-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

PostNL (PNLA; NR/ BBB Neg) 7Y SLB FV

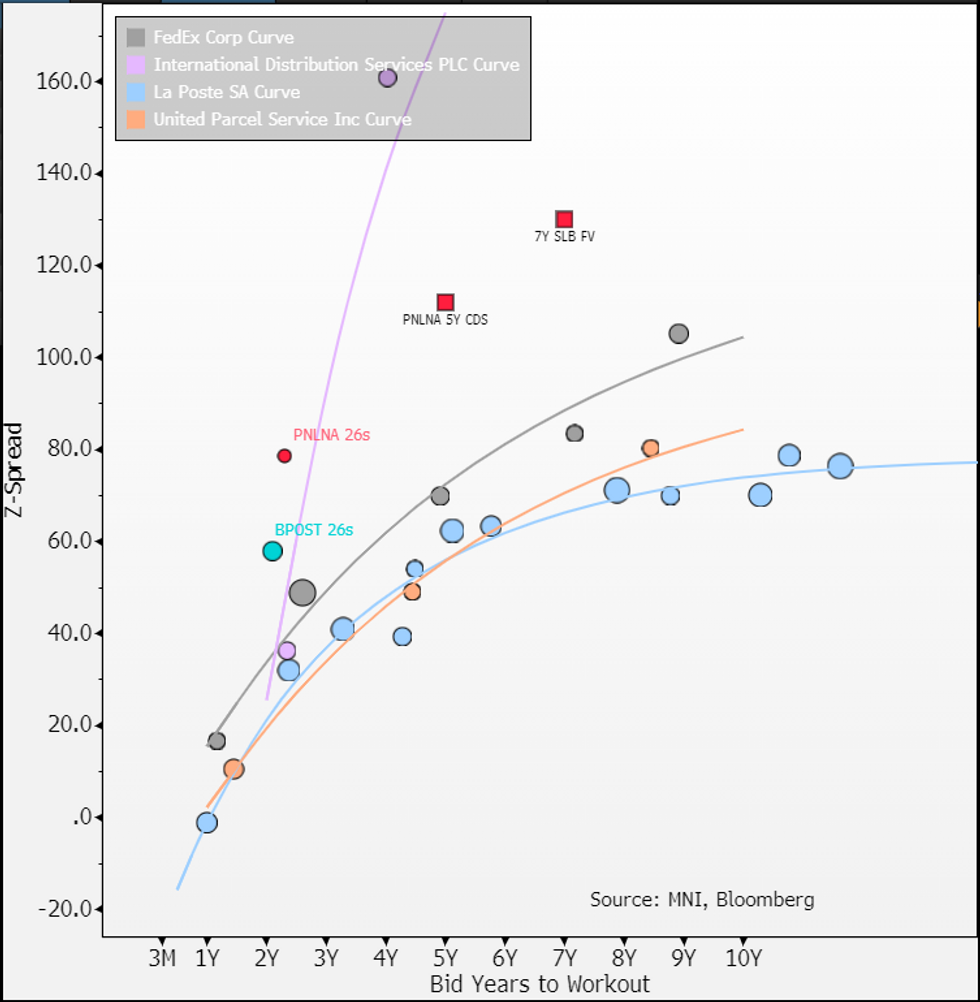

exp. €300m 7Y SLB FV MS+130.

**This FV has now been revised.

Even on LSD NIC we struggle to see this deal as cheap mainly on 1) timing issues (we would rather wait out expected turnaround in volumes into FY24 results), 2) a lack of curve (5yr CDS is there but trades wide as well) & 3) IDSLN28s sitting at Z+160 for those eyeing carry.

- On ratings; its on BBB Neg, the negative outlook is for ~anything that misses S&P expectations - which are in line with company FY24 guidance (see above). We are not too focused on near-term downgrades given how wide 26s already are. The readthrough from the poor performance that leads to any (eventual) d/g would be more important than ratings.

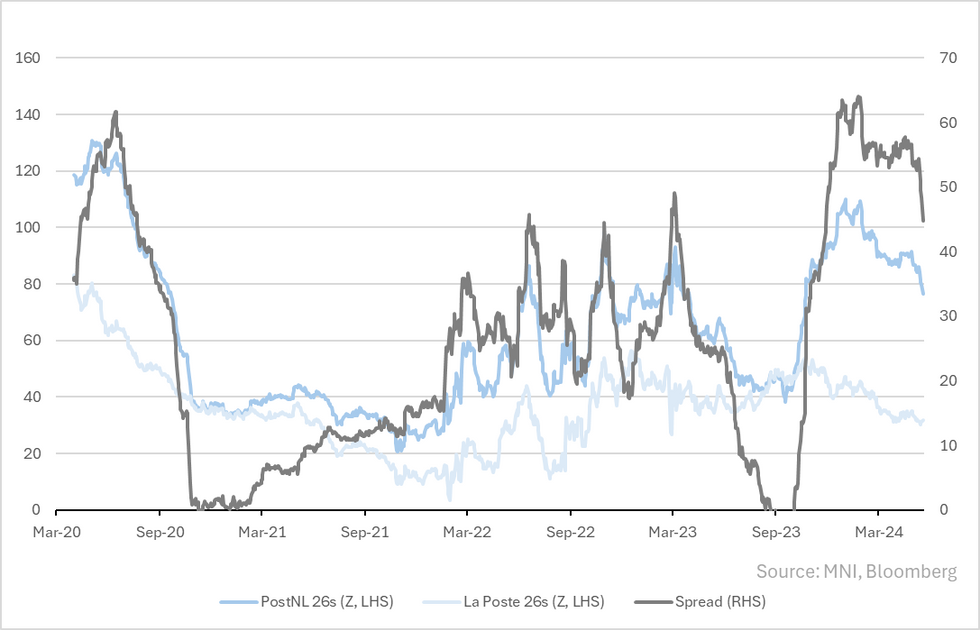

- Vs. peers; the 26s has always traded wide of La Poste (France) & Bpost (Belgium). Bpost (NR/A) is similar scale but has had better consistency in earnings, La Poste (NR/A+ Neg/A+) is private co - both 4-5 notches higher rated. Our FV is +65bps over the La Poste 7Y curve. For comparison; broader IG gives +35 at the 5Y while Tobacco & retailers give +40-50bps at the 7Y.

- Our justification for the higher rating spread is 1) PNLNA26s 2yrs ago traded range bound +20-40bps over LaPoste but was BBB+ till end of '22. 26s now spread +46 2) PNLA26s at Z+80 leaves the 2s7s term premium at +50bps - for BBB curves this is normal - retailer PVH & consumer services co Securitas are spread steeper. 3) below.

- BBB tobacco (see above for similarities in growth dynamics) trades at Z+155 on the 7Y. Given staple nature of postal & less regulation vol, we see it needing to be inside. Note, ratings account for this too. On gross basis its high 3x levered & FCF generation/scale is weak. That compares to tobacco's that have impressive FCF to debt levels. Our FV of +130 is -25bps inside BBB tobacco; we think is fair.

- On SLB step-ups; targeting some strong improvements in emission reductions vs. current levels & small improvement in share of females in senior management (33% to 36% in 6.5yrs). The 3 targets (2 for emissions) are measured at end of 2030, failure to meet any will see single 100bp coupon step up payable at maturity. Step-ups do not impact our FV.

Reminder we have a cheap view on the IDSLN28s (at Z+160), mostly technical & event driven on potential acquirer EP group now committing to IG ratings. Long IDSLN26s (at Z+36) for +5.1pts upside on CoC par put (kicks in if HY downgrade within ~120days) could be eyed as a hedge (though we see as unnecessary & expensive if deal does not close).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.