-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

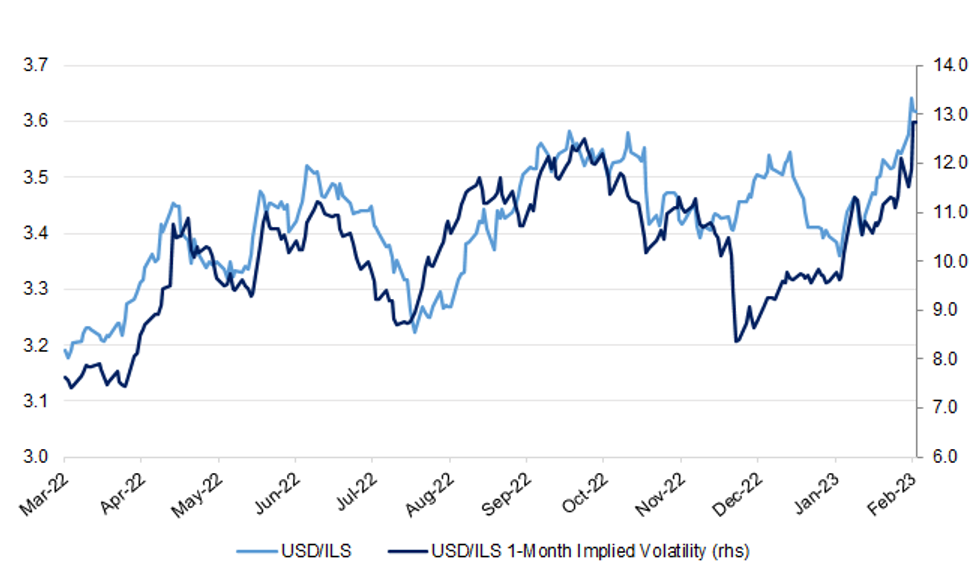

Free AccessShekel Pauses Recovery Amid Israel's Political Turmoil, Implied Vols Remain Elevated

Spot USD/ILS has paused its pullback from a three-year high printed yesterday at ISL3.6927 for now. The rate sold off in morning hours before finding support at ILS3.5921 and retracing losses to stabilise just shy of neutral levels. It last trades -54 pips at ILS3.6160, with bears looking for renewed losses past Feb 21 low of ILS3.5754. On the flip side, bulls keep an eye on the 76.4% retracement of the 2020 - 2021 slide/Feb 22 high located at ILS3.6892/3.6927.

- The RSI moved above the "overbought" threshold as USD/ILS rallied over the past days, but is now staging forays below the 70 threshold, last sitting at 70.3. A close below 70 would suggest that the recent spike may have been overextended.

- The pair's implied volatilities remain elevated amid a brewing domestic political crisis. The overnight tenor lodged best levels in more than a week before easing off. Meanwhile, 1-month implied volatility showed at levels last seen at the beginning of the COVID-19 pandemic, but has since erased its intraday gains.

- The shekel tumbled to new cyclical lows amid concerns over central bank autonomy, before getting some reprieve Wednesday as Prime Minister Netanyahu asked lawmakers from his party to respect the independence of Israel's monetary policy authority.

- Adding to the political risk premium baked into the currency, the ruling coalition earlier this week pressed ahead with a highly controversial overhaul of the Israeli judicial system, despite widespread protests.

Fig. 1: USD/ILS vs. USD/ILS 1-Month Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.