-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessThailand Extends & Expands Lockdown Measures As Outbreak Rages

Spot USD/THB has crept higher and last sits +0.090 at THB32.958, with the baht pressured by aggressive action taken by Thai officials to put a lid on the upsurge in Covid-19 cases. Bulls keep an eye on Jul 27 high of THB32.990, a recent cycle peak, and a clean break here would open up Apr 2, 2020 high of THB33.177. On the flip side, should bears force a break under Jul 29 low of THB32.820, they could take aim at Jul 20 low of THB32.780.

- Thailand's Covid-19 task force emerged from an emergency meeting Sunday, announcing an extension to lockdown measures in 13 provinces including Bangkok through Aug 31 and their expansion to 16 further regions from Tuesday. Restrictions include bans on dine-in services and inter-provincial travel as well as a night curfew. The 29 provinces covered by the restrictions account for 3/4 of Thailand's GDP and are home to 40% of its population. The task force will reassess the Covid-19 situation in two weeks and may relax some measures on Aug 18.

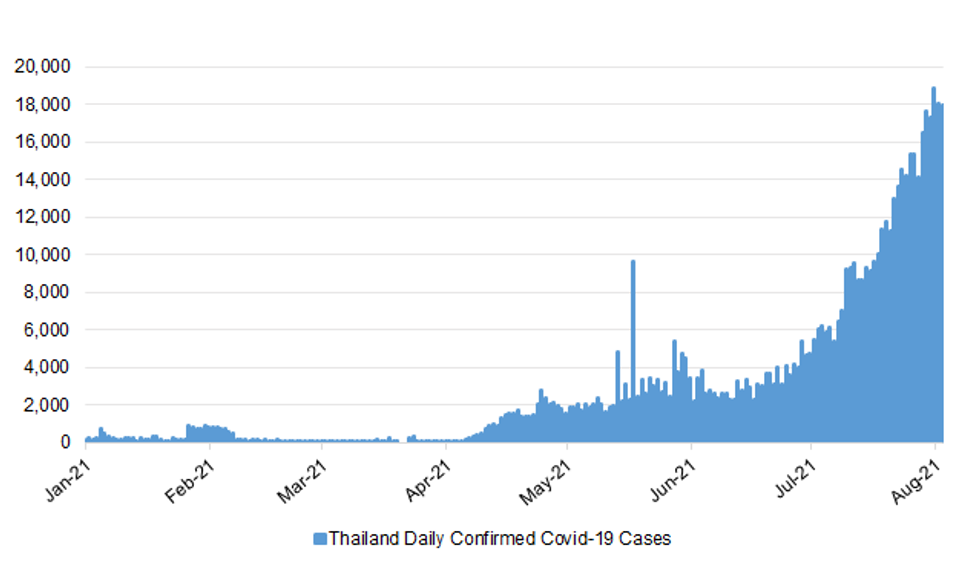

- The Southeast nation added 18,912 new Covid-19 cases on Saturday, a new record high, with the daily count easing slightly to 18,027 on Sunday and 17,970 today. Thousands of protesters marched in dozens of places across Thailand demanding PM Prayuth's resignation, amid widespread criticism of jab shortages and the disappointing pace of vaccine rollout.

- The Bangkok Post reported that Pattaya reopening will likely be postponed "if the province cannot build herd immunity by the deadline". The current wave of Covid-19 has already affected the reopening of Phuket and Phang Nga, both of which banned domestic travellers from entry between Aug 3 and 16.

- Thailand's Markit M'fing PMI deteriorated to 48.7 in July from 49.5 in June, with "both demand and production evidently affected" by "the deterioration of COVID-19 conditions in the country". IHS Markit flagged that "attention on the progress of the vaccination drive continues".

- Looking ahead, the BoT will deliver their monetary policy decision on Wednesday, but there is virtual consensus that the benchmark interest rate will stay put. The next day, Thai Commerce Ministry will publish the latest CPI data.

Fig. 1: Thailand Daily Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.