-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free Access(RPT)MNI INTERVIEW: Community Bankers Say U.S. In Recession

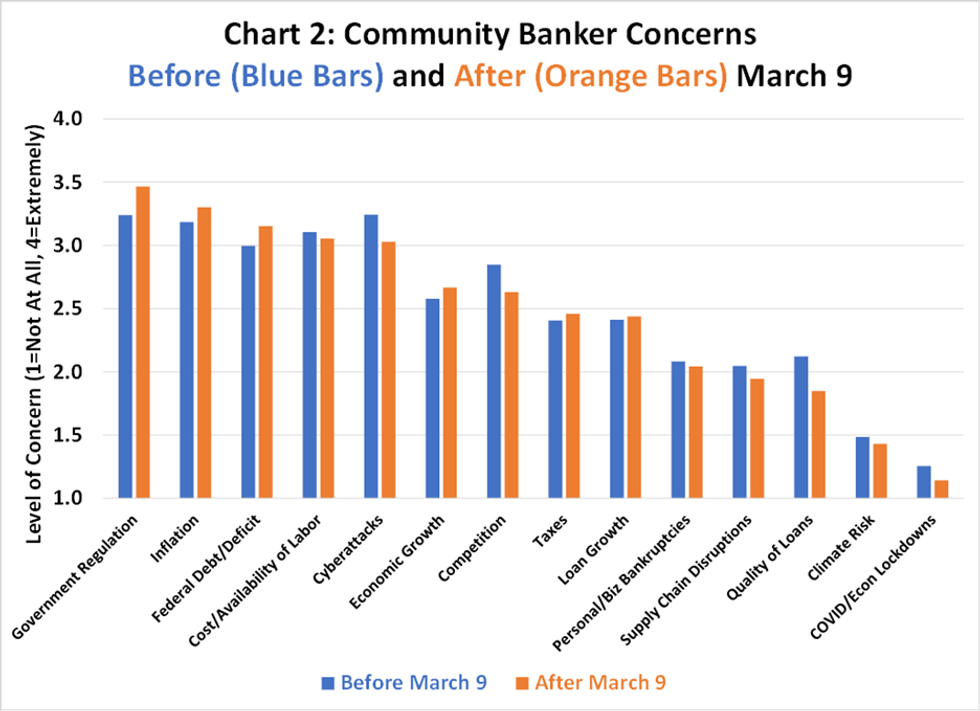

(Story first published April 26) Community banker sentiment in the U.S. cratered further last month after bank runs, deposit complications and the subsequent closure of Silicon Valley Bank and other lenders, according to newly released survey data from the Conference of State Bank Supervisors, a nationwide organization of banking regulators.

Driving community banker sentiment lower are concerns that government regulation could become more burdensome, through either new legislation designed to prevent similar liquidity problems in the future or more forceful supervisory actions as banks continue to adjust to the significantly higher interest rate environment, said Thomas Siems, chief economist at the group.

The liquidity struggles influenced by the Fed’s rapid rate increases since March and the Fed’s apparent policy dilemma of fighting inflation on the one hand, and maintaining financial stability on the other hand, have heightened community banker worries of slower economic growth, higher inflation, and larger federal deficits, he said.

ALREADY IN RECESSION

The data for March has the composite index for average community banker sentiment dropping from 84 before March 9 when SVB experienced the run to 78 for those bankers who completed the survey during the final three weeks of March.

Sentiment though had already been at a series low going back to 2019. The overall first quarter index, released on April 4, had an overall index of 83, where 100 is considered the neutral level. Nearly all of the 330 respondents in the quarterly survey, some 94%, said a recession had already begun.

"I have to really take some stock in that (figure) because community bankers have a lot of insight into what's going on in the economy," said Siems, who spent nearly 34 years at the Dallas Fed. The profitability component of the survey had the greatest quarterly decline for the second consecutive quarter, while some 67% of respondents saw monetary policy getting "worse."

"They know the businesses in their communities that are hiring, firing, who's going to expand, who's not, and they know when people are in trouble with their loans before it shows up in the data," he said.

"The rapidly increasing interest rate environment is a big part of that," Siems said, explaining why the index's measure of community banking sentiment is lower now than during the worst of the pandemic.

"The concern is about the environment," he said. "The greater macro issues are what's driving the concerns because when you look at their top concerns, it's things like the burden of inflation and those bigger issues."

TIGHTER LENDING

Community bankers are already tightening lending standards, Siems said pointing to the Fed's senior loan officer opinion survey that's showed an intensifying restraint in lending standards for recent quarters.

Other community bankers have presented a more benign view, expecting loan growth to remain steady. (See: MNI INTERVIEW: US Community Banks Resilient, Trade Group Says)

If community banks "think that the regulatory authorities are going to be looking at them a little closer, they're going to be a little more picky about how they're going to lend, plus if they think we're in a recession, they're going to be really picky," he said.

Source: Conference of State Bank Supervisors

Source: Conference of State Bank Supervisors

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.