-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUMich: Sentiment Deteriorates As Inflation Concerns Re-emerge

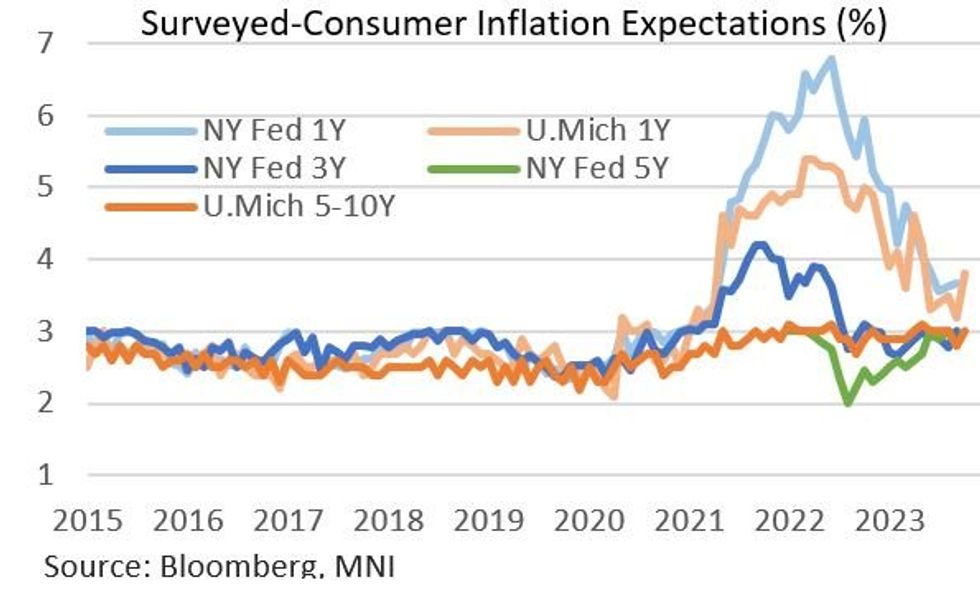

Preliminary University of Michigan consumer sentiment survey for October showed a sharp uptick in near-term inflation expectations alongside a deterioration in confidence and expectations.

- 12-month ahead inflation expectations hit a 5-month high 3.8% (up from 3.2% prior, vs 3.2% expected), while 5-10 year expectations rose to 3.0% (from 2.8% prior, and equal to Jun-Aug levels).

- Consumer sentiment fell to 63.0 (from 68.1 prior and 67.0 expected), with current conditions down 4.7pp to 66.7 (vs 70.3 expected) and expectations off 5.3pp to 60.7 (vs 65.7 expected). All of those were 5-month lows.

- Per the UMichigan release, the rise in inflation expectations and the drop in sentiment are unsurprisingly linked:

- "After stabilizing earlier this year, concerns about inflation have grown again. These concerns underpin the sharp 15% deterioration in consumers’ assessments of their personal finances in this month. About 49% of consumers reported that high prices are eroding their living standards, up substantially from 39% last month and matching the all-time high last recorded in July 2022. Consumers pointed specifically to prices of food and groceries (highest share in over a year) as well as gas and fuel (highest in 2023)."

- The limited rise in longer-term expectations means this report will probably have little impact on the Fed's view of the public's inflation expectations more broadly, with the 1Y jump arguably attributable to short-term gas price fluctuations among other factors noted above. That said, the FOMC will be mindful of the apparent stalling out of progress in inflation expectations, and of any further upticks, as it assesses whether overall expectations remain well-anchored enough to bring the tightening cycle to an end.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.