-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

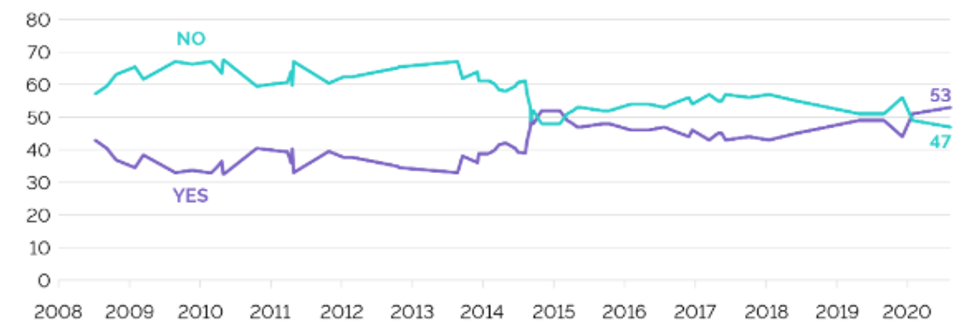

Free AccessSupport For Scottish Independence Hits Record High In YouGov Poll

Public support for Scottish independence has hit a record high according to pollster YouGov, with 53% of respondents (excluding don't knows) stating they support the idea of Scotland leaving the United Kingdom.

- This leaves 47% of respondents saying they want to see Scotland remain as part of the UK. The lead for 'Yes' to independence is up to 6% from 2% in January.

- The concern for Westminster will be that the poll also shows the pro-independence Scottish National Party (SNP) with a substantial lead in both the constituency and regional party-list votes heading into next May's Scottish Parliament elections. The SNP gains 57% and 47% support in the constituency and regional list vote polling respectively, compared to 20% and 21% for the pro-Union Conservatives. If these results were mirrored in the 2021 election it would likely provide the SNP with an overall majority in the Scottish Parliament.

- In that scenario it would be increasingly difficult for the UK gov't in Westminster to deny a second Scottish independence referendum.

- One of the largest issues for pro-Union parties is PM Boris Johnson, who according to polling is singularly unpopular in Scotland. The YouGov poll shows just 20% of respondents believe Johnson is doing well in his job compared to 74% who say he is doing badly. This compares to 72% of respondents saying SNP First Minister Nicola Sturgeon doing well to just 22% doing badly.

- Scotland accounts for 8% of the UK population, 32% of its land mass, and 8% of its overall GVA.

Source: YouGov. Latest data from 6-10 Aug, 1,142 respondents.

Source: YouGov. Latest data from 6-10 Aug, 1,142 respondents.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.