-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

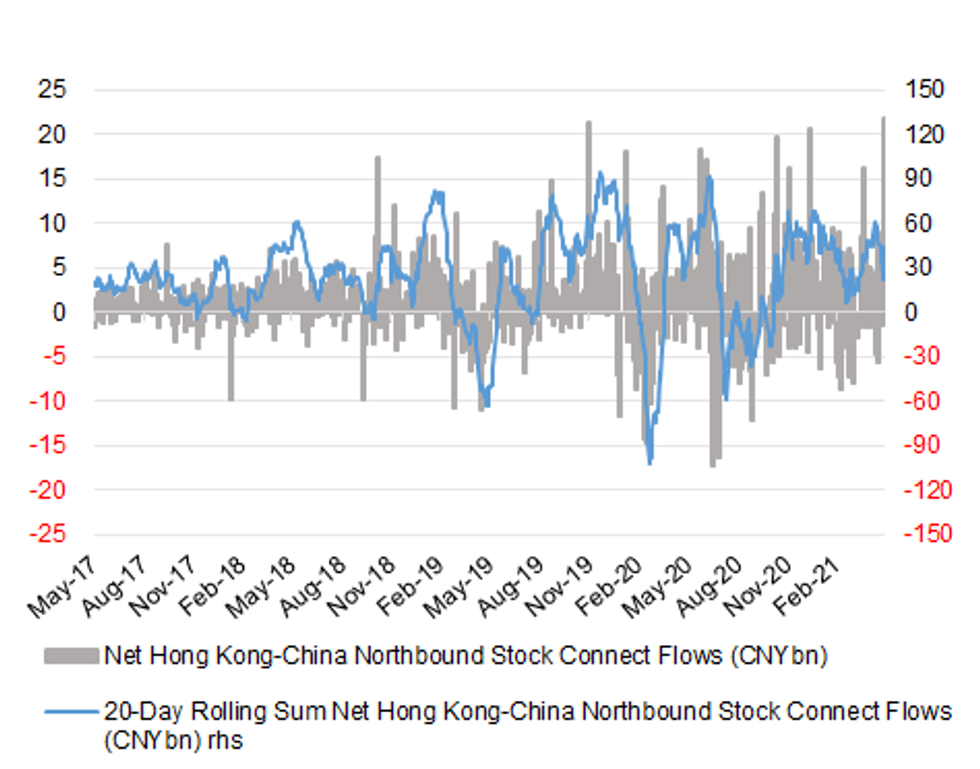

Tuesday Saw Record Net Connect Foreign Inflows For Chinese Stocks

A quick catchup re: yesterday's rally in Chinese equities (CSI 300 +3.2%, Shanghai Composite +2.4% on the day).

- Tuesday saw Chinese mainland equities benefit from record daily net inflows via the northbound legs of the Hong Kong-China Stock Connect schemes, totalling a net CNY21.7233bn.

- Heavyweight Kweichow Moutai added the best part of 6% on the day, perhaps a sign that some investors were pursuing a flight to quality as authorities look to crackdown on what they deem to be speculative-driven moves in local commodity prices. The rotation out of commodity-linked names also seemed to benefit the tech sector, which could have represented a re-allocation for those still seeking a higher beta exposure. Elsewhere, brokerage names benefitted from news that Shanghai will look to bolster its status as an asset management hub.

- The move coincided with USD/CNY printing at the lowest level witnessed since 2018 (no doubt aided by the aforementioned record level of net daily inflows into mainland equities via the Connect schemes), bottoming out just above CNY6.4000 before RTRS sources pointed to China's major state-owned banks buying U.S. dollars at "around CNY6.4000" on Tuesday afternoon, "in a move viewed as an effort to curb fast yuan appreciation." USD/CNH traded as low as CNH6.3922, despite some (separate) talk of state-owned banks intervening around the CNH6.4050 level earlier in the day, before rallying alongside USD/CNY.

Fig. 1: Net Hong Kong-China Northbound Stock Connect Flows (CNYbn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.