the two weeks between Mar 22 - Apr 4. Metro Manila as well as Bulacan, Cavite, Laguna & Rizal will form a "bubble," with residents allowed to move freely within but not outside it. In addition, religious gatherings and indoor dining within the bubble will be prohibited.

- The OCTA research group warned that if Covid-19 infections continue to spread at the current pace, medical frontliners could be overwhelmed as soon as in the first week of Apr.

- Filipino Foreign Affairs Sec Locsin protested the entry of 220 Chinese fishing vessels into a part of the South China Sea which Manila claims to be its exclusive economic zone.

- BSP said last Friday that the current account surplus is expected to narrow this year after hitting $13bn in 2020. The central bank also said that income from foreign visitors fell 91% Y/Y to $83.4mn in Dec.

- Philippine BoP data is due at some point this week, while budget balance comes out on Friday.

- Thursday will see the latest monetary policy decision from the BSP, with interest rates expected to remain on hold.

- Bears look for losses past Mar 12 low of PHP48.370, which would clear the way to Feb 17 low of PHP48.281. Bulls see the 200-DMA at PHP48.713 as the key near-term resistance, after that moving average capped gains during the last three sessions.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.