-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

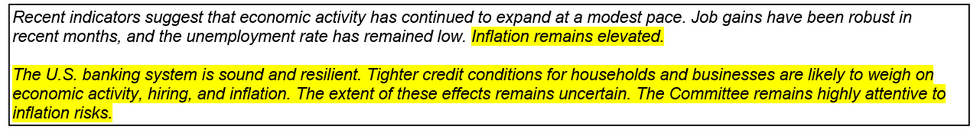

Statement: Will "Inflation Remain Elevated"? (1/2)

MNI expects few to no meaningful changes to the July FOMC Statement vs June's.

- While unlikely, the opening paragraphs (see segment from June's statement below, with potential areas of change highlighted) could provide a meaningful surprise.

- The July Beige Book suggested little change in economic activity vs the previous edition, so there’s probably not much for the Statement to change there. If anything the July edition was more positive on growth than in April and May. The description of job gains being “robust” could be tweaked given the first nonfarm payrolls “miss” in 15 months in June, but there’s unlikely to be any wholesale revision here.

- There were some Beige Book acknowledgements of easing if mixed inflationary pressures though (eg NY Fed: “Inflationary pressures eased noticeably”; Cleveland “Price pressures eased”)

- The phrase “inflation remains elevated” will change once the FOMC is prepared to signal it’s comfortable that inflation is headed toward 2% - even with June’s CPI print on the soft side, it’s premature for that yet.

- Some analysts see the inflation description softened this month on the back of the June data. If so, it would be a dovish surprise, pointing to the FOMC communicating potential for July’s hike to be the last (and as a potential market mover we’ve captured it in our Instant Answers).

- On banks: even with prevailing FOMC sentiment (and the sectoral data itself) seeming to turn more optimistic on the banking sector outlook since June, there is little reason for the FOMC to change the paragraph on banking, which was introduced in the March meeting (replacing a paragraph that signalled risks from Ukraine-Russia fallout) yet still conveys the state of play even if only in banal fashion. Removing it would convey a conviction that banking sector issues no longer presented a reason to hold back on further monetary tightening, despite some factions on the Committee still seeing bank stress-related credit tightening as a downside risk. Even so, if this paragraph were dropped, it shouldn’t be construed as a hugely hawkish surprise or signal.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.