-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTighter Restrictions, More Stimulus

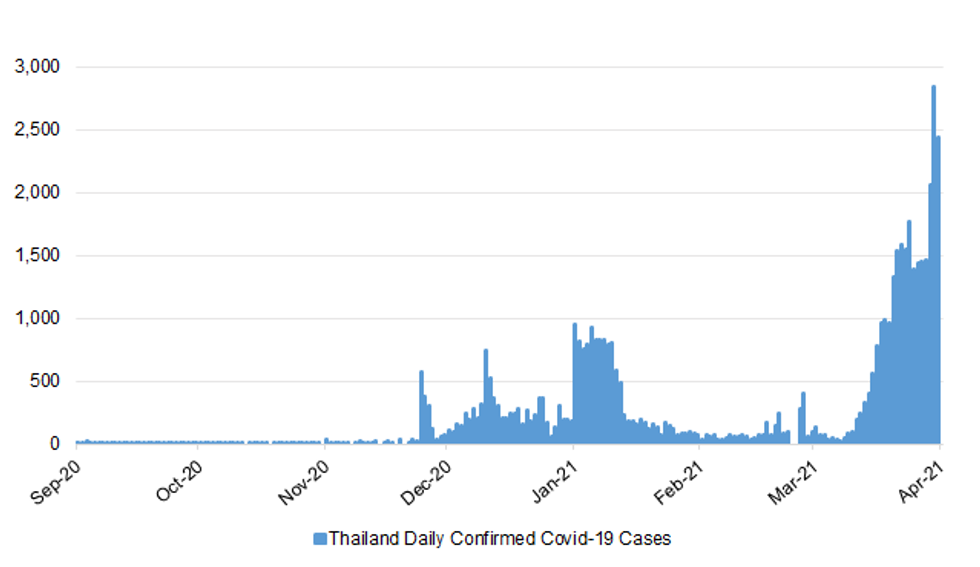

Spot USD/THB holds Friday's range and last trades -0.007 at THB31.388, showing a limited reaction to weekend news flow re: local Covid-19 outbreak.

- Thailand's Public Health Emergency Operation Centre held an emergency meeting Sunday to discuss the resurgence of the local Covid-19 outbreak. Public Health Ministry off'l told the media that the gov't is planning to implement a new colour-coded system of targeted restrictions, which will effectively involve tighter curbs.

- Meanwhile, Bangkok metropolitan authorities shut a range of businesses for two weeks and ordered residents to wear masks or face THB20,000 fines.

- PM Prayuth unveiled plans to inject THB380bn into domestic economy to stimulate consumption and investment. The announcement lacked details re: timeline of spending.

- Public Debt Management Office (PDMO) chief said that the gov't may need to rethink its fiscal sustainability framework, as economic recovery requires continued stimulus.

- PM Prayuth will meet with representatives of the private sector Wednesday to discuss how to facilitate the national Covid-19 vaccination campaign.

- Thailand's M'fing Production Index comes out Wednesday, with analysts surveyed by BBG expecting the index to fall -0.40% Y/Y vs. -1.08%.

- Later in the week's focus moves to Friday's BoP current account balance, trade data & foreign reserves data.

- Bears would be pleased by a slide through Apr 19 low of THB31.173, towards Mar 26 low of THB31.060. Bullish focus falls on Apr 12 cycle high of THB31.575.

Fig. 1: Thailand Daily Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.