-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTax Policy Could Change If NZF Required To Prop Up Nationals

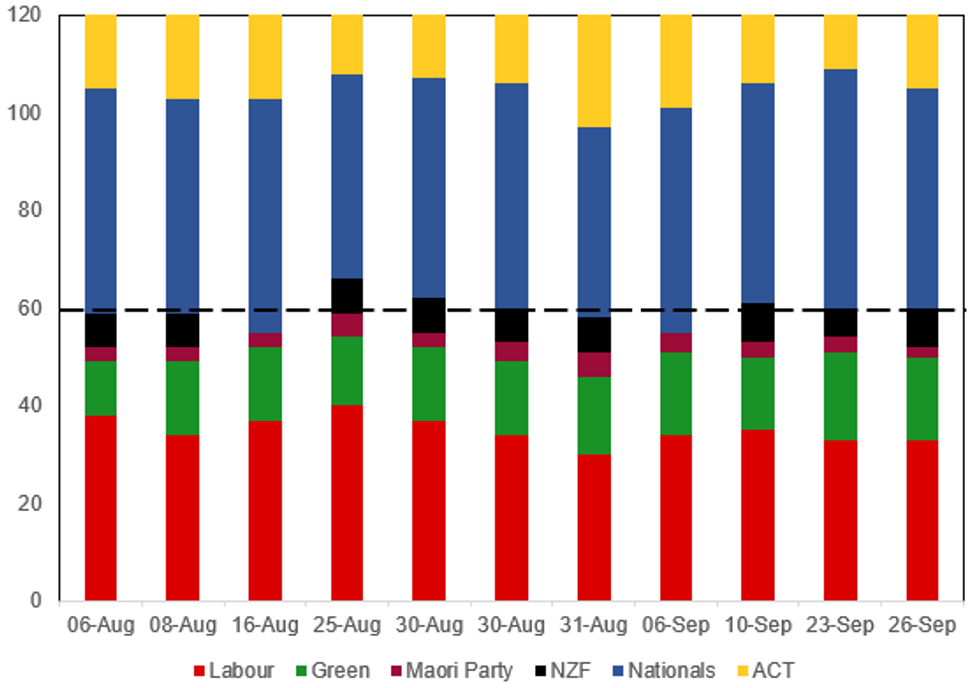

Opinion polling and seat forecasts ahead of the 14 October general election show that a three-party coalition involving the main opposition centre-right Nationals, libertarian ACT, and populist New Zealand First (NZF) would hold a comfortable majority in the House of Representatives if reflected in the final vote. Of the four set of seat projections released in September, three showed that the NAT-ACT-NZF coalition would hold a majority, while one showed the Nationals and ACT crossing the 61-seat threshold without needing NZF support (see chart below).

- Earlier this week, Nationals leader Christopher Luxon confirmed that his party would be willing to form a gov't with NZF. Under the leadership of former Deputy PM Winston Peters, NZF has sat in gov't on two separate occasions, once as part of a Nationals-led administration and once during the first term of former Labour PM Jacinda Ardern.

- The implications of NZF being required to form a majority govt or not could prove significant for New Zealand's fiscal outlook and tax policies. A two-party Nationals-ACT gov't would be more likely to enact significanttax cuts totalling NZD14.6bn(USD8.7bn), including NZD2bn in income tax relief each year, paid for by controversial new taxes on offshore gambling companies and foreign homebuyers.

- However, Peters has stated that “To the best of my efforts, I can’t work out how the fiscals work, and nor can any economist,” and said that he would need to see detailed costings before backing a Nationals-led gov't.

Chart 1. New Zealand General Election Seat Forecasts

Source: Roy Morgan, Talbot Mills, Freshwater Strategy, Reid Research, Guardian Essential, Taxpayers' Union-Curia, Verian, MNI

Source: Roy Morgan, Talbot Mills, Freshwater Strategy, Reid Research, Guardian Essential, Taxpayers' Union-Curia, Verian, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.