-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

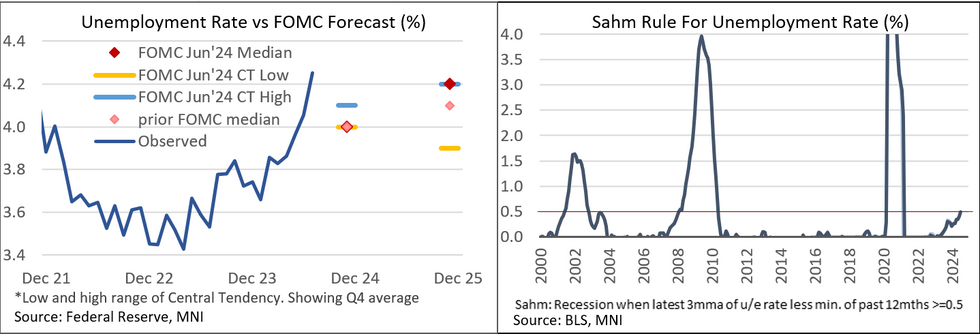

"Sahm Rule" Basically Triggered As U/E Rates (And Participation) Rise

The Household Survey of July's Employment Report was surprisingly weak, even beyond the well-noted jump in the unemployment rate to 4.25% (4.05% prior). The details all leaned disinflationary from a monetary policy perspective, not least with the unemployment rate already shooting above the FOMC's median Dot Plot projection of 4.2% (see chart).

- The U-6 underemployment rate jumped 0.4pp to 7.8%. As such, both the U-3 headline rate and U-6 hit the highest since October 2021.

- The number of unemployed rose by 352k, the biggest rise since August 2023 and vs a 6-month average of 91k. Employment increased by 67k (vs the 114k Establishment number, a relatively narrow gap in comparison to the huge gulf seen over the past year), down from 116k as part of a volatile series. Part-time employment dropped 325k, the most in 3 months, with the number part-time for economic reasons up 346k, a 13-month high.

- The details from a supply-side perspective appeared disinflationary. The participation rate rose 0.1pp to 62.7%, when unrounded the highest since November 2023. This was driven by a sizeable increase in the prime-age 25-54 aged participation rate, up 0.3pp to 84.0%. Age 55+ participation was up 0.1pp at 38.3%, with 16-24 down 0.4pp to 55.5%.

- The labor force increased by 420k, a 4-month high. The employment to population ratio was steady at 60.0% for the 3rd consecutive month.

The "Sahm Rule" - when the latest 3 month moving average of the unemployment rate minus the minimum of the past 12 months exceeds 0.5 percentage points - was basically triggered in July (though technically, our calculation has the reading at "just" 0.49pp), adding to recession signals.

- Though it's worth noting that Fed Chair Powell downplayed this metric on Wednesday: “I would call it a statistical thing that has happened through history. A "statistical regularity" is what I would call it. It is not an economic rule where it is telling you something must happen.”

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.