-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

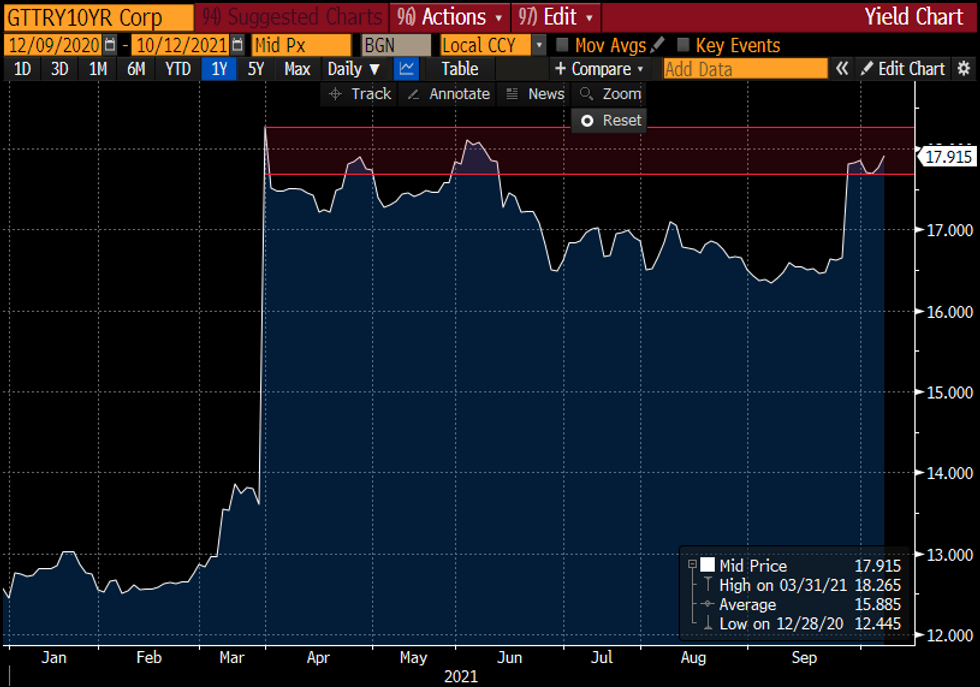

Free AccessTurkGBs Resume Sell-Off, 10Y Approaches Agbal-Removal Highs

- TurkGBs remain under pressure in today's session, sustaining bear steepening momentum from yesterday. 10Y yields stand +21bp higher today, adding to yesterday's +7bp rise to bring spot closer to the 18.00 mark. This is only a short distance from the March highs established following ex-CBRT Gov Agbal's removal for tightening policy too drastically against Erdogan's wishes.

- Since the CBRT's abrupt pivot to core CPI as the new benchmark for policy, 10Y yields have risen +126bp in just under three weeks – unsettled by dovish comments on 'transitory' inflation and weak arguments for loosening policy broadly against the tide of rising CPI across the globe. This has also manifested into acute TRY weakness (-3.98%) and a higher sovereign risk premium (+45.6bp).

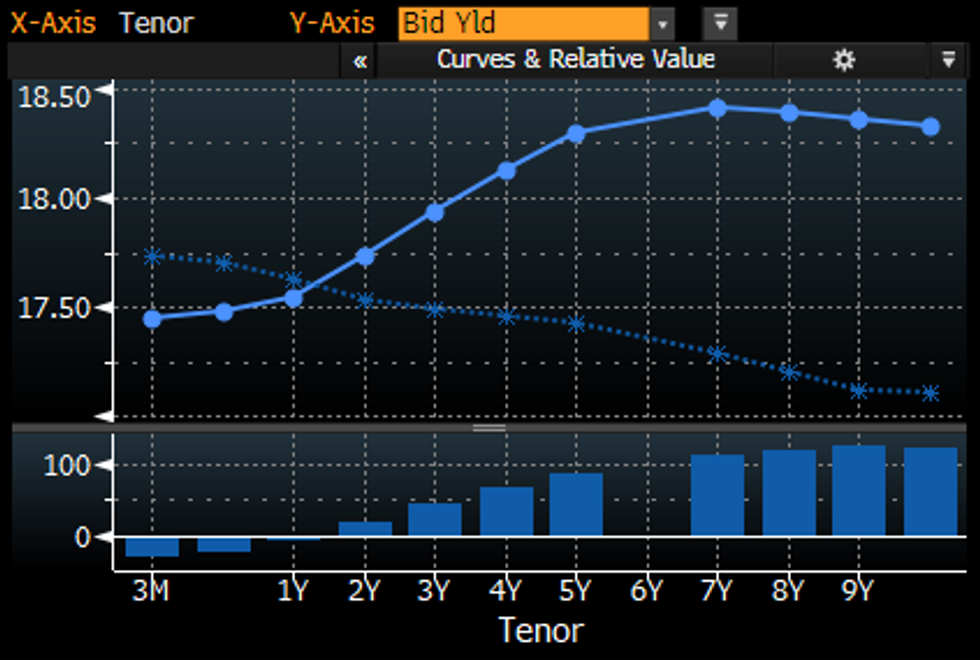

- Overall, the curve continues to trade bear steeper into the upcoming CBRT meeting as markets anticipate further easing in the pipeline for October/November. Current sentiment remains weak in TRY assets, set against a backdrop of higher US Treasury yields and brewing concerns over QE tapering and rates lift-off – widening the already notable CBRT credibility deficit.

- With both core and headline CPI having risen in September (16.98% & 19.58%), another 'revisionary' cut would likely dent confidence further – eroding the core CPI-one wk repo margin of safety further from 1.02% and making the CBRT more vulnerable to problematic policy should core CPI rise further into the end of the year. Here we may see this bear steepening bias retained going into the CBRT meeting, with elevated second round effects from higher FX pass-through, dollarisation and market expectations keeping upside pressure firm.

- Res1 18.00, Res2 18.22, sup1: 17.50, Sup2: 17.00. Beyond there we see the 2018 & 2109 highs coming into focus with notable levels at 18.91, 20.27 & 21.10 to the topside.

TurkGB Curve chg since 23/09/21

TurkGB Curve chg since 23/09/21

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.