-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRinggit Rangebound Despite Softer Palm Oil, Covid Chatter Under Scrutiny

Spot USD/MYR trades flat at MYR4.1315 as we type, despite yesterday's drop in palm oil prices & worrying signals re: local Covid-19 situation. A slide through Apr 7 low of MYR4.1220 would open up Mar 18 low of MYR4.1020, while topside technical focus falls on Apr 9 high of MYR4.1454, followed by Mar 31 high of

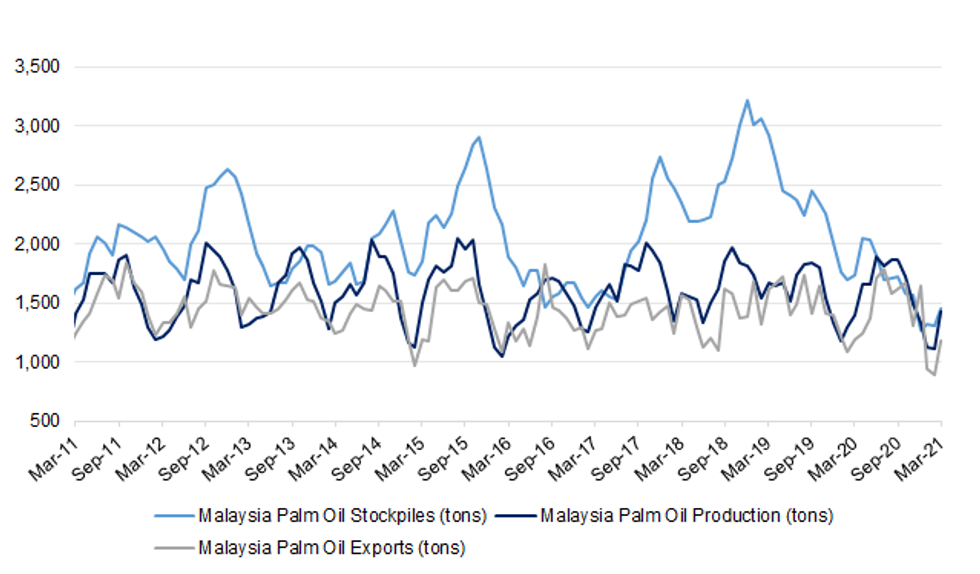

- Bernama cited Human Resources Min Saravanan as noting that the gov't will consider rehiring foreign workers in the plantation, agriculture, m'fing & construction sectors, as employers are struggling to fill vacated jobs in these sectors. The article said that almost 400,000 of jobs in the aforementioned sectors remain unfilled.

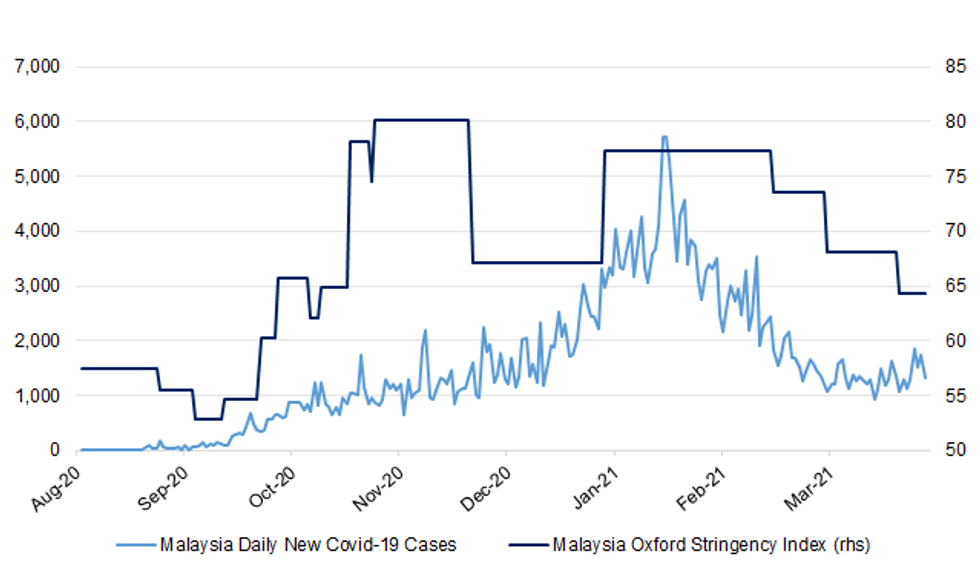

- Malaysian Defence Min Ismail Sabri Yaakob said that the Health Ministry's modelling suggests that a fourth wave of Covid-19 infections may hit the country. The gov't decided to extend existing CMCO & RMCO restrictions through Apr 28 (except for Sarawak, where restrictions were extended through Apr 26).

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Health Min Baba said that the gov't will provide free Covid-19 vaccines to private hospitals to boost the speed of the national inoculation campaign.

- Palm oil futures tumbled in Malaysia as the country's inventories swelled to 1.45mn tons (BBG est. was 1.33mn tons) amid a faster than forecast jump in output.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Malaysiakini reported that PM Muhyiddin lamented the severe depletion of state coffers during the ongoing pandemic and warned that " we don't have much money left."

- Worth noting that PM Muhyiddin will visit Singapore on May 4 to discuss the reopening of the border.

- The Malaysian docket is empty during the remainder of this week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.