-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

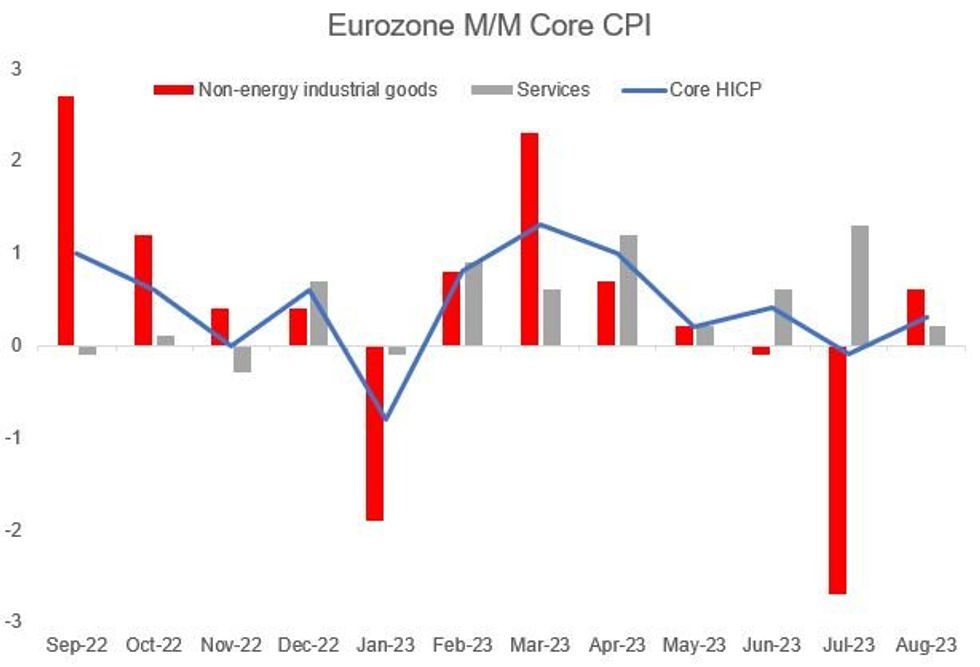

Softening Services Underline Signs Of A Peak In Core Inflation

The flash readings of Eurozone inflation came in at/slightly above consensus estimates coming into the week, but were mostly in line with the expectations formed after national-level prints received prior. All in all, core pressures remain uncomfortably high, but appear to be settling down to a sequential pace that is closer to 2% than to the 4-5% suggested by prints earlier in the year.

- Headline HICP printed at 5.3% Y/Y (5.26% unrounded, 5.3% Jul), and 0.6% M/M (0.56% unrounded, -0.1% July). Those were above the 5.1% / 0.4% consensus but accorded with MNI's estimates based on earlier national prints.

- Likewise the 5.3% Y/Y core HICP reading (5.29% unrounded, 5.5% Jul) with core at 0.3%% (0.34% M/M unrounded) were in line with MNI's expectation coming into the reading, and matched previous expectations - potentially reflecting marginal upside surprises to German and Spanish core, with softer French and Italian readings offsetting.

- On the headline front: energy prices rose 3.2% M/M, bringing the Y/Y rate to -3.3% from -6.1% in July, as various base effects reversed and oil prices rose. Unprocessed food prices fell 0.6% M/M, with procesed food/alcohol/tobacco up 0.3% - both Y/Y figures moderated (processed 10.4% vs 11.3% prior; unprocessed 7.8% vs 9.2% prior).

- As for core items, non-energy industrial goods prices continued deflating Y/Y, to 4.8% (5.0% prior), with services likewise a touch lower (5.5% vs 5.6% prior).

- While sequential NEIG deflation in the prior 2 months (incl -2.7% M/M in Jul) reversed to inflation (+0.6% M/M Aug), part of this may be due to effects of shifting sales periods.

- Additionally, services rose just 0.2% M/M - joint-lowest since January - vs 1.3% in July. The latter was boosted by statistical factors that should fade going forward. Indeed some had expected services would mark another Y/Y high in August before an inevitable fading in September onward - this report marked a positive development on the disinflation front in that regard.

Source: Eurostat, MNI

Source: Eurostat, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.