-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

Rupee Gapped Lower At The Open

The rupee weakened at the open on the back of cautious sentiment following reports of a lockdown in Mumbai. India reported 103,558 new infections in the past 24 hours, a record increase. Because of this Maharashtra, which contains Mumbai, will impose restrictions from 2000IST on Monday. All non-essential services will be halted while private offices have been asked to work from home. USD/INR has since regained some ground, rate last at 73.3313 vs opening levels of 73.3625 and the previous close on Wednesday March 31 of 73.1125

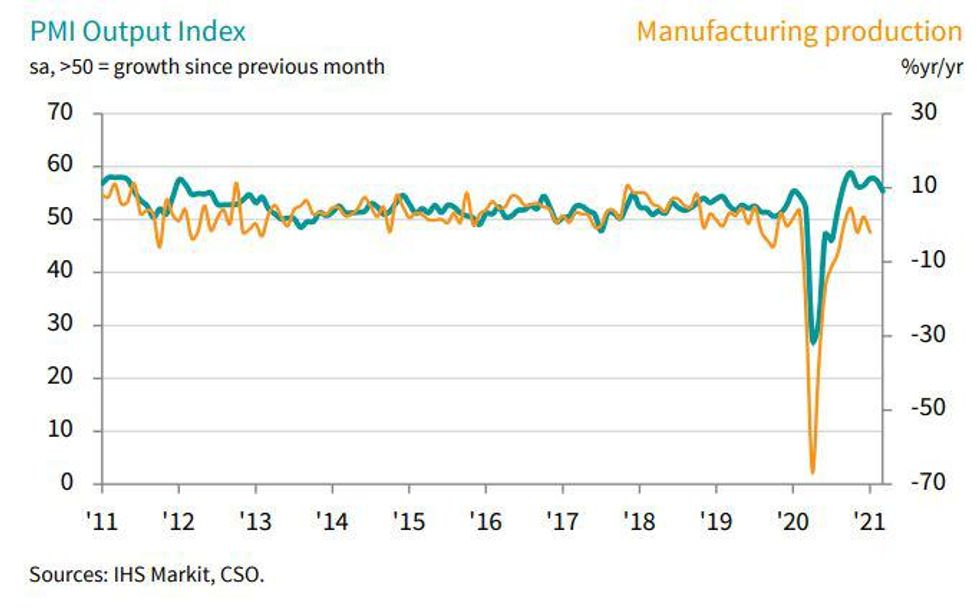

- Elsewhere, Markit India March PMI Manufacturing fell to 55.4 from 57.5 previously, this denotes the lowest reading in seven months. Commenting on the latest survey results, Pollyanna De Lima, Economics Associate Director at IHS Markit, said: "After starting 2021 on a stronger footing than it ended 2020, the manufacturing sector lost further growth momentum in March. Production, new orders and input buying expanded at softer rates. However, in all three cases, the increases were sharp and outpaced their respective long-run averages. "Survey participants indicated that demand growth was constrained by the escalation of the COVID-19 pandemic, while the rise in input buying was curtailed by an intensification of cost pressures. "While predictions that the vaccination programme will curb the disease and underpin output growth in the year ahead meant that business confidence remained positive, growing uncertainty over the near-term outlook due to a rise in COVID-19 cases dragged sentiment to a seven-month low. "With COVID-19 restrictions expanded and lockdown measures re-introduced in many states, Indian manufacturers look set to experience a challenging month in April."

- Markets look ahead to the RBI rate announcement on April 7.

- Fig1: India Manufacturing PMI Output Index & Manufacturing Production Y/Y

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.