-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

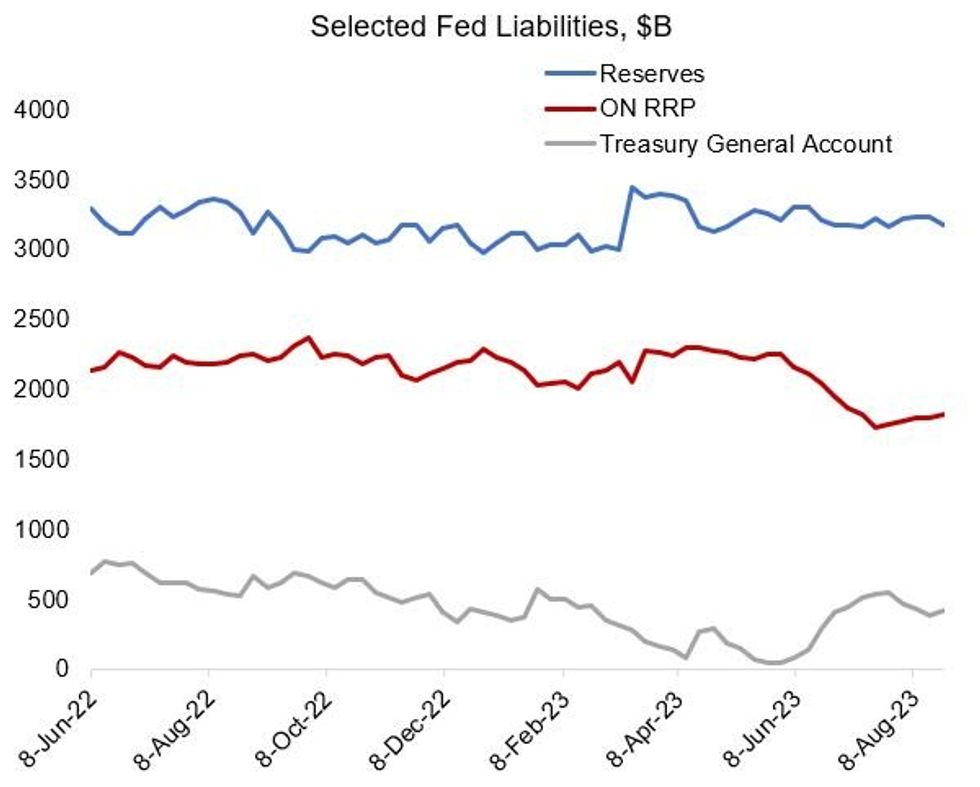

Reserve Scarcity Yet To Materialize (2/2)

Despite concerns over bank reserve scarcity emerging as the Treasury rebuilds its cash pile at the Fed and QT continues, there is no evidence that this is happening so far. System reserve levels are basically unchanged at $3.2T since the debt limit was suspended in early June (down $28B at $3.18T), with the TGA up $368B and overnight RRP usage down $438B. The ostensible reason for this is the benign scenario so far for reserves: soaring Bill supply has been met by demand from money market funds parked at ON RRP.

- St Louis Fed economists are the latest to weigh in on the topic, in a note out this week called “The Mechanics of Fed Balance Sheet Normalization” (link here).

- "As QT-II continues at an accelerated pace, the Fed is likely to reassess the optimal level of reserves in the near future...Earlier this year, Governor Christopher Waller suggested that ON RRP balances could drop to zero without impairing market liquidity. If this is the case, the Fed can continue QT for some time without draining reserves too low. However, there is a risk that ON RRP balances remain sizable and bank reserves represent the majority of the contraction of Fed liabilities as QT continues. In this case, regulatory banking constraints could start binding sooner than expected…”

- They suggest that optimal reserves (before liquidity constraints begin to force money market rates higher) could be as low as $1.9-2T, though “desired liquidity may be something closer to 10% to 12% of nominal GDP ($2.7 trillion to $3.3 trillion), with the current level of reserve balances already around the upper bound of the estimate”.

- Pressure on ON RRP will continue with Treasury’s $650B end-Sept cash target implying continued heavy bill issuance ahead, and the real test will begin emerging closer to then – but there’s no evidence for concern just yet.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.