-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessThird Term Not A Certainty For PM Bettel In 8 Oct Election

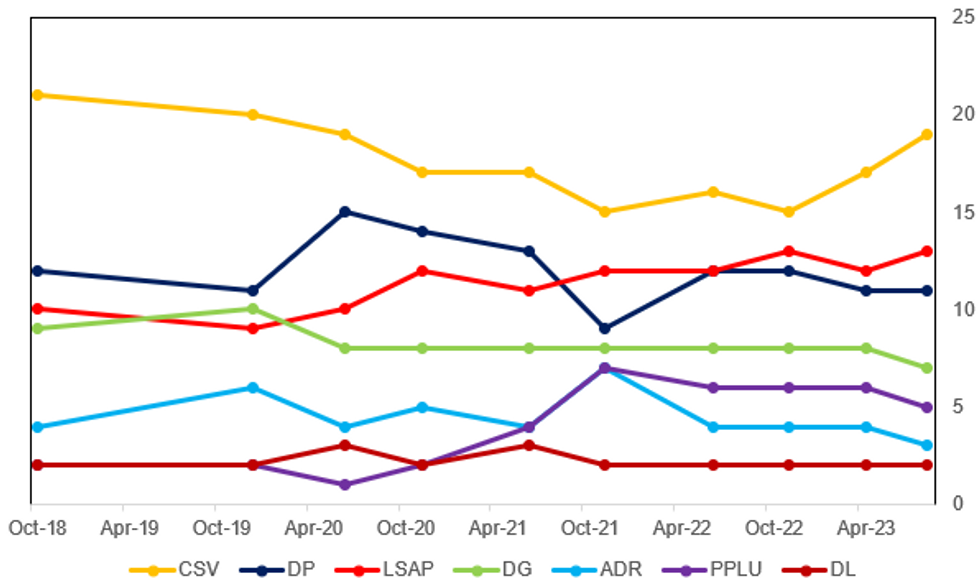

Luxembourg holds its general election on 8 October, with all 60 seats in the Chamber of Deputies up for grabs. Prime Minister Xavier Bettel from the liberal Democratic Party (DP) is seeking a third consecutive term in office at the head of a centre-left coalition that includes the centre-left Luxembourg Socialist Workers' Party (LSAP) and the environmentalist Greens (DG). What little opinion polling has been carried out shows the incumbent gov't securing a narrow one-seat majority, with the LSAP on 13, the DP 11, and DG 7 (see chart below).

- There are a large number of coalition permutations that could come from the election. The main opposition centre-right Christian Social People's Party (CSV) looks likely to emerge as the largest party, and as such could seek to lead coalition negotiations. Should the incumbent tripartite coalition secure 31 or more seats it could look to re-form, but potentially with an LSAP PM should the party win more seats than Bettel's DP.

- The performance of two non-mainstream parties: the conservative populist Alternative Democratic Reform Party (ADR) and the anti-establishment Pirate Party (PPLU) could prove critical. Should they gain in their totals from 2018 (four and two seats respectively) it could force more parties into coalition talks.

- Luxembourg does not face a wave of support for nationalist/populist parties as seen in many other European countries, and as such even if the composition of the coalition changes a major shift in gov't policy on the EU, Ukraine support, or economic policy is unlikely.

Source: ILRES, TNS, MNI

Source: ILRES, TNS, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.