-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessQ4 GDP Stronger Than Norges Bank Projections

Norway Q4 mainland GDP was a touch stronger than expected at +0.2% Q/Q (vs 0.1% prior and cons). Overall, national GDP was +1.5% Q/Q (vs an upwardly revised -0.4% prior). Norges Bank had projected 0.0% Q/Q in its December MPR.

- Today's print aligns with the Norges Bank's commentary in the January Monetary Policy Assessment, where they noted "household consumption appears to have been somewhat higher than projected towards the end of last year".

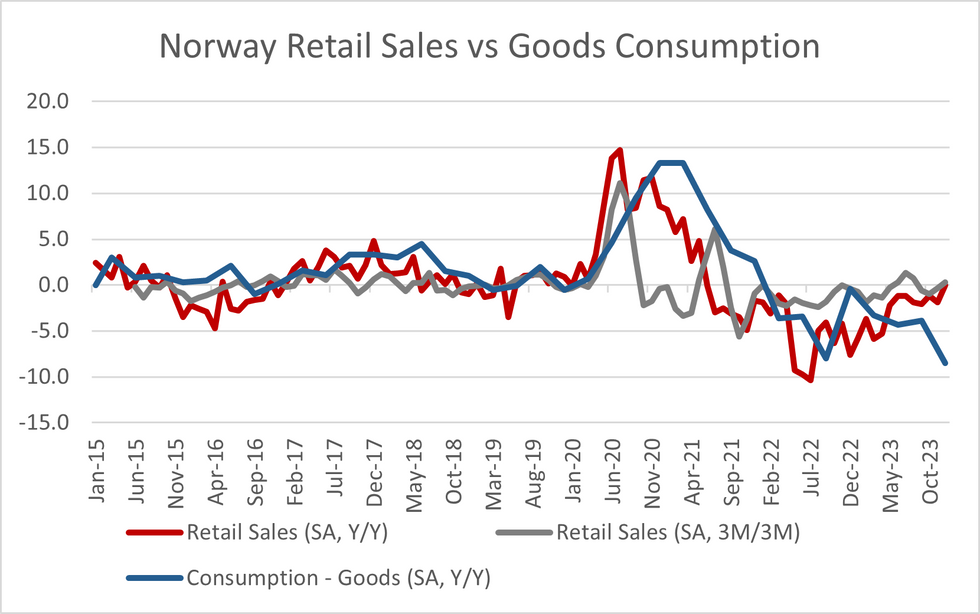

- Looking at the expenditure side of the economy, household consumption rose 0.7%, though this was led by goods consumption (+2.0% Q/Q) while services consumption was subdued (+0.1% Q/Q).

- However, on an annual basis, goods consumption still fell -8.5% Y/Y, while services rose +1.0%. A look at the sub-components suggests the goods weakness was broad-based, but furniture and household equipment saw the largest Y/Y fall of -7.9% Y/Y. This fall is nonetheless surprising given the steady recovery of retail sales seen over the past quarter.

- Mainland gross investment fell -0.8% Q/Q, dragged lower by services components, while the trade balance widened (exports rose 3.3% Q/Q while imports fell -0.7% Q/Q).

- A key input for the Norges Bank in determining when easing can begin will be how wage growth develops. Norges Bank currently expect annual wage growth to be 5.0% in 2024. The Q4 '23 national accounts indicate wages and salaries grew 6.0% Y/Y (vs 7.0% in Q3) and +1.5% Q/Q. Adjusted for total hours worked, wages and salaries grew 5.7% Y/Y in 2023 compared to 4.2% in 2022.

- On Friday (16 Feb), TBU (the Norwegian Technical Calculation Committee for Wage Settlements) will report their CPI estimates for the year, which will feed into wage negotiations starting 15 March.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.