-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessReserve Drain Hasn't Yet Begun On Treasury Cash Rebuild (2/2)

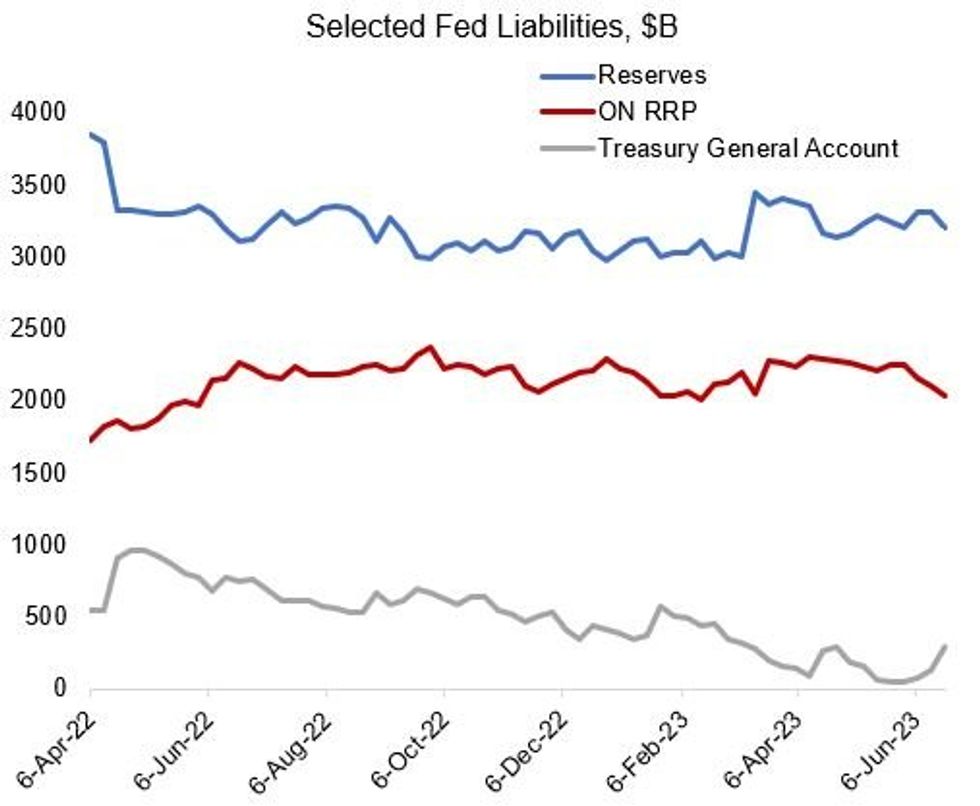

The resumption of the decline in the Fed's balance sheet has focused attention on shrinking overnight reverse repo and reserve levels as the Treasury rebuilds its post-debt limit cash pile in the TGA.

- This month it’s been overwhelmingly a story of ON RRP cash being reduced, with reserves steady. Between May 31 and Jun 21, the TGA is up $244B, with ON RRP down $218B, and reserves down just $1.6B.

- The TGA has risen to $292B from $22.9B at the start of the month, and is set to rise above $400B in the coming week, suggesting further declines in reserves and ON RRP.

- System reserves have fluctuated heavily over the past three months. The current level of $3.2T is about $1T below the Dec 2021 peak and $100B below last week’s level. Meanwhile daily overnight RRP has fluctuated around the $2T mark since mid-month, down from above $2.2T at end-May, but looks to continue falling alongside the TGA increase.

- We continue to see potential for reserve scarcity to be tested by late September as Treasury ramps up its cash build, and as quantitative tightening continues to passively reduce reserves. But even with rapid Treasury bill issuance ongoing, there’s no sign of reserve scarcity so far (in money markets or otherwise) yet, and probably no reason to be concerned until if / when reserves fall another $200B to under $3T.

- Chair Powell showed little concern about reserve scarcity at last week’s June FOMC press conference (“we are starting at a very high level of reserves and still-elevated RRP to take up, for that matter, so we don't think reserves are likely to become scarce in the near term or even over the course of the year”) and reiterated the same sentiments before Congress this week.

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.