March 19, 2025 14:49 GMT

FED: Uncertainty To Be Manifested In March's FOMC Meeting Communications (1/2)

FED

USEM BulletFederal ReserveCentral Bank NewsEmerging Market NewsBulletMarketsFixed Income BulletsForeign Exchange BulletsNorth America

Chair Powell on March 7 identified “four distinct areas” of government policy changes whose “net effect…will matter for the economy and for the path of monetary policy”: “trade, immigration, fiscal policy, and regulation”. The related uncertainty over the outlook is likely to manifest in March’s FOMC meeting communications in three main ways.

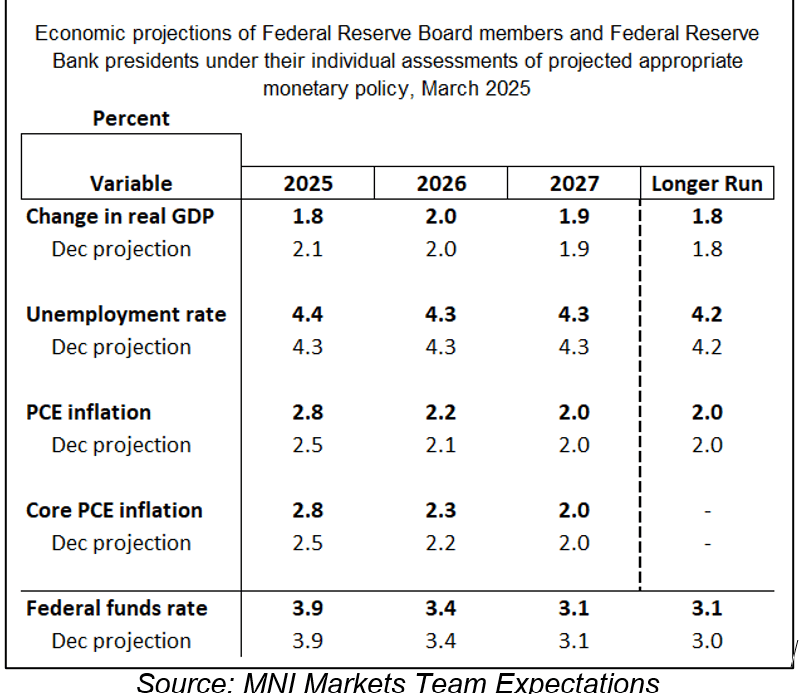

- First, while the most closely-eyed median Fed funds rate dots in the new quarterly projections are unlikely to change – still showing 50bp of cuts in each of 2025 and 2026 – the distribution is likely to shift. MNI regards the risks as mostly tilted to a more hawkish distribution versus December, which appears to be a difference from consensus as multiple analysts see risks weighed toward more rather than fewer cuts in the Dot Plot.

- We think that for 2025 at least, the higher dot submissions could rise in number while the lowest could diminish. The hawks are likely to become a little more hawkish in light of the lack of disinflation progress since the December meeting and some signs of rising inflation expectations, while the the doves have sounded less confident that inflation will pull back sufficiently to warrant more than 2 cuts this year. Regardless of any distributional changes, the lack of movement in the medians vs December is illustrative of a Committee that is somewhat paralyzed as it awaits outside events to unfold.

- Second, the macroeconomic projections will show higher inflation combined with lower growth this year. We anticipate a 0.3pp downgrade in the 2025 real GDP growth median, with the unemployment forecast ticking up 0.1pp as a result. Meanwhile, both core and headline PCE inflation forecasts are set to rise 0.3pp each, largely reflecting the impact of tariffs (though most FOMC members have said they expect it to have a one-off impact).

- Recent PCE readings haven’t been benign, and a tariff-led resurgence in inflation later this year – if only temporary – alongside a loosening in the labor market with weaker activity puts the FOMC in a difficult position, particularly if medium/long-term inflation expectations rise. As of September, the Fed looked very close to meeting both goals, helping make the case to start the rate cut cycle at that point – but there has been limited to no progress since that point. And on inflation, while FOMC officials have largely expressed confidence that it’s headed back to 2% sustainably, recent data and looming tariffs have discouraged even the biggest doves (Goolsbee, Waller, Williams).

- GDP growth in Q1 looks to be slower than in Q4, if not outright contractionary (per the Atlanta Fed’s GDP nowcast), in part due to tariff uncertainty. There is also the additional factor of government austerity under the Trump administration, which is likely to see federal spending and employment cut sharply – but there is not yet much tangible evidence of this in the data and there remains great uncertainty over the scope of cutbacks.

481 words