-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessToo Early To Assess Reserve Strain From Treasury Cash Rebuild (2/2)

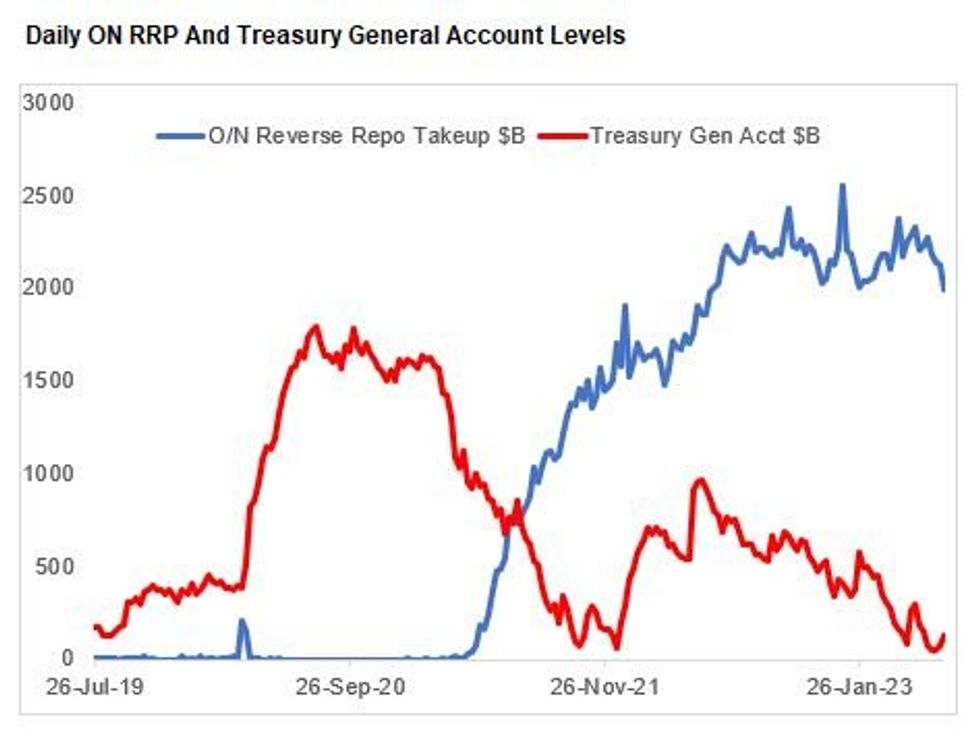

While the decline in ON RRP usage looks likely to continue, it's still too early to determine whether the Treasury's cash rebuild will drag down system reserves to "scarce" levels.

- Note in the week to Wednesday, system reserves were unchanged, and were actually up $26B to $3.306B over the prior 4 weeks despite continued QT (SOMA assets fell a net $52B over the same period), ON RRP fell by $161B and the TGA rose by $66B.

- Those trends are unlikely to be sustained - reserves are almost certain to head lower, to below $3T in the coming months as the TGA is refilled via funds flowing from both banks and money market funds parked at RRP.

- As we discussed in this month's Treasury Issuance Deep Dive (PDF Link here), the “minimum” level of reserves is probably somewhere between $2.3-2.8T, so being conservative, a drain of $400-500B of reserves from current levels could begin to pressure the banking system, if not before. The longer we go on, the more QT will continue to put consistent pressure on the banking system as well.

- Though Fed Chair Powell at Wednesday's press conference was unconcerned with the reserves outlook, It's not hard to see a situation in which reserves fall to $2.9T – the upper bound of the scarcity zone – by end-September.

- And as we get closer to that time, there will be a regular reassessment of whether ON RRP has indeed made up the bulk of bill funding, and whether banks are feeling any pressure.

- As we discuss in the Deep Dive, we'll be looking at multiple indicators on that front in the months ahead, including: bank deposit rates on offer, repo rates, Fed funding facility usage (including BTFP), and borrowing from FHLBs.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.