-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/ILS Approaches Jan Lows, No Intervention Expected This Time

- USD/ILS has been on a notable run in recent weeks, falling sharply into month-end after breaking key support around the 3.20 handle. The Jan 14 low comes in at 3.1130, and with price action now in oversold territory, may run into some support around the level. Nevertheless, analysts are forecasting firm prospects for ILS over the medium terms as its tech sector continues to expand.

- In January, the Bank of Israel intervened in the market, announcing it would buy up to $30 billion in dollars during 2021 in order to weaken the shekel. It has since bought even more than that, although it seems the bank's goal is to slow down the strengthening of the shekel, not to reverse the trend.

- Local analyst says the flourishing of the hi-tech sector is also one of the reasons for the significant increase in direct and financial investments in Israel, among other things through the acquisition of local companies as well as through capital raising and IPOs of the high-tech sector.

- These $-denominated profits have caused a sizeable rise in to foreign-currency sales by importers and companies holding overseas offerings, as well as the movement of foreign currency to Israel to invest in shekel bonds by foreign investors – driving the recent appreciation.

- The Bank of Israel has also signalled that a rapid recovery in economic activity supports less market intervention this time around. "This is an inflation factor that few inflation forecasters take into account."

- Expectations that Israel will raise its benchmark interest rate from the historic low 0.1% in the coming months is strengthening the bond market, which also impacts the shekel.

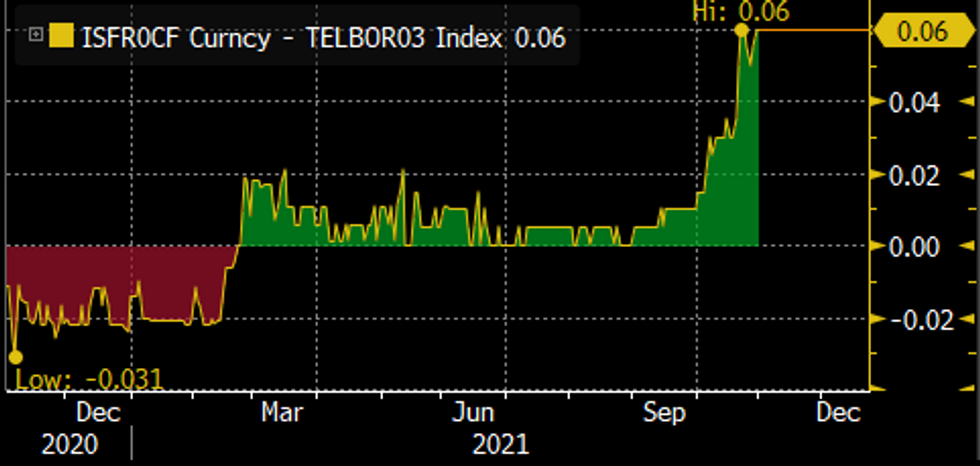

- 3x6 FRA-Telbor Spreads have widened sharply in October, rising from +1bp to +6bp after remaining mostly stable in the 1-2bp zone since March

3x6 FRA - Telbor Spread

3x6 FRA - Telbor Spread

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.