April 08, 2024 15:12 GMT

Trade Surplus Narrows Sharply In February After Record January

GERMAN DATA

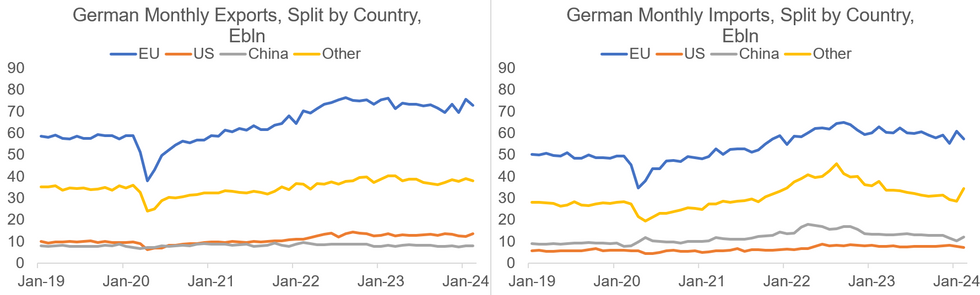

The German trade surplus fell more significantly than expected in February, to E21.4bln on a seasonally-adjusted basis vs E25.0bln consensus and E27.6bln in January. The narrowing of the surplus came as exports decreased 2.0% M/M and imports increased 3.2%.

- Even so, after January's all-time high trade surplus, the contribution of the first two months of net exports to Q1 2024 GDP could be positive (vs a 0.0pp contribution seen in Q4 2023), given relative strength in nominal terms versus import/export price inflation.

- Looking at a geographical split, the drop was driven by a strong increase in imports from third-party countries (+14.7% M/M vs -18.3% prior), with imports from Australia, Russia, and Norway up in particular (+27.4%, +23.5%, and +22.5% M/M, respectively).

- This suggests that part of the rise in the import bill might have been due to higher energy prices. Norway for instance is Germany's largest gas supplier. Destatis has not yet released the breakdown of goods by category.

- Elsewhere, imports from China increased at the highest monthly rate since March 2022 (+16.0% M/M vs -10.9% prior), partly reversing a downtrend that began in early 2022.

- Exports to third-party countries saw an uptick (+0.4% M/M; vs +3.1% prior). With EU members, however, trade declined (exports -3.9% M/M, imports -5.7% M/M).

- Trade is projected to rebound back into positive territory in real terms in the second half of 2024 per MNI's collation of sell-side analysts, with real exports seen at -2.2%, -0.9%, +0.4%, and +0.8% Y/Y Q1-Q4 2024, and real imports seen at -1.8%, -1.6%, +0.2%, and +1.1% Y/Y, respectively (estimates have been unchanged over the past month).

MNI, Destatis

MNI, Destatis

277 words