-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

Strong Mainland Inflows Via Connect Over The Past Couple Of Days, A/H Premium Narrows

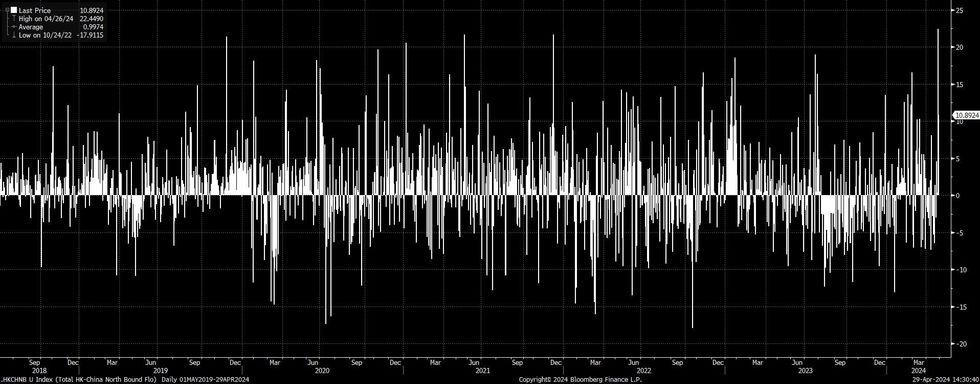

Monday saw a second straight day of double-digit CNYbn inflows for mainland Chinese equities via the HK-China Stock Connect links. CNY10.9bn of net buying came on the back of Friday’s daily record of CNY22.4bn of net inflows.

- Some analysts have suggested that market participants are starting to exhibit a fear of missing out (FOMO) when it comes to Chinese equities, given the rebound from ’24 lows in most of the benchmark indices.

- While FOMO isn’t a pure ‘explainer’ for the rally, tighter regulatory scrutiny, policymaker desire to attract capital to China, background discussions surrounding a weaker yuan (positive for H shares as the mainland looks for value stores), early '24 state-backed buying and technical breaks resulting in fresh year-to-date highs for the CSI 300, are all noted as supportive factors.

- Dividend and buyback plays also feature heavily in the sell-side notes we have read, pointing to a preference for cash flow.

- On top of that, fundamental valuations remain attractive. This is particularly important when viewed through a global lens, given expectations for higher for longer Fed interest rates vs. the policy easing bias in China.

- We also note that the A/H share premium index has narrowed to fresh year-to-date lows, meaning that HK listings are leading the latest leg of the rally (A-shares continue to trade at a notable premium to H-shares).

- Still, most sell-side desks note that longer-term investors have not returned to the space, even as policymakers attempt to promote inflows from that investor cohort.

- While Q1 economic data outperformed vs. sell-side calls, the economic outlook can hardly be deemed buoyant (see industrial profit data released over the weekend for an example). Still, the overall data development underscores the ability of policymakers to keep easing measures ‘targeted.’

- Further policy easing and broader stabilisation for the embattled property sector are likely pre-requisites for the return of longer-term capital.

- Looking ahead, comments from April’s Politburo meeting could cross at some point in the next 24 hours and Chinese official PMI data is due on Tuesday, with the latter expected to show a slight moderation in the rate of expansion across all 3 major survey metrics.

- The Labour Day holiday will see mainland markets closed Wednesday through Friday. with HK closed on Wednesday.

Fig. 1: HK-China Northbound Stock Connect Flows (CNYbn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.