-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

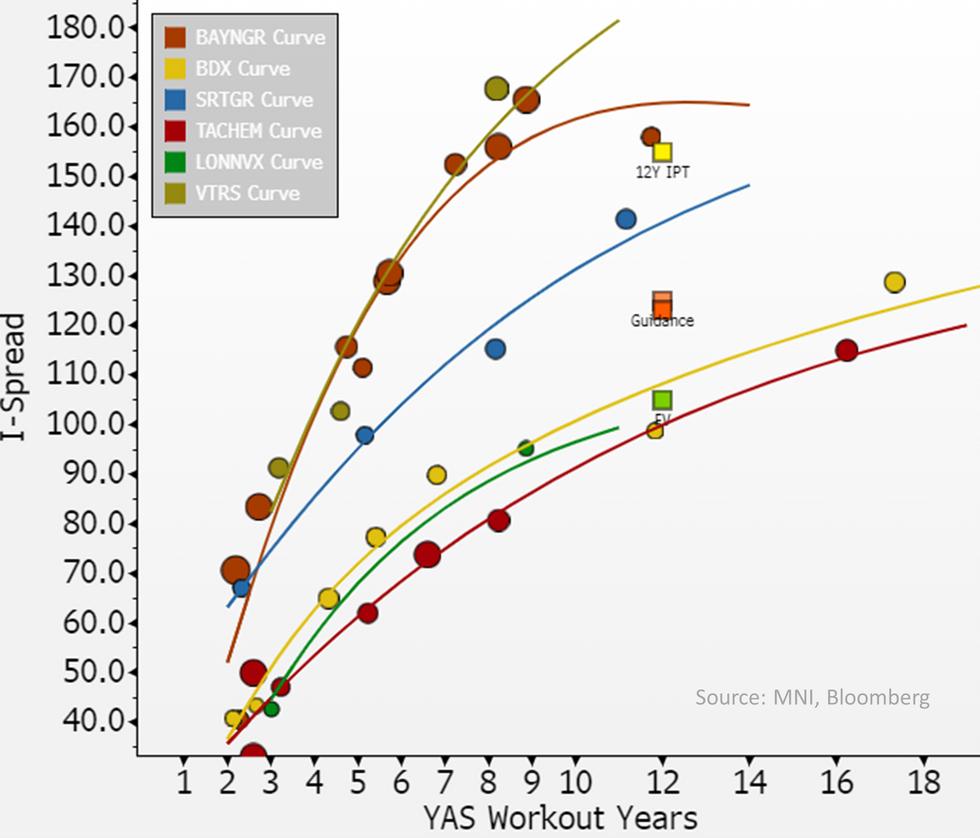

Free AccessSartorius (SRTGR; NR, BBB S) {SRT GR Equity} 1Q Earnings

For those eyeing BBB healthcare names that were well wide of comps we mentioned for Lonza's 12Y FV, worth noting there is more risk on IG ratings for Viatris, Bayer & Sartorius. We do like VTRS short-end (liquidity isn't a issue even on a drop to HY); 27's at MS+91/4%/€92. We also do see some value in smaller Sartorius post its €1.3b equity raise in February - 1Q earnings tomorrow one to watch.

- Sartorius reports tomorrow morning, 35's (€106) are trading at MS+142 (40bps wide of BDX 36s) and may be motivated to come in if headline performance has held in-line with expectations (EBTIDA €240m).

- It was targeting 4x leverage (at group level) by year-end - X-factor for us was any equity raises to speed that up (Capex is heavy for it leaving little in FCF) and it delivered with €1.2b equity raise in Feb which it sees bringing leverage to 3.5x (net debt is €4.9b).

- Leverage peaked at 5x post Polyplus acquisition (for €2.4b) which saw a 4-part/€3b local deal. S&P was happy at BBB Stable likely on mgmt guiding to rapid deleveraging towards the target 2-3x.

- As background; Sartorius is a smaller (€4b sales) healthcare co that mostly does Bioprocess solutions alongside lab products & services. Note debt is issued out of finance vehicle with guarantor as parent/Sartorius Group (not Sartorius Stedim Biotech {DIM FP Equity} which it has a 70% stake in). Its a healthy margin business (>30%) with strong medium term guidance (>10%) out to 2028 (which analyst have taken) - its guiding to 1/5th of growth to be inorganic.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.