-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

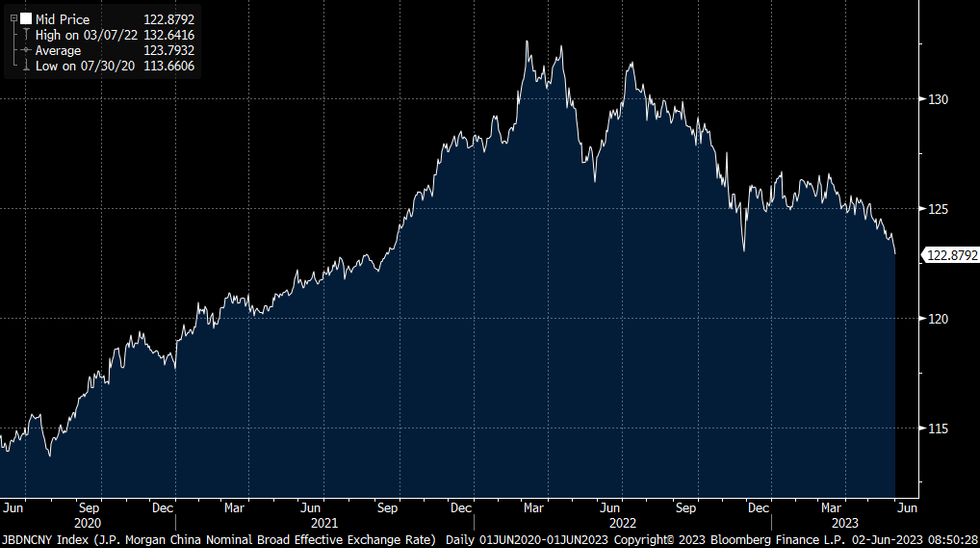

Free AccessUSD/CNH Sees Sharp Pullback From Fresh Highs, NEER Still Weaker Though

USD/CNH pulled back sharply after making fresh highs late in Asia Pac trade. The pair got near 7.1400, before pulling back sub 7.1050 by the NY session. Like elsewhere, the CNH benefited from softer USD conditions, amid lower yields/speculation the Fed will pause in June. For Thursday, CNH gained 0.21%, while USD/CNY finished sub 7.1000. This still leaves the CNY NEER lower at 122.88, -0.27% (J.P. Morgan index), which is fresh lows back to Sep 2021 (see the chart below).

- CNH's fortunes may largely rest with broader USD/yield trends in the near term, with yesterday's better than expected Caixin PMI print providing only fleeting support to the currency.

- The MNI policy team interviewed Chen Zhongtao, vice director at China Logistics Information Center (CLIC), who stated Chinese manufacturing risks further declines in the second half without continued fiscal and monetary support, after worse-than-expected PMI data revealed the highest proportion of companies expressing concerns over demand in the survey’s history (see this link for more details).

- To recap, local equities finished away from highs, although the CSI 300 remains above the 3800 level. In US trade on Thursday the Golden Dragon index rebounded strongly though, up over 4%, moving the index back above the 6200 level.

- Onshore bond yields are mostly tracking lower at the front end, the 2yr last around 2.15%, while the 10yr continue to hold above 2.70%.

- The local data calendar is empty until next Mon, when the Caixin services PMI prints.

Fig 1: J.P. Morgan CNY NEER At Fresh Lows Back To Sep 2021

Source: J.P. Morgan/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.