-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPMIs Reinforce Outperformance Theme

We noted late last week that China's PMI prints may reinforce the China outperformance theme (see this link for more details). Today's non-manufacturing PMI printed much stronger than expected, coming in at 54.7 versus 50.5 expected and is back to close to highs from May of last year. The manufacturing PMI missed estimates (50.2 versus 50.5 expected), although it still managed to move back into expansionary territory.

- The surprising aspect of today's result is the extent of the non-manufacturing PMI bounce, particularly given on-going covid related restrictions observed during June.

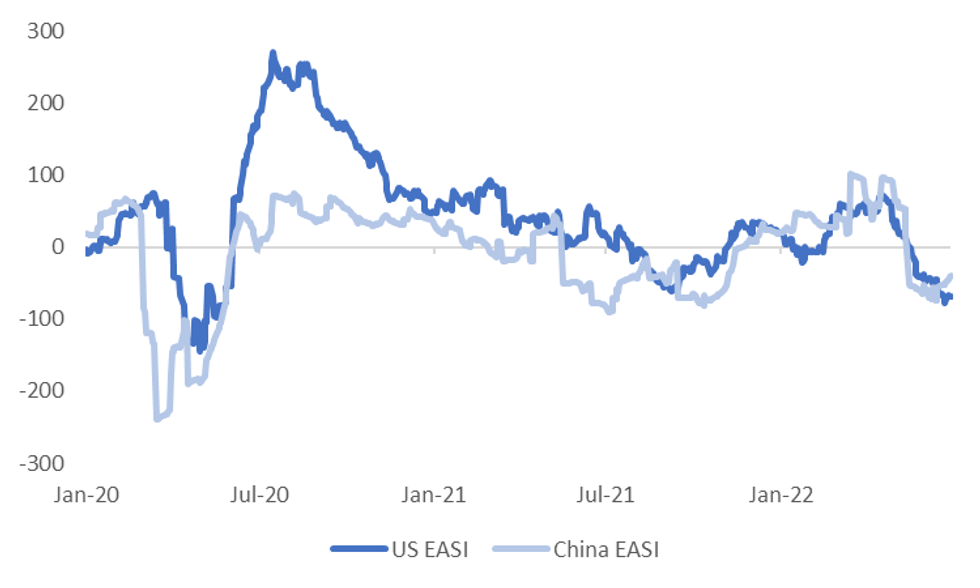

- In any case, today's outcomes should be enough to push the Citi China Economic Activity Surprise Index (EASI) higher. The chart below plots the China EASI versus the US EASI, which have crossed over recently.

Fig 1: Citi China & US EASI Trends - Crossing Over

Source: Citi, MNI - Market News/Bloomberg

Source: Citi, MNI - Market News/Bloomberg

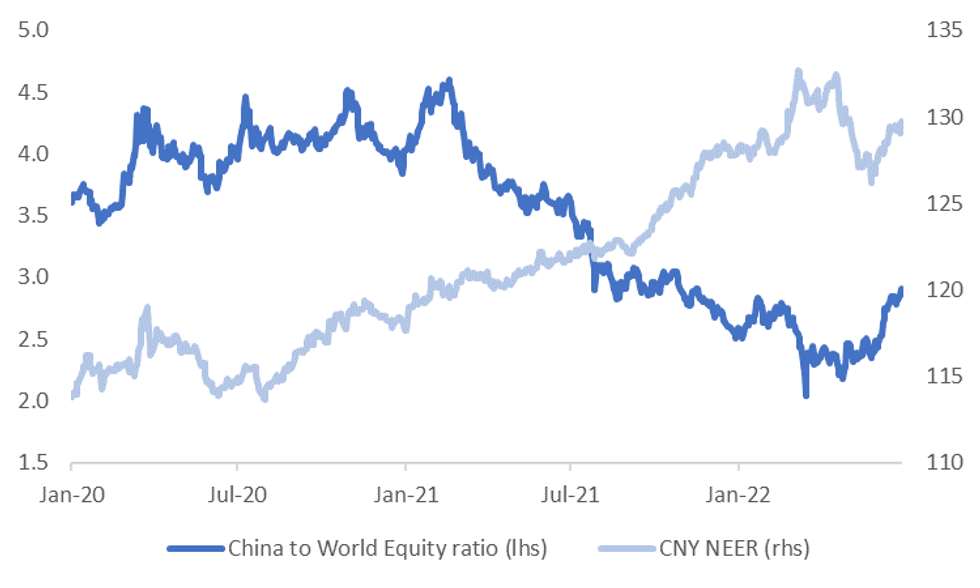

- Such a backdrop may reinforce the China outperformance theme that has been evident in FX and equities. The second chart below plots the ratio of China to world equities against the CNY NEER.

- Correlations between these two series swing about, but sharp periods of China equity outperformance have coincided with rising NEER levels.

- A good analogy with the current episode is late Q1 2020. China was emerging from its first Covid wave just at the rest of the world was going into its first. China is currently emerging from its second wave, while economic conditions in the US/EU are more uncertain as tighter financial conditions bite.

- There are of course caveats, a lot will depend on how Covid cases evolve given China's dynamic Covid zero strategy. Note we get more updates on China's economic momentum tomorrow, with the Caixin manufacturing PMI due, while the Caixin services PMI prints early next week.

Fig 2: Chine To World Equity Ratio Versus J.P. Morgan CNY NEER

Source: J.P Morgan, MNI - Market News/MNI

Source: J.P Morgan, MNI - Market News/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.