-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPM Delivers Statement On Houthi Airstrikes Amid Fallout From Downbeat Polls

Prime Minister Rishi Sunak is delivering a statement in the House of Commons outlining the gov'ts justification for its joint airstrikes with the US on Houthi targets in Yemen carried out last week. Sunak: "[Houthi] attacks push up prices and put in peril vital supplies like medicines...We have attempted to resolve this through diplomacy...We shouldn't fall for [the Houthis] malign narrative that this is about Israel and Gaza. They target ships from around the world." Earlier in the day in a wide-ranging speech, Defence Secretary Grant Shapps stated that the UK would 'wait and see' on whether more strikes would be required.

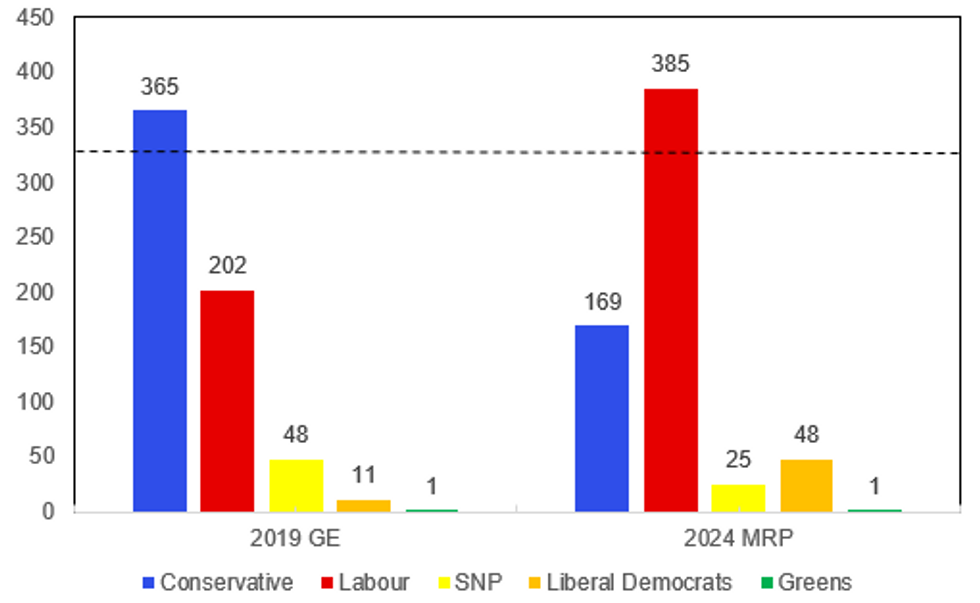

- Sunak's statement comes amid notable focus on the latest MRPopinion poll from YouGov. The poll shows that if the UK held a general election today, the main opposition centre-left Labour party would be on course for a sizeable majority with 385 of 650 seats. The incumbent centre-right Conservatives are on course for its worst electoral performance since 2001 with 169 seats, down from 365 in the 2019 general election.

- In terms of the impact of the poll, and others showing the Conservatives on course to lose the election, it could put pressure on Chancellor Jeremy Hunt to offer a Budget on 6 March that includes more 'giveaways' in the form of tax cuts or spending increases in an effort to bolster the gov'ts standing before the election (seen as likely in H224).

Source: YouGov, MNI. Fieldwork: 12th December 2023-4th January 2024. 14,110 respondents

Source: YouGov, MNI. Fieldwork: 12th December 2023-4th January 2024. 14,110 respondents

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.