-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPolls Show Right-Wing Gov't Most Likely Election Outcome

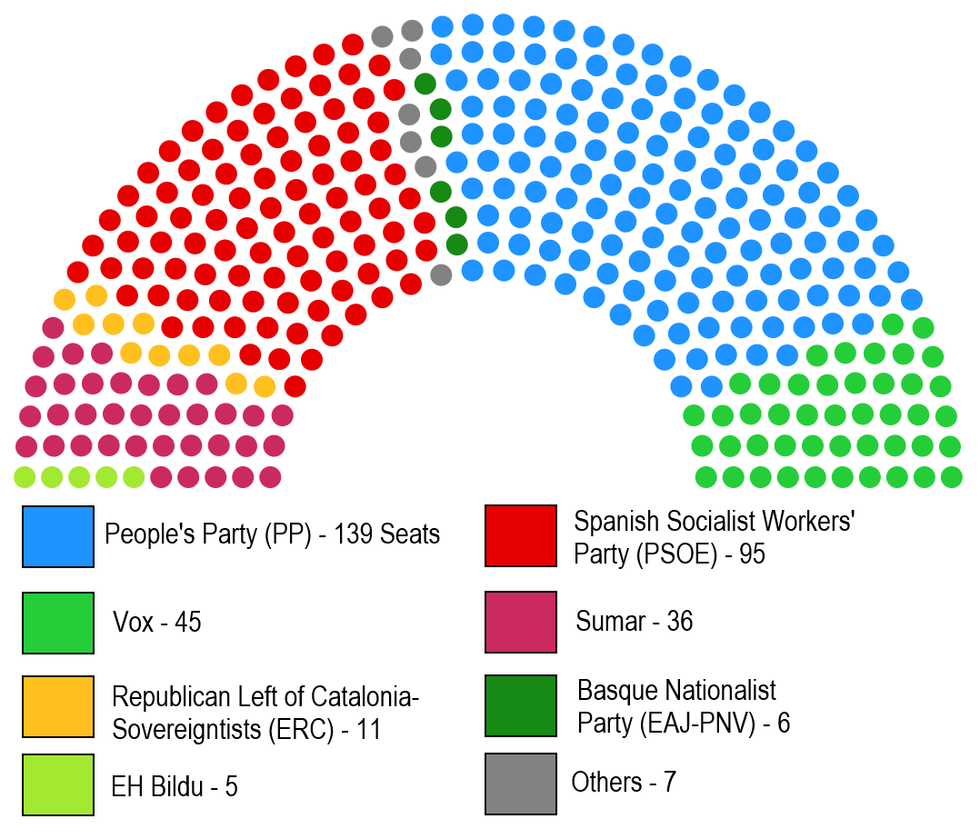

Opinion polling from the month of May shows that, if reflected in the upcoming 23 July general election, the parties of the right would be on course to secure an overall majority in the Congress of Deputies. An average of seat projection polling from May has the centre-right People's Party (PP) winning 139 out of 350 seats, well short of the 176 needed for a majority.

- The right-wing nationalist Vox would come in third place with 45 seats according to the polling, totaling 184. It is unclear whether the two would be able to form a formal coalition, or if Vox could support a minority PP gov't in a confidence-and-supply agreement.

- In calling a snap election, PM Pedro Sanchez is banking on the prospect of a PP-Vox gov't boosting turnout for his centre-left Spanish Socialist Workers' Party (PSOE) and the left-wing Sumar (United) alliance (which is seen as likely to include the PSOE's junior partner, Podemos).

- The election will be watched closely in Brussels, given Spain assumes the six-month rotating presidency of the Council of the European Union on 1 July. A change in gov't could see a change in priorities for the presidency, a sub-optimal situation for the EU given the significant preparation that goes into each six-month period, and the focus in H223 on the prospect (or lack thereof) of reform to EU fiscal rules post-pandemic.

Chart 1. Projected Seats in Congress of Deputies based on Average Opinion Polling from May 2023

Source: IMOP, Data10, ElectoPanel, GAD3, NC Report, Sociometrica, MNI. N.b. Seat total sums to 344 rather than 350 due to averaging.

Source: IMOP, Data10, ElectoPanel, GAD3, NC Report, Sociometrica, MNI. N.b. Seat total sums to 344 rather than 350 due to averaging.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.