-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

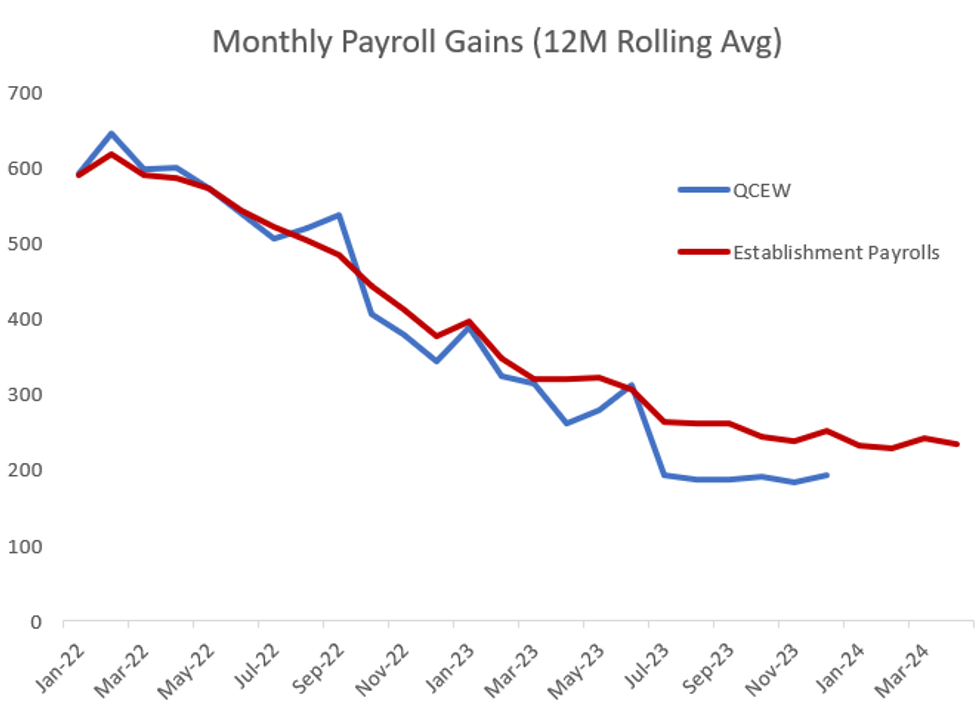

Free AccessQCEW To Signal Overestimated 2023 NFP Gains, But Interpretation Key

Today sees the release of the final Quarterly Census of Employment and Wages (QCEW) for 4Q 2023 (1000ET) by the Bureau of Labor Statistics - which is very likely to confirm that the more widely-cited nonfarm payrolls series is revised significantly downward for 2023.

- The preliminary releases of the QCEW showed roughly 55k per month fewer job gains than the Establishment survey of the nonfarm payrolls report - equating to about 650-700k fewer jobs over 2023.

- That will eventually be reflected in a downward annual revision for nonfarm payrolls, as we noted after the QCEW 4Q 2023 preliminary update on May 22.

- There appear to be two schools of thought to the way such a downgrade should be interpreted. By one reckoning, it's as simple as job growth being weaker than headline payrolls' 250+k monthly gains immediately suggested, which would go some way into squaring up why inflation was diminishing in 2H 2023 even as job gains appeared strong.

- Powell and the Fed saw the disconnect as indicative of labor supply-side improvements keeping a lid on wages, but it may just have been as simple as weaker job gains than they thought. A downward revision in NFPs would square better with other measures of private employment showing more weakness than nonfarm payrolls did in 2023.

- The other interpretation is that while nonfarms will be revised lower, they are a better gauge of labor dynamics than the QCEW, which purports to capture 95% of the labor force but is based on unemployment insurance records so theoretically excludes those working without employment authorization. That potentially includes a large number of immigrant workers who have been adding to the labor force since the pandemic. The nonfarms Establishment survey asks firms to count all employees, whether or not they are working legally, so may provide a more holistic picture.

- If the Fed takes the first interpretation seriously, it should be dovish for their deliberations next week (FOMC minutes in 2023 showed some participants citing the QCEW). If they lean toward the 2nd, it could leave the status quo intact, particularly as they use multiple other labor market indicators to give a more full picture - and in any case, this is not "new news" as we already have strong weakness in prelim QCEW.

- The Q1 annual QCEW revisions (which would revise March 2023 through March 2024) usually carry more weight (this year's report is on Aug 21st, which would guide to revisions from March '23 through March '24), the timing of this release is auspicious ahead of some key FOMC deliberations on the strength of the labor market in deciding when to cut.

QCEW is NSA, Establishment Payrolls is SASource: BLS, MNI

QCEW is NSA, Establishment Payrolls is SASource: BLS, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.