-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Vols Surge Ahead of US CPI

MNI China Daily Summary: Wednesday, December 11

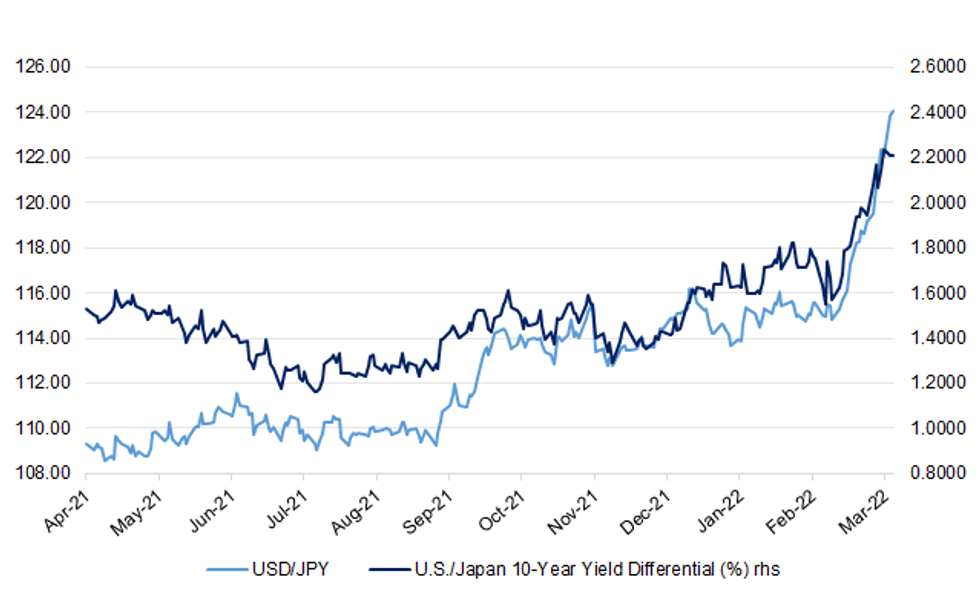

Recapping JPY’s Downward Spiral

JPY hovers just shy of the Y124.20 mark after moving as high as Y125.09 on Monday, with the trajectory of the latest bout of JPY weakness catching the eye of many.

- USD/JPY has started to “overshoot” the rough level that the outright 10-Year U.S. Tsy/JGB yield spread indicates it could trade at.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- When it come to the yield differential itself, the BoJ’s Monday moves to enforce the upper end of its permitted 10-Year JGB yield trading band (including the declaration of daily unlimited BoJ fixed rate buying operations through the end of March), which stands at 0.25%, underscored the dovish divergence of the Bank when compared to its major developed market counterparts. This may have reinforced expectations that the aforementioned U.S./Japan 10-Year yield spread will widen further, given the momentum in Tsys & historical context when looking at current yield levels.

- Still, there are plenty of other factors in play when it comes to the move lower in the JPY.

- Monday’s comments from Japan’s former top currency diplomat, Eisuke Sakakibara (“Mr Yen”), gained plenty of airtime, as he told RTRS that Japanese authorities don’t need to take action re: JPY weakness yet. Sakakibara went on to suggest that Japan should intervene in the currency market or raise interest rates to defend the JPY if USD/JPY moves beyond Y130. Elsewhere on that front, Japanese Chief Cabinet Secretary Matsuno noted that the government is watching the impact of recent JPY declines on the economy “with vigilance,” which marks an uptick in the language used to describe the government’s overview re: FX. Still, Matsuno played down the focus on absolute levels of exchange rates, reiterating that "it's desirable for exchange rates to move stably, reflecting economic fundamentals."

- Long positioning in JPY on the part of Japanese retail accounts could be exacerbating the move higher. Various press reports have flagged record net cumulative JPY longs on the part of Japanese retail investors (going back to ’06), as measured by Tokyo Futures Exchange data.

- A reminder that Japan’s net importer status when it comes to raw materials and energy products adds an extra layer into the matter, leaving the JPY susceptible to weakness in inflationary environments e.g. the one the world is facing at present.

- 1-week USD/JPY implied volatility moved to the highest levels observed since the backend of the Mar/Apr ’20 COVID-related vol. on Monday, before paring back from extremes.

- The aforementioned Monday high (Y125.09) provides the initial point of technical resistance for USD/JPY, with a more detailed looks at technical analysis surrounding the cross available here. To summarise, the uptrend in USD/JPY that started in January ‘21 when the pair reversed from a low of Y102.59, remains intact. Technical signals suggest that the pair is likely to continue to appreciate in Q222 and a clear break of Y125.00 and Y125.86 would strengthen the bullish condition. At current levels, USD/JPY is extremely overbought and the most recent portion of the uptrend is very steep. A correction is overdue.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.